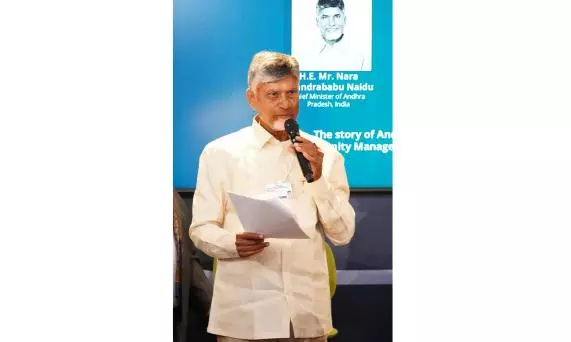

Amaravati to Be Developed as Hub for Financial Institutions: CM at Bankers' Meet

The Chief Minister, explaining his plans to develop Amaravati as a financial hub, noted that the foundation had recently been laid there for offices of 15 banks and financial institutions.

Vijayawada: Outlining his vision for Amaravati, Chief Minister N. Chandrababu Naidu has said the capital city is being developed also as a hub for financial institutions.

Naidu made these remarks while reviewing the flow of bank credit to various sectors at the 233rd and 234th meetings of the state-level bankers’ committee in Amaravati on Friday.

The meetings were held soon after the chief minister returned from the World Economic Forum in Davos. He stressed the government’s priority for economic revival and financial discipline.

Naidu said the Centre was ready to extend Viability Gap Funding (VGF) for PPP projects and that the state was moving ahead with the ‘One Family–One Entrepreneur’ model.

Citizens should not be forced to borrow from private lenders and they must be able to access institutional credit for agriculture and other needs, he said.

Banks were urged to extend generous credit to the renewable energy sector, noting that both the Centre and the state were prioritising the segment and that DISCOMs were providing counter-guarantees.

The Chief Minister, explaining his plans to develop Amaravati as a financial hub, noted that the foundation had recently been laid there for offices of 15 banks and financial institutions.

Naidu underlined the critical role of Micro, Small and Medium Enterprises (MSMEs) in driving inclusive and balanced development in Andhra Pradesh. He urged bankers to substantially step up credit flow to the sector, particularly for enterprises run by Backward Classes (BCs), Scheduled Castes (SCs) and Scheduled Tribes (STs).

Reviewing the implementation of the Annual Credit Plan (ACP) for 2025–26, bankers informed the CM that loans worth Rs 2.96 lakh crore had so far been disbursed to agriculture and allied sectors. Of this, Rs 1,490 crore was extended to tenant farmers. Credit flow to MSMEs stood at Rs 95,714 crore, officials said.

Naidu stressed the need for credibility and prudent financial management, stating that excessively high-interest borrowings in the past had weakened systems. “With credibility and branding, loans can be raised at lower interest rates,” he said, adding that the government was placing strong emphasis on both.

He said Andhra Pradesh has the potential to reschedule loans worth Rs 2 lakh crore, of which Rs 49,000 crore has already been restructured, resulting in a savings of Rs 1,108 crore.

Calling for greater banker support to expand natural farming, MSMEs and other priority sectors, the chief minister said empowering weaker sections through enterprise was vital to bridging economic disparities.

Naidu reiterated the government’s goal of creating five lakh women entrepreneurs and said large-scale lending to SCs, STs and BCs was essential for equitable growth.

Drawing parallels with the success of DWCRA groups, Naidu called for strengthening Farmer Producer Organisations (FPOs).

On Tidco housing, he acknowledged beneficiaries’ difficulties due to “unfulfilled commitments in the past” and assured that technical issues faced by banks in extending loans would be resolved with coordinated efforts.

The CM also sought a reduction in the multiple charges levied on DWCRA group bank accounts, announced reforms to cleanse land records, and highlighted the introduction of QR-code-enabled Pattadar Passbooks to enhance security and transparency.

Bankers were encouraged to explore similar QR-based systems for bank accounts. Naidu suggested inviting district collectors to future SLBC meetings for better coordination.

Infograph:

- Several banks were backing entrepreneurs through the Ratan Tata Innovation Hub in Amaravati

- Union Bank is supporting the main hub, while SBI and Bank of Baroda are backing the Rajamahendravaram spoke hub, Canara Bank the Anantapur hub, Punjab National Bank the Visakhapatnam hub, Indian Bank the Tirupati hub, and HDFC Bank the Vijayawada hub

- Union Bank, as the lead bank, has also contributed Rs 10 crore from its CSR funds to the Innovation Hub