Thiruvananthapuram: Crackdown on evasion turns boon

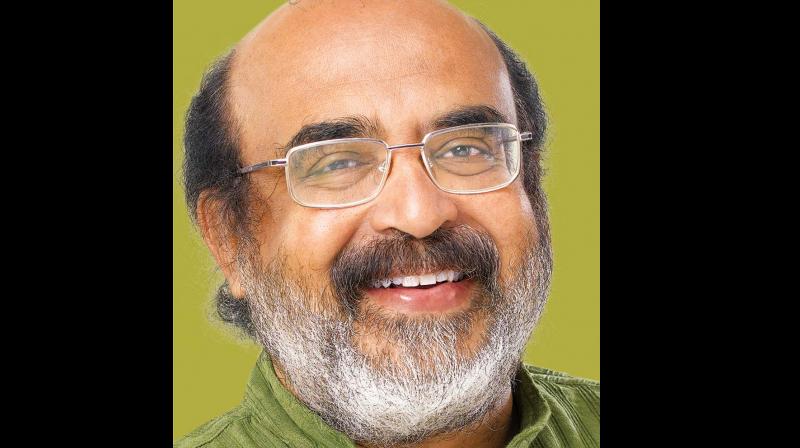

THIRUVANANTHAPURAM: Finance minister Dr Thomas Isaac's only relief in these times of crisis is the unprecedented increase in the rate of growth of motor vehicle taxes. After the crackdown on the 'Pondy set' (elite Malayalis who tend to register their vehicles in Pondicherry to bypass Kerala's taxes) motor vehicle taxes (MVTs) have grown by an effervescent 22 per cent. This augurs well for KIIFB, too, as it is a share of MVT that keeps it solvent. Dr Isaac will not tinker with the tax rate lest he dampens demand and kill the goose that lays golden eggs. His revenue option from motor vehicles, therefore, will be to tighten compliance.

For instance, the finance department has told the minister that poor administrative supervision was causing serious shortfall in the collection of the tax, especially the levy of the 'onetime' tax imposed on vehicles. Under the Kerala Motor Vehicle Tax Act, vehicles should pay a 'onetime' tax at the time of the first registration of the vehicle. The rates are six per cent, eight per cent, 10 per cent, 15 per cent and 20 per cent of the value of vehicles having purchase value up to Rs 5 lakh, between Rs 5 lakh and Rs 10 lakh, between Rs 10 lakh and Rs 15 lakh, between Rs 15 lakh and Rs 20 lakh, and more than Rs 20 lakh respectively. The purchase value includes the GST, cess and customs/excise duty.

However, it has been found that in most cases the ex-showroom price was considered as the purchase value to collect the onetime tax. Fixing "on road" price as the purchase value, which is what the law says, alone will secure the government somewhere near Rs 10 crore annually. In many cases it has also been found that the 'one-time tax' was charged on the basis of redundant classifications, causing further loss to the exchequer.

Over Rs 5 crore could be mobilised if only the state sternly dealt with violations. Under the Motor Vehicles Act, a penalty should be extracted if a vehicle is found carrying more weight than the gross vehicle weight. It has also been found that contract vehicles that had been registered with ordinary seats later, with the clear intent to avoid tax, convert to push back seats without permission. Last fiscal alone, the CAG had estimated that Rs one crore was lost as a result of this "illegal conversion".