Union Budget 2017: Top Highlights

Finance Minister Arun Jaitley presented the Union Budget for 2017-18 in Parliament on Wednesday.

New Delhi: Finance Minister Arun Jaitley presented the Union Budget for 2017-18 in Parliament at 11 am on Wednesday, during the Budget Session.

Here are the top highlights of the Budget:

Personal Income Tax:

- There will be no scrutiny of first time tax payers: Arun Jaitley

- A simple 1 page form will be introduced to file IT returns: FM

- Of 3.7 crore individuals who filed tax returns in 2015-16, 99 lakh showed income below exemption limit: Arun Jaitley

- 15 per cent surcharge on incomes above Rs 1 crore to continue: Arun Jaitley

- Surcharge of 10 per cent for those whose annual income is between Rs 50 lakh to 1 crore: FM

- No tax for those who use tax rebates on Rs 4.5 lakh income: FM

- Combined effect of new tax structure will be that people with income below Rs 3 lakh will not have to pay tax, and those between Rs 3 and 3.5 lakh will pay a maximum of Rs 2,500: FM

Read: Tax rate for Rs 2.5 - 5 lakh income slab cut to 5%, says Arun Jaitley

- Between Rs 3 lakh to Rs 5 lakh, income tax rate reduced to 5 per cent from 10 per cent: Jaitley

- Main burden of taxes is on honest taxpayer and salaried employees who show their income correctly: FM

Political funding:

- Parties can receive donations in cheque or digitally from their donors: Arun Jaitley

- In according with EC suggestion, maximum donation a political party can receive in cash from a single source will Rs 2000: FM

- Even after 70 years, country has no transparent system of political funding: FM

Read: Budget 2017: Jaitley’s proposals to cleanse the system of political funding

Companies Tax:

- Government not to remove Minimum Alternative Tax in 2017-18. I propose to allow a carry forward of MAT for a period of 15 years as against 10 years now: Arun Jaitley

- Companies which have turnover upto Rs 50 crore will get 5 per cent tax rebate. Their income tax rate thus reduces to 25 per cent. 96 per cent of Indian companies will thus get this benefit. It will boost our MSME sector: FM

Tax:

- Plan to extend basket of financial instruments to which the capital gains can be invested sans payment of tax

- Capital gains tax exempt for persons under land pooling mechanism for creation of new Andhra Pradesh capital Amaravati: FM

- Draft bill placed in public domain for law against chit fund scams, to protect the poor: Arun Jaitley

- Advance tax on income tax increased by 34.8 per cent due to demonetisation: FM

- Main priority of government to eliminate black money component from the economy, says Arun Jaitley

- Thrust of tax proposal is to stimulate growth, promote digital economy, and combat black money: FM

- Tax collection has increased by 17 per cent per year over the last 2 years: FM

- When too many people evade taxes burden falls on those who are honest. We are mainly a tax non-compliant society: Arun Jaitley

- RBI review committee recommended 3 per cent fiscal deficit for next 3 years: Arun Jaitley

- Revenue deficit has come down to 2.1 per cent.

- Our Direct Tax collection is not commensurate with income. Only 1.8 crore Indians have filed IT returns: Arun Jaitley

- Out of 3.7 crore who filed tax returns in 2015-16, only 24 lakh persons showed income above Rs 10 lakh, says Arun Jaitley

Total expenditure:

- Total resources being transferred to the states & union territories with legislature is Rs 4.11 lakh crore: FM

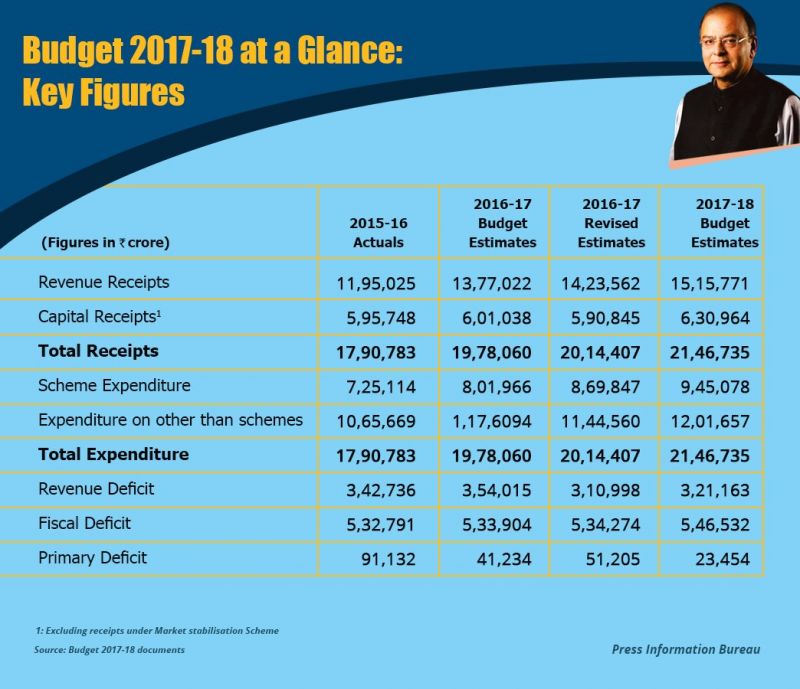

- Rs 21.47 lakh crore to be allocated as total expenditure in the Budget: FM

Defence:

- Defence forces to get centralised, hassle-free rail ticket booking system. They do not have to stand in queues any more: FM

- 2,74,114 crores allocated to defence expenditure, including pensions: FM

Digitisation:

- Government will consider early implementation of recommendations of committee of Chief Ministers on digital transactions: Arun Jaitley

- Digital payment infrastructure and grievance handling system will be strengthened: Arun Jaitley

- Aadhar pay facility will be launched soon to help those without mobile wallets: FM

- Digital transaction has witnessed an increase, 1,25,000 people have adopted BHIM app already: Arun Jaitley

Finance:

- Fiscal deficit at 3.2 % of GDP; remain committed to achieving 3% in 2017-18: FM

- Rs 10,000 crore provided for recapitalisation of banks: FM

- Foreign Investment Promotion Board (FIPB) has been abolished: FM

- A computer emergency response team will be established to ensure cyber security in financial sector: Arun Jaitley

- Expert committee to be created to integrate spot and derivative market for commodity trading: FM

- Total allocation for infrastructure will be Rs 3,96,135 crores: Arun Jaitley

- Want to make India a global hub of electronic infrastructure: FM

Roadways and Airways:

- Under Bharat Net project, Optical Fibre Cable has been laid for a length of 1,55,000 kms: FM

- Selected airports in Tier 2 cities will be taken for Public-Private Partnership: FM

- Rs 64,000 crore allocated for National Highways: FM

Railways:

-

Service charges on e-tickets booked through IRCTC will be withdrawn: FM

-

By 2019, all coaches of Indian Railways will be fitted with bio-toilets, and Railways will integrate end to end transport solutions for selected commodities through partnership: Arun Jaitley

Read: Union Budget 2017: Arun Jaitley says railways to focus on safety, cleanliness

- A new metro rail policy will be announced. This will also open up new jobs for our youth: Arun Jaitley

- 500 stations to be made differently abled-friendly: FM

- Dedicated trains will be launched for tourism and pilgrimage

- Rail Raksha Fund to be created with corpus of 1 lakh crore over 5 years, said the Finance Minister

- Total capital for rail budget has been pegged at 1,37,000 crores, said Arun Jaitley

Key figures at glance. (Photo: Twitter/Finance Ministry)

Key figures at glance. (Photo: Twitter/Finance Ministry)

Medical:

- Two new All India Institute of Medical Sciences to be set up in Jharkhand and Gujarat: Arun Jaitley

- Action plan to eliminate Kala Azar, filariasis by 2017, leprosy by 2018, measles by 2020 & TB by 2025: FM

Social welfare:

- For senior citizens, Aadhaar based health cards will be issued: FM

- Allocation for welfare of Scheduled Castes increased to Rs 52,393 crore: Arun Jaitley

Housing:

- Open defecation free villages are now being given priority for pipe to water supply: FM

- 100% village electrification will be achieved by May 1, 2018: Arun Jaitley

- Under various schemes, allocation stepped up to 1,84,632 crores to facilitate affordable housing and infrastructure to poor: Arun Jaitley

- Mission Antyodaya to bring 1 crore houses out of poverty, make 50,000 Gram Panchayats poverty-free: Arun Jaitley

- Government to complete 1,00,00,000 houses by 2019 for homeless and those living in kaccha houses: FM

Education:

- In higher education, we will undertake reforms in UGC,

give autonomy to colleges and institutions: Arun Jaitley - Special schemes will be annouced to create employment in textile sector: Arun Jaitley

- National Testing Agency to conduct all entrance exams for higher education: FM

- PM Kaushal Kendras will be set up in more than 600 districts across the country to offer advanced training and foreign languages: FM

- Will leverage ICT by Swayam course, where students can learn course work online: FM

- Innovation fund for secondary education to encourage local innovation, gender parity and ICT transformation: Arun Jaitley

Agriculture:

-

Total allocation for rural, agricultural and allied sectors for 2017-18 is Rs 187223 crore, which is 24% higher than last year: FM

-

Target of agricultural loans to farmers set at record Rs 10 lakh crore in 2017-18: FM

-

Arun Jaitley said the highest ever amount of Rs 48,000 crore has been allocated for MNREGA scheme.

-

Dairy processing infrastructure fund will be set up under NABARD, with fund of 8,000 crore: FM

-

A model law on contract farming and a dairy processing fund will be set up in 3 years: Arun Jaitley

-

Dedicated micro irrigation fund to be set up. For post harvest, farmers will get better prices in market: FM

-

Issuance of soil health cards have gathered momentum. We will setup a mini lab in krishi vigyan kendras: Arun Jaitley

-

We will take special efforts to ensure adequate flow of credit to under served areas, Northeastern states and Jammu and Kashmir: FM

-

Government to spend more on rural areas, infrastructure and poverty alleviation with fiscal prudence.

-

Arun Jaitley said agricultural growth has risen to 4.1 per cent for 2016-17.

-

Government committed to double farmer income: Arun Jaitley

-

We have taken more steps to help farmers to increase production and deal with post harvest problems: FM

Budget Speech

- “In recent times, there have been cases of big time offenders escaping the country. Government is considering amendment to the law to confiscate the property of such offenders, unless they submit to the relevant authority,” Jaitley said in a reference to liquor baron Vijay Mallya, who has fled to the UK.

-

"We are aware that we need to do more. Our agenda for next year is to transform, energise and clean India," Arun Jaitley said addressing the Speaker.

-

"Pace of remonetisation has picked up and the effects of demonetisation will not spill over next year. Drop in economic activity during remonetisation will only have a transient impact," Arun Jaitley said.

Read: Union Budget 2017: Demonetisation seeks to create a new normal, says Arun Jaitley

-

The Finance Minister hailed both GST and demonetisation as 'tectonic changes' in the Indian economy. He also called merger of Railway Budget with General Budget a 'historic step'.

-

Advantages in terms of GST are competitiveness, greater transparency etc have been discussed in both Houses: Arun Jaitley.

-

Saying that demonetisation seeks to 'create a new normal', the Finance Minister added that it was a follow up of the other measures taken by the govt in past two years.

-

India is seen as engine of global growth. We have witnessed historic reform in last one year, Arun Jaitley stated.

-

India has become the 6th largest manufacturing country in the world, up from the 9th position, Arun Jaitley said.

-

"India stands out as a bright spot in the world economy. India's macro-economic policy continues to be source of our success," Arun Jaitley said.

-

The Finance Minister said that GDP growth had recovered following demonetisation. He said India's growth rate was much higher than the global estimate of 3.4 per cent for 2017.

-

Arun Jaitley said that inflation, which was in double digits and has now been controlled, while sluggish growth has been replaced by high growth. He also mentioned that the government has launched a war against black money through its demonetisation policy.

-

"The government is now seen as a trusted custodian of public money, I express gratitude to people for their strong support," said Arun Jaitley.

-

Amid continuing protests from the Opposition benches, Finance Minister Arun Jaitley began to present the Budget.

-

However, this announcement caused huge protest from the Opposition benches. Mallikarjun Kharge rose to speak, detailing Ahamed's health condition before his death.

-

"Honourable members, as you are aware, the House is adjourned on the death of a sitting member. However, as the President has given his assent for the Budget to be presented, it will go ahead. But the House will not function tomorrow as a mark of respect to Ahamed," Mahajan announced.

-

Lok Sabha Speaker Sumitra Mahajan provided an obituary to deceased lawmaker E Ahamed before the start of the Budget session. The House then stood in silence as a mark of respect for Ahamed.

-

“Budget has sanctity. It is a constitutional obligation. We are already in the 11th hour. There should be no controversy over it,” Union Minister Venkaiah Naidu said on Opposition demands to postpone the Union Budget.

- However, many Opposition leaders including RJD chief Lalu Prasad Yadav have now demanded that the Budget should be postponed.

- Lok Sabha Speaker Sumitra Mahajan condoled the demise of E Ahamed but said that the Budget would take place as scheduled. "We have to keep in mind that budget is a constitutional obligation, will have to be presented."

- The FM presented the Budget in the Union Cabinet after the President gave his assent to it.

- Arun Jaitley also tweeted that he would present the Budget at 11 am.

-

However, Congress has demanded that the Budget be postponed. “It’s not March 31, there is a lot of time to present budget. Government can postpone it,” Congress leader in Lok Sabha Mallikarjun Kharge said.

-

He added that 'delaying' the announcement of Ahamed's death was an 'inhuman act' on the part of the government.

Government sources earlier told ANI that the Budget would go ahead despite the death of lawmaker and former Union Minister E Ahamed, who collapsed on Tuesday in Parliament while President Pranab Mukherjee was delivering his speech, and died of a cardiac arrest in the wee hours on Wednesday.

The obituary to Ahamed will be made either before or after the Budget, ANI said. Opposition parties have been taken into confidence regarding the decision, the report said.

Earlier, there was speculation that the Budget may be postponed, as it is the custom to adjourn the House following the death of a sitting member. Lok Sabha Speaker Sumitra Mahajan is expected to take a formal call on holding the Budget at 10 am on Wednesday.

The government has brought forward the Budget this year, from February end to February 1. It will take place before the Assembly elections in 5 states.

On Tuesday, the government presented the Economic Survey 2016-17 in Parliament, which projected that the GDP growth rate will decline to 6.5 per cent for the current financial year, due to the impact of demonetisation. However, the growth rate will rebound to 6.75-7.5 per cent in the coming fiscal, the report said.

It also projected agricultural growth rate to rise and industrial growth rate to fall to 5.2 per cent from 7.4 per cent during the current financial year.

The Economic Survey also recommended a Universal Basic Income (UBI) for all citizens, to replace several social security schemes. The report said that UBI is an idea ‘whose time as come’. However, there is no immediate effort on the part of the government to implement this measure.