Who will RBI gov oblige?

Das will have busy days ahead as he adjudicates on the issue of liquidity and credit availability for banks and non-banking finance companies (NBFCs).

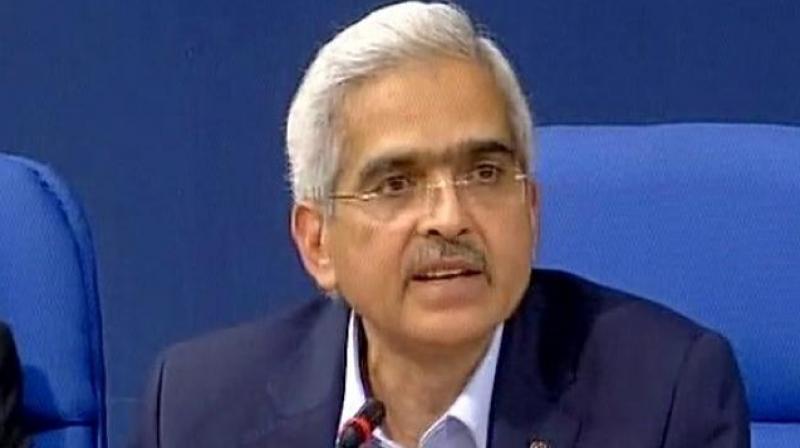

The government and non-banking finance companies that have been smarting under the strict capital adequacy norms of the Reserve Bank of India (RBI) are expecting this to be reversed with the appointment of the new RBI governor, Shaktikanta Das.

Will Mr Das be able to swallow the poison that was allowed to develop and weaken the banking system? His predecessor Urjit Patel had refused to be a Neelakanthan who had swallowed the poison that came out of churning the ocean. It is well known that PSU banks recover just 25 per cent of loans estimated at '8 lakh crore. It would be interesting to know what happened in the 10 years that saw the banking system transform from a strong system with the lowest ratio of non-performing assets among G-20 countries to one that needs the people’s money to bail it out.

Even more worrying is their susceptibility to frauds through which they lost '41,167 crore in 2017-18.

Mr Das will have busy days ahead as he adjudicates on the issue of liquidity and credit availability for banks and non-banking finance companies (NBFCs). The government is jittery as the medium, small and micro enterprises depend for their funding on non-banking finance companies. The latter have also sought relaxation from the strict norms prescribed by the RBI under the former governor Urjit Patel. It needs to be seen how much Mr Das obliges the government which brought this nemesis on itself with the reckless demonetisation and then the flawed implementation of the Goods and Services Tax that dealt a body blow to banks and the economy.