Pak lawmakers rushing to pay higher taxes after Panamagate

Members of the National Assembly paid more than Rs 173 million during the same period up by 26 per cent.

Islamabad: In the wake of the Panamagate case, Pakistani officials have recorded a stunning hike in taxes paid by lawmakers, from a paltry 15 to a whopping 3,852 per cent rise in individual cases, authorities said on Friday.

Finance Minister Ishaq Dar launched the fourth tax directory of parliamentarians prepared by the Federal Board of Revenue (FBR).

It shows that lawmakers, including members of the federal cabinet, paid Rs 396 million in taxes during tax year 2016 an increase of Rs 86 million or 28 per cent, The Express Tribune reported.

Tax contributions by members of the Senate rose to Rs 223 million up by 30 per cent. Members of the National Assembly paid more than Rs 173 million during the same period up by 26 per cent.

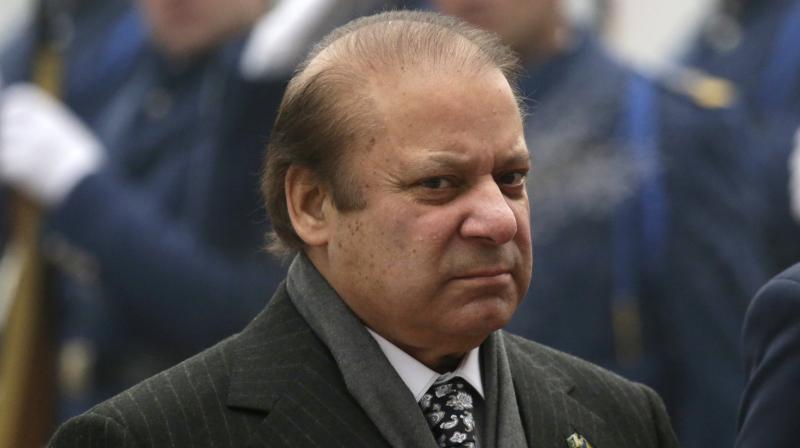

Embattled Prime Minister Nawaz Sharif, whose political future will be decided tomorrow by the Supreme Court when it will announce its much-awaited verdict in the Panamagate case in which he and his family are accused of corruption, paid Rs 2.52 million in taxes, an increase of 15 per cent or Rs 328,872 over the previous year.

Sharif, who has been the prime minister of Pakistan for a record three times, faces the risk of being disqualified if the court finds him guilty of corruption and money laundering. He leads Pakistan's most powerful political family and the ruling PML-N party.

Cricketer-turned politician and Pakistan Tehreek-e-Insaf chairman Imran Khan paid Rs 159,609 in income tax, which was higher by 109 per cent or Rs 83,356 over the previous year.

Jahanghir Khan Tarin, another PTI leader, paid the highest income tax Rs 53.7 million. His contribution surged by 42 per cent or Rs 16.1 million over a single year.

The fiscal year 2015-16 closed three months after the Panama Leaks created ripples in Pakistan's politics. The release of tax details coincide with the finaldecision by the court in the case.

Since the FBR started publishing the tax directory of parliamentarians four years ago, tax contributions by members of the National Assembly and Senate increased by more than 200 per cent. There are still as many as half a dozen members of the federal cabinet who did not file their income tax returns for the tax year 2016.

Instead of taking legal action against them, Finance Minister Ishaq Dar on Friday gave them one month more to file their tax returns. Commerce Minister Khurram Dastgir Khan, Minister for Overseas Pakistanis Syed Sadaruddin Shah Rashidi, and Ports and Shipping Minister Mir Hasil Khan Bizenjo are prominent among those who did not file their income tax returns for a second consecutive year, according to the tax directory.

Federal minister for National Food Security Sikandar Hayat Bosan and Minister for Housing and Works Akram Khan Duranni are also among those who did not submit their income tax returns.

Tax contributions by cabinet ministers increased by more than 70 per cent to Rs 28.6 million against the preceding year. But a few federal ministers and parliamentarians paid taxes on their salaries they received as the members of parliament.

Of the 1,169 members of the Senate, National Assembly and four provincial assemblies, as many as 159 legislators did not file tax returns. Under the law, filing income tax return is binding on all citizens earning more than Rs 400,000 a year and non-filer parliamentarians may face serious consequences if FBR chose to act against them.

Several lawmakers and cabinet ministers saw a dramatic increase in the amount of taxes they paid, which either reflected an abnormal increase in their incomes, or willingness to pay their taxes.

PTI's Senator Mohsin Aziz paid Rs 8.9 million in income tax which amounted to an unbelievably high 1896 per cent or Rs 8.5 million more than the preceding year.

JUI-F's Senator Mohammad Talha Mahmood paid Rs 32.5 million in income tax also higher by Rs 18.5 million or 131 per cent.

Senator Talha's name also appeared in Panama Leaks. Senator Rozi Khan Kakar paid Rs 49.9 million in income tax, showing a stunning growth of 312 per cent or Rs 37.8 million more than the preceding year. Senator Ishaq Dar's tax contribution increased 18 per cent to Rs 4.6 million.

Senator Aitzaz Ahsan's tax contribution declined 44 per cent to Rs 13.9 million. Senator Barrister Farogh Naseem's tax contribution increased by 74 per cent to Rs 20.3 million. Senator Taj Mohammad Afridi also paid Rs 6.4 million less than his previous year's contribution that stood at Rs 35.3 million.

The income tax paid by Minister of State for Interfaith Harmony Pir Aminul Hasnat Shah increased by 3,852 per cent to Rs 4.6 million in 2016.

In the preceding tax year, the minister paid just Rs 116,711 under the same head, according to FBR's record. Punjab Chief Minister Shehbaz Sharif paid Rs 9.53 million against Rs 7.6 million in income tax last year an increase of 25.4 per cent.

NA Speaker Sardar Ayaz Sadiq paid Rs 104,853 in income tax against Rs 1.4 million tax paid in 2015. Leader of Opposition in NA Khursheed Shah paid Rs 124,215 in income tax against Rs 100,054 last year.

Sindh Chief Minister Murad Ali Shah paid Rs 743,471 income tax against Rs 661,661 in the previous year. Khyber-Pakhtunkhwa Chief Minister Pervaiz Khattak paid Rs 813,869 against Rs 766,480 last year. His counterpart from Balochistan, Sanaullah Zehri paid Rs 1.4 million against Rs 1.28 million last year.

Former Information Minister Pervaiz Rashid paid Rs 137,271 against a mere Rs 3,611 last year. Interior Minister Chaudhry Nisar Ali Khan paid Rs 1.2 million an increase of 40 per cent.

Petroleum Minister Shahid Khaqan Abbasi, who also owns a controlling stake in Air Blue, paid Rs 2.7 million in 2016, up by 24 per cent.

Water and Power Minister Khawaja Asif paid Rs 831,986 against just Rs 466,630 in the previous year. Planning Minister Ahsan Iqbal contributed just Rs 82,440. Railways Minister Khawaja Saad Rafique paid roughly Rs 4 million in income tax, or 35 per cent more than the previous year.

Senate Chairman Raza Rabbani paid Rs 492,201 against Rs 730,107 in the previous year. His deputy Maulana Abdul Ghafoor Haideri paid Rs 417,404 against Rs 202,666 in income tax in 2015.