Tobacco Excise Revenues to Be Shared With States at 41%

At the time of the introduction of the GST on July 1, 2017, a compensation cess mechanism was put in place for five years till June 30, 2022, to make up for the revenue loss suffered by states on account of GST implementation.

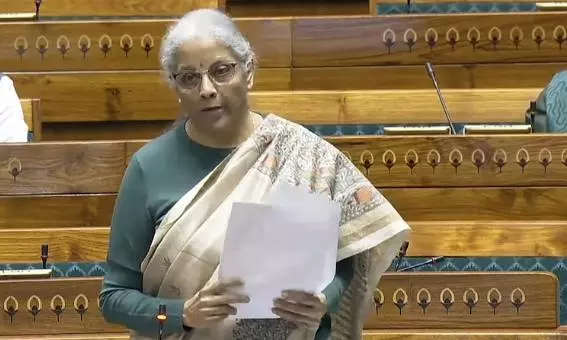

New Delhi: Union finance minister Nirmala Sitharaman on Wednesday said tax revenues collected from excise duty on tobacco and related products will be part of the divisible pool, and 41 per cent of that will be shared with the states. “This is not an additional tax, and the same tax burden, as currently applicable under the GST regime, will continue. The bill seeks to levy excise duty on tobacco related products,” she said, while replying to the debate on the Central Excise (Amendment) Bill in Lok Sabha.

“This is not an additional tax. This is not something which the Centre is taking away. This is not a cess. This is excise duty. It existed before GST as well. It is coming back to the Centre, to be collected as excise duty, which will go to the divisible pool. It is going to be redistributed again at the 41 per cent which has to go to the states,” the finance minister replied in the House.

While moving the Central Excise (Amendment) Bill, 2025 in Lok Sabha, Sitharaman said that the levy of excise on tobacco would ensure that incidence of tax on the demerit goods remains same even after the expiry of the GST compensation cess. “In order to ensure that the incidence is not lower than what it was during GST with the compensation cess, we are bringing this exercise. In a way we are saying cigarettes should not become affordable now because incidence has become lesser,” she said.

Later, the bill was passed by a voice vote in the House to levy tax on tobacco and related products. Now, the government will enact a law to levy a higher excise duty on tobacco and related products once the GST compensation cess ends. The bill, once enacted, will give the government the fiscal space to increase the rate of central excise duty on tobacco and related products after GST compensation cess, which is currently levied on all tobacco products like cigarettes, chewing tobacco, cigars, hookah, zarda, and scented tobacco, ceases to exist.

Currently, a 28 per cent GST plus cess at a varied rate is levied on tobacco and related products. The bill, however, proposes to levy an excise duty of 60-70 per cent on unmanufactured tobacco. As per the bill, excise on cigars and cheroots are proposed at 25 per cent or Rs 5,000 per 1,000 sticks, whichever is higher. Cigarettes, depending on length and filter are also proposed to be levied in the range of Rs 2,700-Rs 11,000 per 1,000 sticks, while chewing tobacco is taxed at Rs 100 per kg. For example, cigarettes, not having filters, and of length not over 65 millimetres will attract duty of Rs 2,700 per 1,000 sticks and Rs 4,500 per 1,000 sticks for length over 65 millimetres but not exceeding 70 millimetres.

The bill also seeks to substitute the table containing the tariff rates of tobacco and tobacco products in Section IV of the Fourth Schedule to the Central Excise Act, 1944. “Even in India, prior to GST, tobacco rates were increased annually. This was primarily due to health-related concerns, as higher prices or taxes were intended to act as a deterrent so that people would not get into the habit,” said FM Sitharaman.

When GST was introduced on July 1, 2017, the rates of central excise duties on tobacco and such products were reduced significantly to allow for the levy of compensation cess without a large impact on their tax incidence. “Compensation cess levied on tobacco and tobacco products will be discontinued once interest payment obligations and loan liabilities under the compensation cess account are completely discharged,” she said.

At the time of the introduction of the GST on July 1, 2017, a compensation cess mechanism was put in place for five years till June 30, 2022, to make up for the revenue loss suffered by states on account of GST implementation. “In another, probably, couple of weeks the loans will be completely repaid. The Centre, therefore, wants to make sure that the excise will come back to us so that we can levy the duty,” the finance minister said.