Union Budget 2026: New I-T Act to Come Into Force from April 1

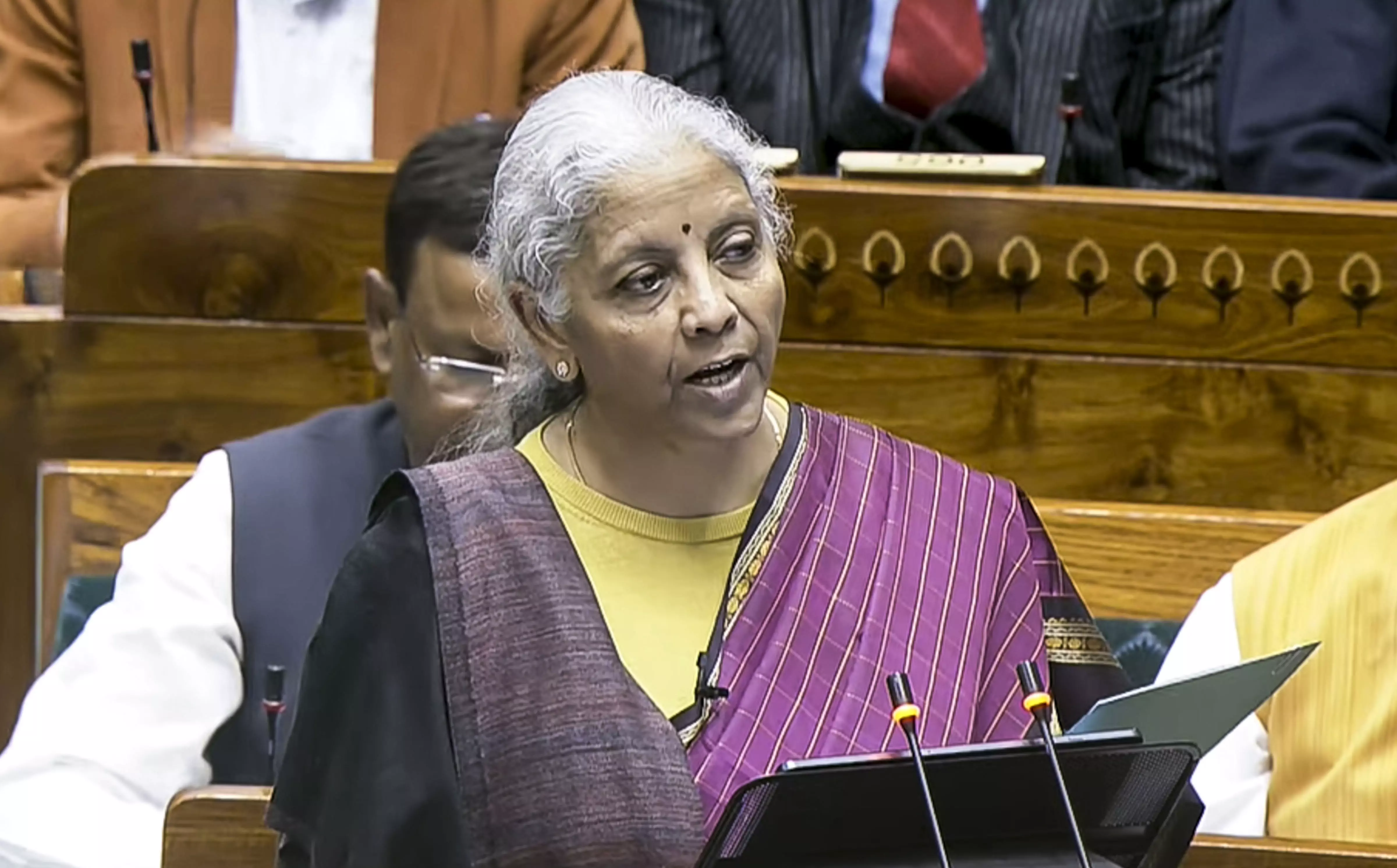

Nirmala Sitharaman made history with the presentation of a record ninth consecutive Budget

New Delhi: Finance Minister Nirmala Sitharaman on Sunday announced that the new Income Tax Act will come into force from April 1, 2026, as she presented her ninth consecutive Union Budget in Parliament. However, contrary to expectations from taxpayers, the finance minister did not propose any changes to the existing income tax slabs in the current Budget.

In a relief measure, Sitharaman proposed extending the deadline for filing income tax returns. Under the proposal, taxpayers will be allowed to file their returns up to March 31 instead of the existing December 31 deadline, subject to payment of a nominal fee.

The finance minister also announced a reduction in the Tax Collected at Source (TCS) rate under the Liberalised Remittance Scheme. The TCS on remittances for education and medical education has been proposed to be lowered from 5 per cent to 2 per cent.

Additionally, the TCS rate on the sale of overseas tour packages will be reduced to 2 per cent from the current 5 per cent. The rate had earlier stood at 20 per cent before being revised downward.

Earlier, the Union Cabinet, headed by Prime Minister Narendra Modi, approved the Union Budget 2026-27 following a meeting in Parliament.

Nirmala Sitharaman made history with the presentation of a record ninth consecutive Budget. This will take Sitharaman closer to the record of 10 budgets that were presented by former Prime Minister Morarji Desai over different time periods.

Live Updates

- 1 Feb 2026 11:33 AM IST

Centre to build seven high speed rail corridors between cities as growth connectors: Delhi to Mumbai to Pune, Pune to Hyderabad, Hyderabad to Bengaluru, Hyderabad to Chennai, Chennai to Bengaluru, Delhi to Varanasi, Varanasi to Siliguri

- 1 Feb 2026 11:28 AM IST

Nirmala propose a scheme for container manufacturing with a budgetary allocation of Rs 10,000 cr over 5 years

- 1 Feb 2026 11:17 AM IST

To accelerate and sustain economic growth, I propose interventions in six areas -Scaling up manufacturing in 7 strategic sectors; Rejuvenating legacy industrial sectors; Creating champion MSMEs; Delivering a push for infra; Ensuring long-term security and stability; Developing city economic regions. - FM