PSBs' registered net loss of Rs 17,993 cr in FY16: MoS Finance

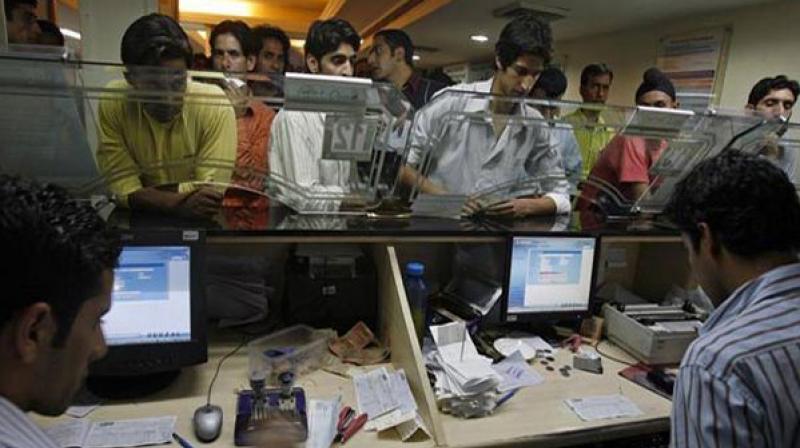

New Delhi: Public sector banks (PSBs) posted anet loss of Rs 17,993 crore in the last fiscal, showed a government data today. According to the data presented in Lok Sabha by Minister of State for Finance, Santosh Gangwar, in reply to a query, the 28 public sector banks reported a collective net loss of Rs 17,993 crore in 2015-16.

Of them, 14 banks registered net loss in their books for 2015-16, while the remaining logged profits. Among those making losses, Bank of India had the highest share with Rs 6,089 crore; Bank of Baroda Rs 5,396 crore; Punjab National Bank Rs 3,974 crore; IDBI Bank Rs 3,665 crore; Oriental Bank of Commerce Rs 2,897 crore; UCO Bank Rs 2,799 crore; Syndicate Bank Rs 1,643 crore and Central Bank of India Rs 1,418 crore.

The high level of non-performing assets (NPAs) and rules by RBI to make higher provisioning for sub-standard assets were the main reasons for the banks to register big losses. However, banks have now taken many corrective measures for loan recovery and are supposed to return to profits in next few quarters.

Of those who made profits in their books last fiscal included SBI at Rs 9,951 crore; State Bank of Hyderabad Rs 1,065 crore; State Bank of Bikaner & Jaipur Rs 851 crore and Andhra Bank Rs 540 crore. Gangwar said that the government has proposed to infuse Rs 70,000 crore into the PSBs out of the budgetary allocation for four years to 2018-19 under the Indradhanush Plan.

"The government has already infused a sum of Rs 25,000 crore in 19 PSBs during financial year 2015-16 and a budgetary provision of Rs 25,000 crore has been made for 2016-17. Government has allocated Rs 22,915 crore to 13 PSBs as on July 19, 2016," he said.

Government has revised performance indicators for banks which are basically built on improving efficiency and capital utilisation.