Trump slaps 125% tariff on China, cuts duty for others

Wall Street stocks rocketed higher suddenly on Wednesday after US President Donald Trump announced a 90-day tariff pause on all countries except China

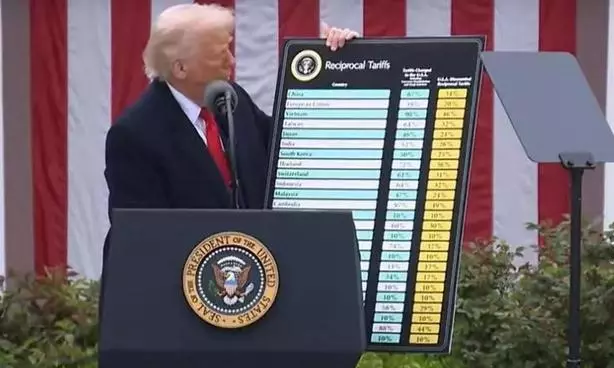

Hyderabad: After taking the world to the brink of a global trade war, US President Donald Trump on Wednesday lowered reciprocal tariffs for all countries, except China, to 10 per cent as against previously duty ranging between 50 per cent to 17 per cent. The punitive tariff on China, however, was raised from previously announced 104 per cent to a humongous 125 per cent. Earlier, China in a tit-for-tat move announced an 86 per cent tariff on US goods, setting off a trade war between global hegemons.

“Based on the lack of respect that China has shown to the world's markets, I am hereby raising the tariff charged to China by the United States of America to 125 per cent, effective immediately,” Trump wrote on Truth Social.

Stating that more than 75 countries had asked for negotiations over the tariffs, Trump said he “authorised a 90 day pause, and a substantially lowered reciprocal tariff during this period, of 10 per cent, also effective immediately.”

With the pause in punitive rates, Indian goods will attract a 10 per cent duty in the US, and external affairs minister S. Jaishankar said the country is engaged with the Trump administration on a bilateral trade agreement.

“The tariff escalation against China by the United States simply piles mistakes on top of mistakes and severely infringes on China's legitimate rights and interests,” China’s finance ministry said. In a separate statement, Beijing's commerce ministry said it would blacklist six American artificial intelligence firms, including Shield AI and Sierra Nevada Corp.

Earlier in the day, the European Commission called the US reciprocal tariff unjustified and damaging, and announced a 25 per cent duty on specific American goods.

The Commission said duties would come into effect in stages — on April 15, May 16, and a final stage on almonds and soybeans on December 1 — which can be suspended at any time if the US agrees to a fair and balanced negotiated outcome.

PHARMA TARIFF SHORTLY

Meanwhile, Trump, in his overnight address to House Republicans, announced that he is going to impose tariffs on pharmaceutical drugs very shortly.

“We are going to be announcing very shortly a major tariff on pharmaceuticals,” Trump said, in his overnight address to House Republicans, without providing details on the planned levy.

The announcement, which was made before he paused punitive tariff for all countries except China, pulled down the stock valuations of major pharma companies in India and Europe. The Nifty Pharma index dropped 1.7 per cent, with the stocks of almost all listed pharma companies falling, as the US is the largest importer of Indian pharmaceutical products.

“Once we do that, they’re going to come rushing back into our country, because we’re the big market,” Trump said. “The advantage we have over everybody is that we’re the big market.”

‘KISSING MY A**’

Despite several pleas for reconsidering his tariff decision, Trump refused to back down and bragged that “countries are calling us up, kissing my a**... They are dying to make a deal.”

Trump went on to mock the leaders of the countries seeking the deal in a simpering voice: “Please, sir, make a deal. I’ll do anything. I’ll do anything, sir.”

US Treasury Secretary Scott Bessent was more dismissive of American businesses’ pleas to back down. “Wall Street has grown wealthier than ever before, and it can continue to grow and do well. But for the next four years, the Trump agenda is focused on Main Street. It's Main Street's turn,” Bessent added, referring to smaller businesses, investors, and institutions.

The economies of the US ($29 trillion) and China ($18 trillion) together account for 44 per cent of the $106-trillion global economy. Similarly, the US, China and Europe together account for over 34 per cent of the $33-trillion global trade.

The trade war between the two major economies, which contribute massively to global prosperity, is expected to have a ripple effect that will slow economic growth in almost all countries. The US President, however, said his government was working on “tailored deals” with trading partners.

CRUDE OIL, DOLLAR, YUAN FALL

Growing fears of weakened demand sent global crude oil prices to four-year lows, with international benchmark Brent North Sea crude dropping below $60 a barrel.

Oil prices fell to their lowest level in four years because of weakened global economic growth assessments.

Government bond yields — essentially the interest countries pay to borrow money — rose in the US, Japan, and Britain, among others. The global uncertainty also hit the US dollar, which was long considered a safe haven in uncertain times.

The dollar fell over one per cent, while China allowed the yuan to fall to its 17-year-low — raising the prospect of competitive currency devaluation. The South Korean won also fell to its lowest level against the dollar since 2009 this week.

“Alarmingly, US Treasury markets are also experiencing an incredibly aggressive sell-off... adding to the evidence that they're losing their traditional haven status,” said Jim Reid, managing director at Deutsche Bank.

WALL STREET CELEBRATES

Wall Street stocks rocketed higher suddenly on Wednesday after US President Donald Trump announced a 90-day tariff pause on all countries except China.

Shortly after Trump announced his latest pivot on his Truth Social platform, the S&P 500 surged six per cent higher to 5,281.44, snapping a brutal run of losses since Trump’s “Liberation Day” tariff announcement a week ago.

Earlier in the day, stock markets were in panic mode as Trump was determined to impose global punitive tariffs on 60 trade partners. Tokyo’s Nikkei index closed almost four per cent lower on Wednesday. Paris and Frankfurt each sank four per cent in afternoon trading, while London was down 3.5 per cent.

South Korea’s Kospi lost 1.7 per cent, and Aust-ralia’s S&P/ASX 200 declined 1.8 per cent.

Chinese markets, which reported early losses, recovered after Chinese investment funds intervened to buy shares in massive volumes to steady the market.

Besides worries about a recession due to the tariffs, investors have also been unnerved by rising Treasury bond yields.

US equities briefly jumped into positive territory after Trump posted a message on social media to “Be cool ... This is a great time to buy!!!” But within moments, stocks had quickly reverted back to near their prior level.