Hello, bankbot: The next AI bank

Banks and insurance companies replace voice response systems with robotic chatbots.

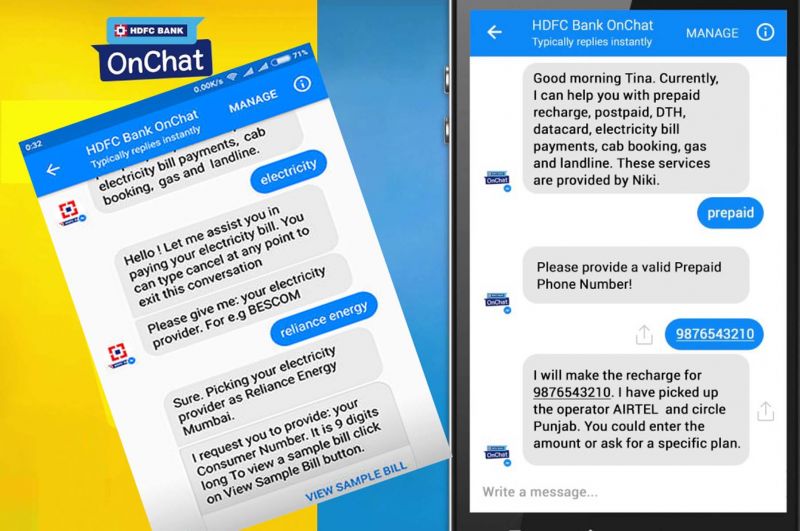

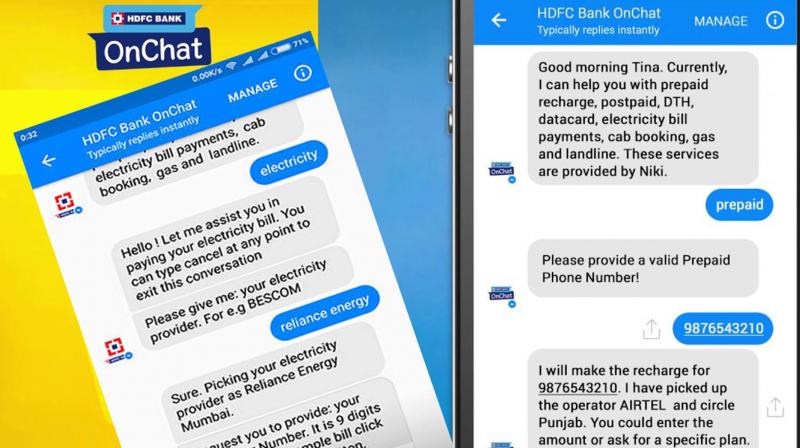

For nine months now, users of Facebook Messenger have been able to utility bills, avail travel services or make movie bookings by just chatting with a cool robotic tool: HDFC Bank's chatbot, OnChat. The Artificial Intelligence-driven, chat tool has made so many friends, that the bank has been able to turn one in four users into customers

Businesses led by banks and financial institutions in India are only just realising the untapped potential of leveraging the smart new tools of Internet and social media to acquire new customers and retain old ones. And innovative startups are helping them do just that.

OnChat replaces conventional mechanisms like Interactive Voice Response (IVR) and can understand language combs like Hindi and English "Rs 50 ka recharge karna hai 987654321 par”. On Chat was developed for HDFC by Niki.ai. The Bengaluru-based startup harnessed Artificial Intelligence and Machine Learning to craft the tool and is now working on an insurance bot and a stock smart tool.”

HDFC Bank offers another chatbot, called Electronic Virtual Assistant or EVA on Web and mobile. The banking bot was built by another AI-savvy startup: Senseforth AI Research.

CEO and Co-Founder Shridhar Marri explains: “EVA currently handles 50,000 plus semantic variations for thousands of banking related intents. Eva tracks and analyses everyday customer issues and gains a deeper understanding of their behaviour patterns...EVA never sleeps and her learning never stops!”

HDFC is not alone in hitching its wagon to the intelligent agent trail. ICICI Bank and its insurance mate ICICI Lombard have also turned to Senseforth to create chatbots for them.

The State Bank of India (SBI) is soon to launch its own chatbot, SIA or SBI Intelligent Assistant to take on customer queries and introduce to the bank's various products . SIA was created for SBI by another startup, Allincall led by IIT Mumbai and Kharagpur alumni. Axis Bank turned to Singapore - headquartered Active.ai to develop its customer-facing chatbots. Active.ai does most of its development in Bengaluru.

Finacle, the banking solution from Infosys, has many global customers for its core banking tools. Niki.ai has also developed a chat-based e-commerce solution for Finacle which is offering the chatbot named Niki , as a smart-purchasing tool along with its own suite of banking solutions. Says Niki CEO Sachin Jaiswal: "Keeping the online shopping experience natural and convenient has definitely worked. It’s as easy as talking to a friend."

Today's banking customers spend significant parts of their life using mobile devices. Chat comes naturally to them. Yet for the most part, the mobile banking experience has been underwhelming. That may change when more banks and financial institutions embrace new user interfaces like chatbots.

Goodbye, menus, icons and click. Hello bankbot!