After GST introduction, commerce studies out of shadows

Hyderabad: It’s always been engineering first and medicine next for most Indian students. But no longer. Commerce studies are coming to the forefront thanks to development that have opened up fresh avenues for jobs.

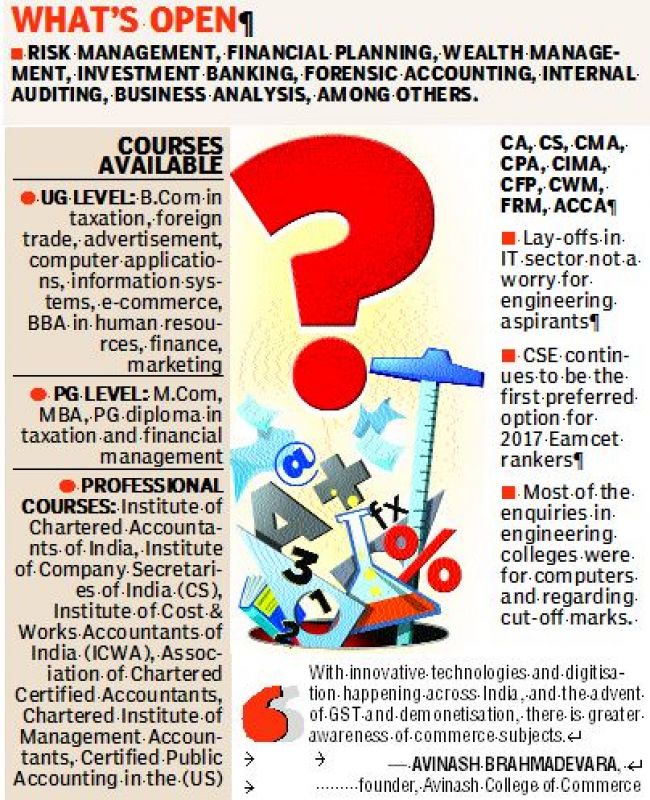

There are increasing prospects in the finance, banking and related sectors, experts said. Digitisation and the adoption of innovative technologies is the result of the increase in regulatory framework in banking and finance, that is opening up more doors to commerce students. The introduction of the Goods and Services Tax regime provides yet another opportunity to those who have chosen to look beyond BE and MBBS.

A survey says India needs approximately 8 to 10 lakh commerce professionals in the coming years in accounting, audit, taxation, compliance matters, banking and finance, financial planning, wealth management, risk management, said experts.

Students and parents are not yet aware of the job avenues provided by new regulations, portfolio management, investment banking, securities markets and others. Chartered accountants and company secretaries are authorised to certify statutory documents, and play a crucial role in advising on various policies affecting the economy.

Mr Avinash Brahmadevara, founder, Avinash College of Commerce, said, “With innovative technologies and digitisation happening across India, and the advent of GST and demonetisation, there is greater awareness of the commerce industry. There are sufficient number of colleges in our city and state. Not many institutions provide quality output to the industry, thereby making it difficult for recruiters.”

Mr Bhrahmadevara is the youngest triple-qualified post graduate professional. He said commerce education was an evergreen option and was never affected by global recession unlike the software industry.

As the banking, financial services and insurance (BFSI) sector depends on trade and commerce, learning the nuances of commerce right from Class XII will benefit the students to get into the largest service sector,” he said.

Mr Brahmadevara said, “there is a need to create awareness about the demand in commerce industry, which will help students choose careers other than in maths and science. Commerce is the life blood of any business, it teaches a student the methods of making, managing and multiplying money.”

St. Mary’s College, Yousufguda, in Hyderabad has started a value added programme — Chartered Institute for Securities & Investment — in collaboration with a UK-based financial services professional body, for commerce students which helps students get a certification in finance and helps them learn certain skill sets needed for students to get employment in the finances sector.

College principal J. Mathew George said, “We started this value-added course for students who want to take up finance. There is a lot of demand for commerce courses and jobs. But a number of students want to go for higher studies, that too abroad.”

He said the college had received more than 600 pre-applications for undergraduate courses in commerce for walk-in admissions in nine days, but only 240 were eligible after the cut-offs.

Prof. S.V. Satyanarayana, head of the department of commerce, Osmania University, said, ‘’Commerce is the most popular stream in Osmania University. About half the admissions are in the commerce stream at the undergraduate level. We have several different subjects in commerce streams like BCom (general), BCom (taxation), BCom (computers), BCom (advertising) and BCom taxation.”

He said that apart from these, autonomous colleges like St. Francis, Villa Mary and Loyola were starting new courses in collaboration with the Association of Chartered Certified Accountants, a London-based organisation, to provide greater opportunities for students.

“Taking into consideration the needs of the industry, we are revising the syllabus. We have introduced a paper on Goods and Service Tax.,” Prof. Satyanarayana said.