By invitation: GST, burdening traders with Notification Raj!

If liberalisation in the early nineties reduced the Inspector Raj, GST has burdened businesses with the Notification Raj .

The Goods and Services Tax (GST), the greatest tax reform in the country since Independence, was welcomed by everyone, including those in trade, industry and services and paved the way for a unified tax across the country despite its federal structure.

While the concept is good and working successfully in India, the multiple GST rates to ensure overall revenue collections based on matrix of rates of all states has posed a serious challenge in over 140 countries. Most countries in the world now have a single rate GST and only a few like Brazil and Canada have a dual rate. India, however, has multiple rates GST and several products like petrol, diesel and power are still not covered by the tax.

In the tearing hurry post the Constitutional amendment approved by parliament and state legislatures to introduce GST, there was hardly any time for the government machinery, the software/hardware/telecom network, and for trade and industry to digest the new reform and this led to confusion.

Business took a beating and with big industries insisting that small traders or service providers register under GSTN despite being exempt from it, primarily to avoid payment of GST on a reverse charge basis, the turnover exemptions given to small players were negated. MSMEs were hit hard due to increasing cost of compliance and unfriendly software, which delayed release of forms and increased their requirement of working capital. The latter was primarily due to monthly compliance vis-a-vis quarterly compliance coupled with increased tax burden on account of higher rates or reverse charge mechanism.

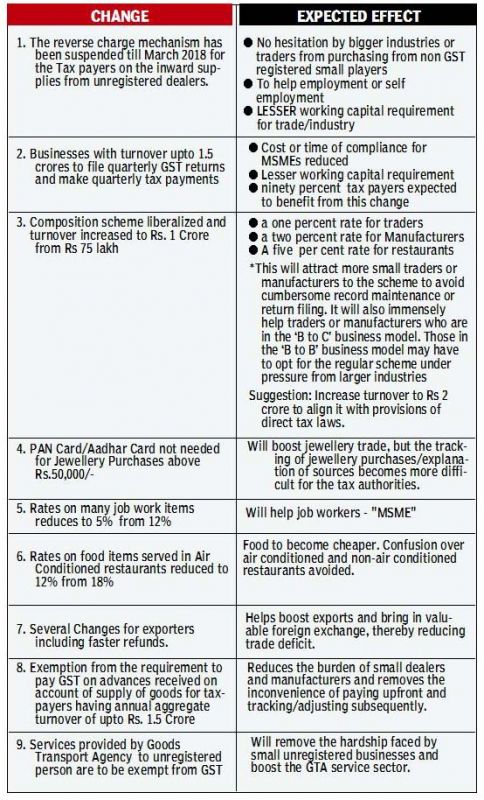

Though the GST Council meets every month, the initial reaction of the powers- that- be was that everything was hunky dory and those criticising the GST were tax evaders. Three months of disruption and slowdown in economic activity gave a wake-up call and the just concluded GST Council’s meeting corrected various anomalies.

Though the above are not exhaustive, they gives a bird’s eye view of the GST Council’s empathy for trade and industry and in turn the common man and the economy.

The GST Council should closely follow up these good measures with solving other pending issues such as the continuing glitches in the GST portal, which indicate gaps in the robustness of the software/hardware of the network to handle such volumes. Also, we need to have more transparency and accountability among all players supporting the GST network. The government should deal with any complacency with an iron hand.

If liberalisation in the early nineties reduced the “Inspector Raj,” GST has burdened businesses with the “Notification Raj”. Frequent interaction with trade, industry and professionals should minimise the use of notifications. Let businessmen re-engineer their businesses to the dynamics of technology and markets and not get bogged down with tax notifications. A good tax system should be simple and stable too.

Demonetisation, which was a very bold move of the Modi government, will have long term benefits such as reducing the power of black economy. But with GST following so close on its heels, and the international scenario not being very encouraging, there is a slowdown in economic activity in the country.

However, whenever a new tax system is introduced, teething problems and disruptions are to be expected. Trade and industry should get back to doing business and giving higher tax revenue to the government to help the country’s economic development.

As for customers and businessmen, the timely booster dose of GST changes, such as on jewellery purchases, should bring more cheer this Diwali.