Union Budget 2026: New I-T Act to Come Into Force from April 1

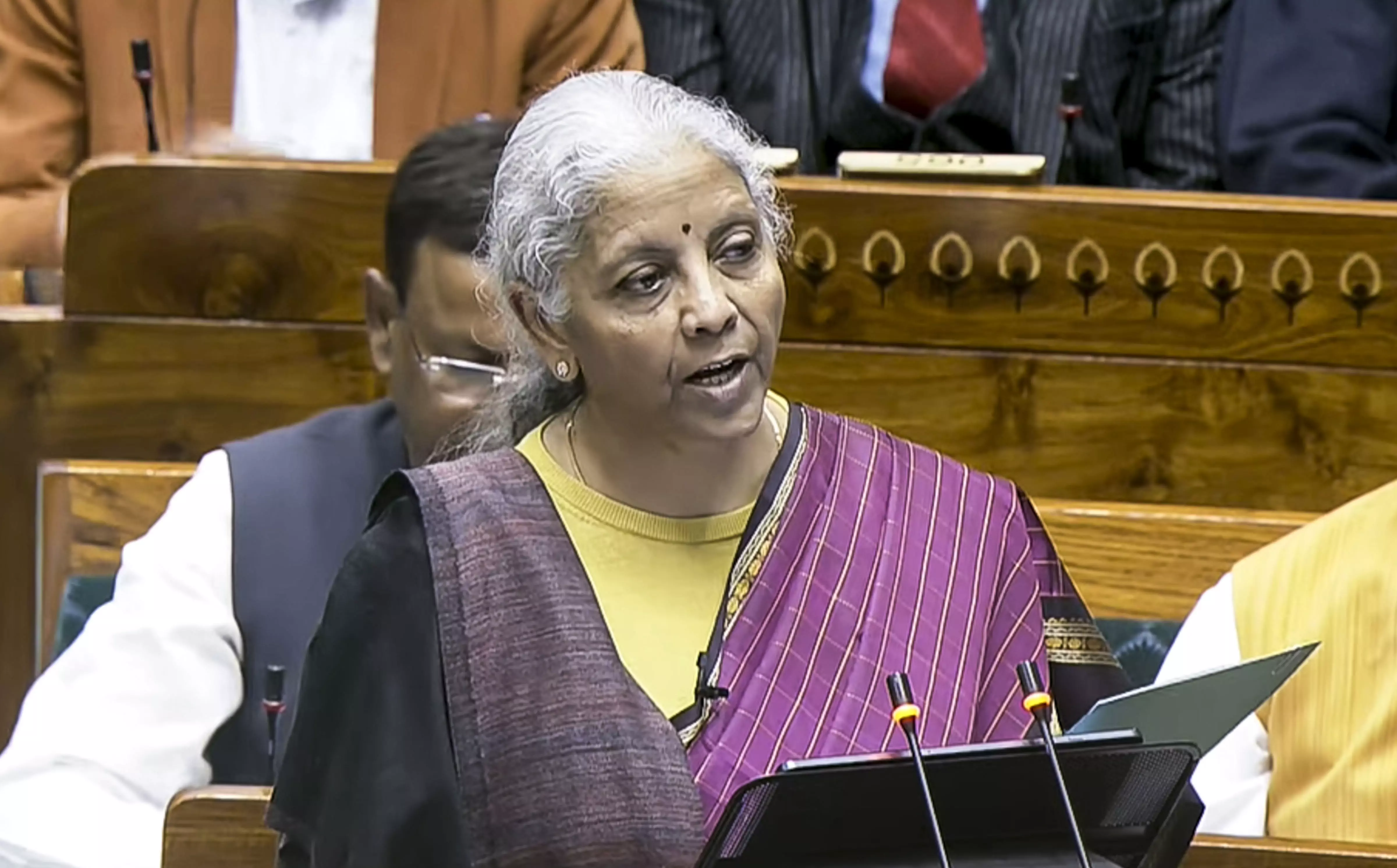

Nirmala Sitharaman made history with the presentation of a record ninth consecutive Budget

New Delhi: Finance Minister Nirmala Sitharaman on Sunday announced that the new Income Tax Act will come into force from April 1, 2026, as she presented her ninth consecutive Union Budget in Parliament. However, contrary to expectations from taxpayers, the finance minister did not propose any changes to the existing income tax slabs in the current Budget.

In a relief measure, Sitharaman proposed extending the deadline for filing income tax returns. Under the proposal, taxpayers will be allowed to file their returns up to March 31 instead of the existing December 31 deadline, subject to payment of a nominal fee.

The finance minister also announced a reduction in the Tax Collected at Source (TCS) rate under the Liberalised Remittance Scheme. The TCS on remittances for education and medical education has been proposed to be lowered from 5 per cent to 2 per cent.

Additionally, the TCS rate on the sale of overseas tour packages will be reduced to 2 per cent from the current 5 per cent. The rate had earlier stood at 20 per cent before being revised downward.

Earlier, the Union Cabinet, headed by Prime Minister Narendra Modi, approved the Union Budget 2026-27 following a meeting in Parliament.

Nirmala Sitharaman made history with the presentation of a record ninth consecutive Budget. This will take Sitharaman closer to the record of 10 budgets that were presented by former Prime Minister Morarji Desai over different time periods.

Live Updates

- 1 Feb 2026 11:12 AM IST

"Keeping Aatmanirbharta as a lodestar, we have built domestic manufacturing capacity, energy security and reduced critical import dependencies. Simultaneously, we have ensured that citizens benefit from every action of the Government, undertaking reforms to support employment generation, agricultural productivity, household purchasing power and universal services to people. These measures have delivered a high growth rate of around 7% and helped us make susbstantial strides in poverty reduction and improvement in the lives of our people." - FM Nirmala Sitharaman

- 1 Feb 2026 11:11 AM IST

Presenting Union Budget 2026-27, Union Finance Minister Nirmala Sitharaman says,"We have pursued far-reaching structural reforms. Fiscal prudence and monetary stability, while maintaining a strong thrust on public investment, keeping self-reliance as a pillar. We have built domestic manufacturing capacity, energy security and reduced critical import dependencies."

- 1 Feb 2026 11:02 AM IST

Congress leader Sachin Pilot on Sunday took a dig at the Centre ahead of the Union Budget, alleging that the government’s policies over the years have failed to make a tangible impact at the grassroots. He urged the government to deliver meaningful relief to the poor, farmers, youth and the middle class.

- 1 Feb 2026 10:54 AM IST

The Union Cabinet, headed by Prime Minister Narendra Modi, approved the Union Budget 2026-27 following a meeting in Parliament. - AFP Photo

- 1 Feb 2026 10:49 AM IST

GST: Goods and Services Tax (GST) collection in 2025-26 is estimated to rise 11 per cent to Rs 11.78 lakh crore. FY27 GST revenue projections will be closely watched, as the revenue growth is expected to gain momentum with the government's implementation of rate reductions since September 2025.

- 1 Feb 2026 10:48 AM IST

Tax Revenue: The 2025-26 Budget had pegged gross tax revenues at Rs 42.70 lakh crore, an 11 per cent growth over FY25. This includes Rs 25.20 lakh crore estimated to come from direct taxes (personal income tax + corporate tax), and Rs 17.5 lakh crore from indirect taxes (customs + excise duty + GST).

- 1 Feb 2026 10:47 AM IST

Capital Expenditure: The government's planned capital expenditure for this fiscal year is budgeted at Rs 11.2 lakh crore. The government is likely to maintain its focus on capital expenditure in the upcoming Budget, with a 10-15 per cent increase in the capex target from the current level, as private sector players remain cautious.