Parliament Approves Bill To Levy Higher Excise Duty On Tobacco, Related Products

The Bill aims to augment resources for meeting expenditure on national security and public health, and to levy a cess for the said purposes on machines installed and other processes undertaken for the manufacture or production of specified goods, and for matters connected therewith

New Delhi: Parliament on Thursday approved a bill to levy a higher excise duty on tobacco and related products once the GST compensation cess ends, with the Rajya Sabha returning the legislation to Lok Sabha. The Lok Sabha had passed the Central Excise (Amendment) Bill, 2025, on Wednesday.

The finance minister also assured that tobacco products would still be taxed under the demerit category at 40 per cent in the GST regime. Later, the bill was returned to Lok Sabha by a voice vote. The Bill, once enacted, will give the government the fiscal space to increase the rate of central excise duty on tobacco and related products after GST compensation cess, which is currently levied on all tobacco products like cigarettes, chewing tobacco, cigars, hookah, zarda, and scented tobacco, ceases to exist.

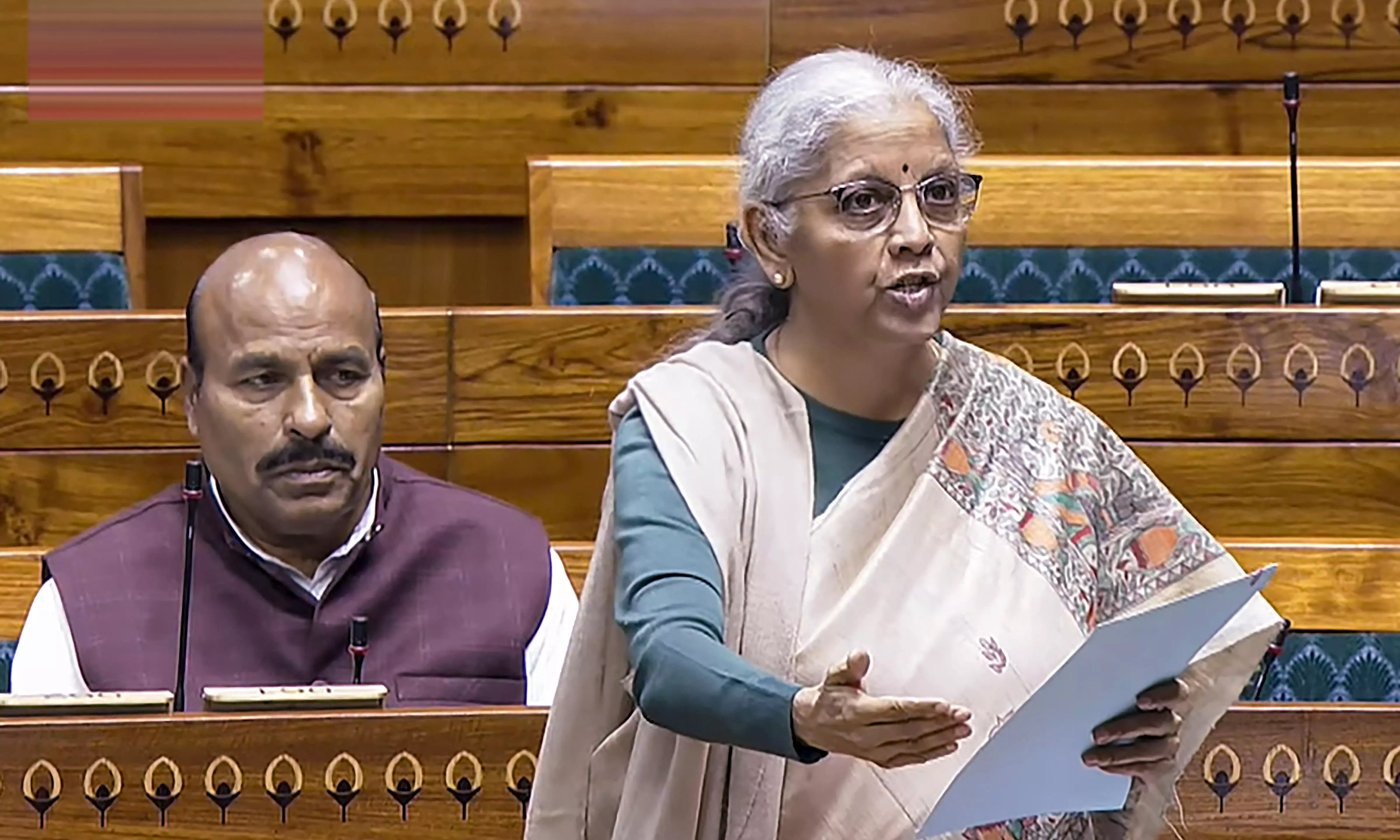

Replying to a discussion on the bill in Rajya Sabha, finance minister Nirmala Sitharaman spoke on the various aspects of the legislation, and responded to questions from various members. She also told the House that farmers are being encouraged to give up tobacco and grow other cash crops.

“This is being done in Andhra, Bihar, Karnataka, Madhya Pradesh, Maharashtra, Odisha, Tamil Nadu, Telangana, UP, and West Bengal. In these states, more than 1 lakh acres of land are shifting from tobacco cultivation to other crops," she said.