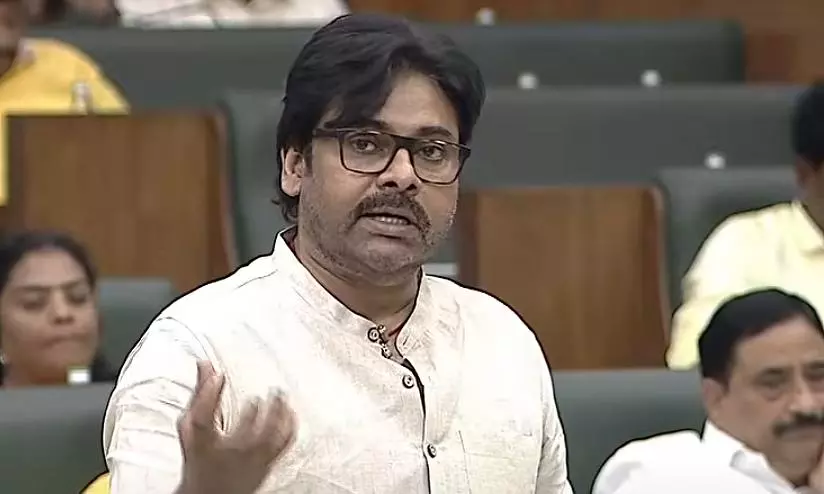

GST Reforms Will Boost E-Economy, Improve Public Welfare: DCM Pawan

Pawan said this reform would boost demand in markets, attract new industries and create employment opportunities. “Every citizen will receive either direct or indirect benefits from this decision.

VIJAYAWADA: Deputy Chief Minister K. Pawan Kalyan has said the new GST framework would boost the economy and improve public welfare.

Participating in the discussions in the state assembly on Thursday, he said the reduction of tax rates on essential commodities, including abolition of the 5 per cent GST on milk and lowering the burden on daily-use goods from 18 per cent to 5 per cent, would directly help households.

The upcoming implementation of GST 2.0 reforms from Sept 22 is set to place India on a new growth trajectory, Pawan Kalyan said.

Reiterating AP’s strong support for the Centre’s initiative, he described GST reform as a historic step that would strengthen the economy, improve people’s purchasing power, and benefit poor and middle-class families.

Pawan said this reform would boost demand in markets, attract new industries and create employment opportunities. “Every citizen will receive either direct or indirect benefits from this decision. Simplification of the tax regime will enhance transparency, reduce the burden on traders, and increase savings among the people,” he said.

The Deputy Chief Minister lauded finance minister Nirmala Sitharaman for spearheading the move and recalled PM Modi’s Independence Day address from the Red Fort, where the reform was first announced.

“Although the state’s revenues may face some decline, the chief minister has extended his full support, keeping people’s interests above fiscal setbacks. It is significant that AP is the first state to back GST 2.0 wholeheartedly,” he stated.

Pawan stressed the need for awareness programmes to ensure the reform’s benefits reach every family. “Revenue officers must directly interact with rural households. Massive campaigns should be undertaken through the media,” he urged, calling for grassroots-level outreach efforts.

He said, “Healthcare too is set to gain, with tax on medicines brought down to 5 per cent and exemptions on life insurance premiums. Similarly, education-related goods will be made more affordable, while MSMEs will benefit from simplified taxation.”

“With GST 2.0, people’s disposable incomes will rise, consumption will grow and new investments will follow, driving India towards stable and inclusive growth,” PK said, saying Andhra Pradesh would actively support its successful implementation.