Union Budget 2026: New I-T Act to Come Into Force from April 1

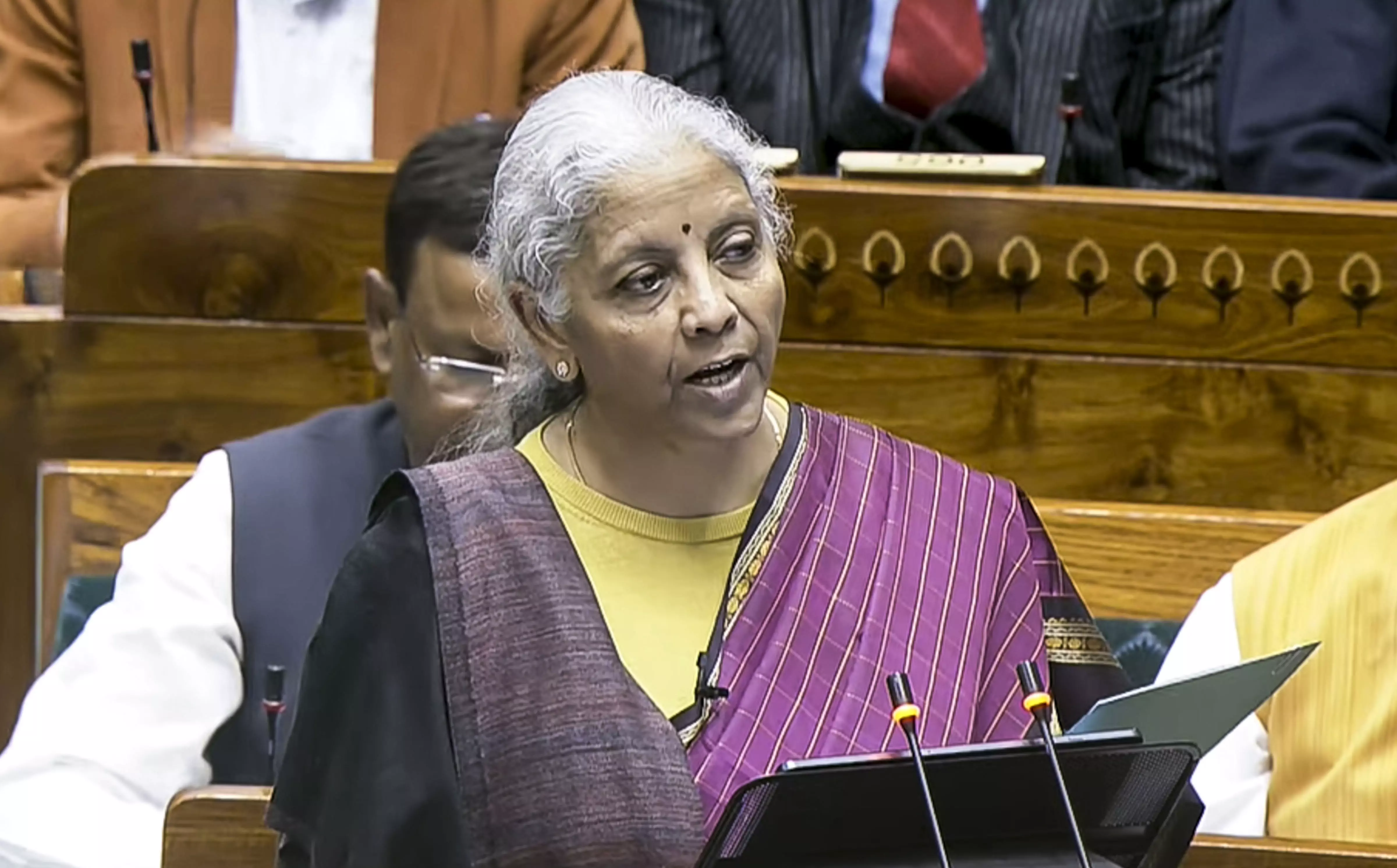

Nirmala Sitharaman made history with the presentation of a record ninth consecutive Budget

New Delhi: Finance Minister Nirmala Sitharaman on Sunday announced that the new Income Tax Act will come into force from April 1, 2026, as she presented her ninth consecutive Union Budget in Parliament. However, contrary to expectations from taxpayers, the finance minister did not propose any changes to the existing income tax slabs in the current Budget.

In a relief measure, Sitharaman proposed extending the deadline for filing income tax returns. Under the proposal, taxpayers will be allowed to file their returns up to March 31 instead of the existing December 31 deadline, subject to payment of a nominal fee.

The finance minister also announced a reduction in the Tax Collected at Source (TCS) rate under the Liberalised Remittance Scheme. The TCS on remittances for education and medical education has been proposed to be lowered from 5 per cent to 2 per cent.

Additionally, the TCS rate on the sale of overseas tour packages will be reduced to 2 per cent from the current 5 per cent. The rate had earlier stood at 20 per cent before being revised downward.

Earlier, the Union Cabinet, headed by Prime Minister Narendra Modi, approved the Union Budget 2026-27 following a meeting in Parliament.

Nirmala Sitharaman made history with the presentation of a record ninth consecutive Budget. This will take Sitharaman closer to the record of 10 budgets that were presented by former Prime Minister Morarji Desai over different time periods.

Live Updates

- 1 Feb 2026 12:06 PM IST

FM Nirmala Sitharaman: I propose that any interest awarded by the motor accident claims tribunal to a natural person will be exempt from income tax and any TDS on this account will be done away with

- 1 Feb 2026 12:06 PM IST

Ease of doing business: FM says individual persons residing outside India will be permitted to invest in equity instruments of listed Indian companies through the portfolio investment scheme. She also proposes to increase the investment limit for PROI from 5% to 10%

- 1 Feb 2026 12:05 PM IST

Govt will support high-value crops such as coconut, sandalwood, walnuts: Nirmala

- 1 Feb 2026 12:03 PM IST

Electronic manufacturing stocks jump 6 pc as Budget hikes outlay to Rs 40,000 cr

- 1 Feb 2026 12:02 PM IST

The Sports Sector provides multiple means of employment, skilling and job opportunities. Taking forward the systematic nurturing of sports talent which is set in motion through the Khelo India programme, I propose to launch a Khelo India Mission to transform the Sports sector over the next decade: Nirmala

- 1 Feb 2026 12:01 PM IST

Nirmala Sitharaman announced the launch of India Semiconductor Mission (ISM) 2.0, with a Rs 40,000 crore outlay, aiming to boost the country's semiconductor ecosystem.

- 1 Feb 2026 11:54 AM IST

I propose to set up three new All India Institutes of Ayurveda; Upgrade Ayush pharmacies and drug testing labs and make available more skilled persons; Upgrade the WHO global Traditional Medicine Centre in Jamnagar, says FM Nirmala

- 1 Feb 2026 11:53 AM IST

To further enhance competitiveness in coconut production, I propose a coconut promotion scheme to increase production and enhance productivity through various interventions, including replacing non-productive trees with new saplings or plants of varieties in major coconut-growing states. A dedicated program is proposed for Indian cashew and cocoa to make India self-reliant in raw cashew and coconut production and processing, enhance export competitiveness and transform Indian cashew and Indian cocoa into premium global brands by 2030: Nirmala Sitharaman