Mysuru Mp Terms Tax Notices to Traders ‘an Attempt to Recover Revenue Loss Over Guarantee Schemes’

The MP said the notices served on small traders including bakeries and condiment vendors had caused widespread anxiety and clarified the tax notices were not issued by the Union government but were actions undertaken by the state commercial tax department.

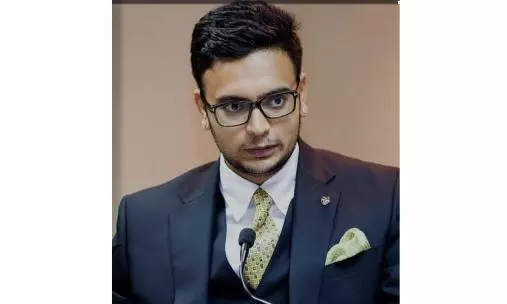

Bengaluru: Taking exception to notices served on traders by the commercial tax department (CTD) to clear pending taxes under Goods and Services Tax (GST), Mysuru-Kodagu MP Yaduveer Krishnadatta Chamaraja Wadiyar said: “It appears to be an attempt by the state government to recover revenue lost due to unscientific financial guarantees by burdening the common trader.”

The MP said the notices served on small traders including bakeries and condiment vendors had caused widespread anxiety and clarified the tax notices were not issued by the Union government but were actions undertaken by the state commercial tax department.

The Lok Sabha member said serving tax notices was discouraging UPI usage in local businesses and undermining the nation’s digital payment ecosystem and instilling a sense of fear among traders. He alleged, “Backdated tax notices for four to five years have been served on traders which is unacceptable.”