CAG Flags Widening TG’s Fiscal Gap

Debt servicing costs continued to rise, with interest payments amounting to ₹14,370.64 crore. Expenditure on salaries reached ₹23,953.64 crore, while subsidy spending increased to ₹8,123.93 crore.

Hyderabad: The state government’s income and expenditure rose during the first half of the 2025–26 fiscal (April–September) compared with the same period last year, though revenue collections fell short of budgetary targets, according to a report released by the Comptroller and Auditor General of India (CAG) on Friday.

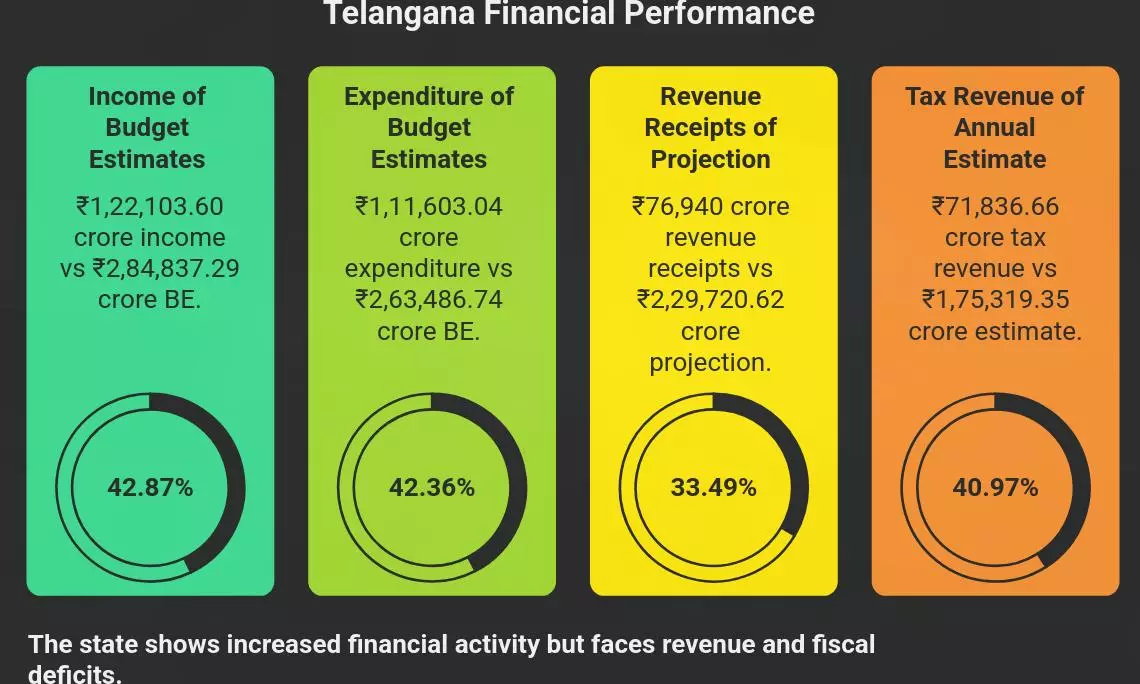

The report said the state’s income during the first six months stood at ₹1,22,103.60 crore, while expenditure was ₹1,11,603.04 crore. Both figures crossed the ₹1 lakh crore mark in the first half of the fiscal, reflecting higher financial activity. Income represented 42.87 per cent of the Budget Estimates (BE) of ₹2,84,837.29 crore, up from 39.41 per cent in the same period last year. Expenditure reached 42.36 per cent of the BE of ₹2,63,486.74 crore, compared with 39.75 per cent last year.

However, the state reported a revenue deficit of ₹12,452.89 crore in the first half, against a revenue surplus projection of ₹2,738.33 crore for the full year. The fiscal deficit widened to ₹45,139.12 crore, nearing the annual target of ₹54,009 crore.

Revenue receipts totalled ₹76,940 crore, 33.49 per cent of the projected ₹2,29,720.62 crore. Of this, tax revenue accounted for ₹71,836.66 crore, or 40.97 per cent of the annual estimate of ₹1,75,319.35 crore. Borrowings during the period matched the fiscal deficit level, also touching ₹45,139.12 crore.

Debt servicing costs continued to rise, with interest payments amounting to ₹14,370.64 crore. Expenditure on salaries reached ₹23,953.64 crore, while subsidy spending increased to ₹8,123.93 crore.

The report noted moderate growth in GST and stamps and registration revenue but declines in sales tax and excise collections, adding pressure to the state’s finances. The CAG observed that while government spending on welfare and development had expanded, the revenue shortfall and mounting debt obligations pose fiscal challenges for the remainder of the financial year.