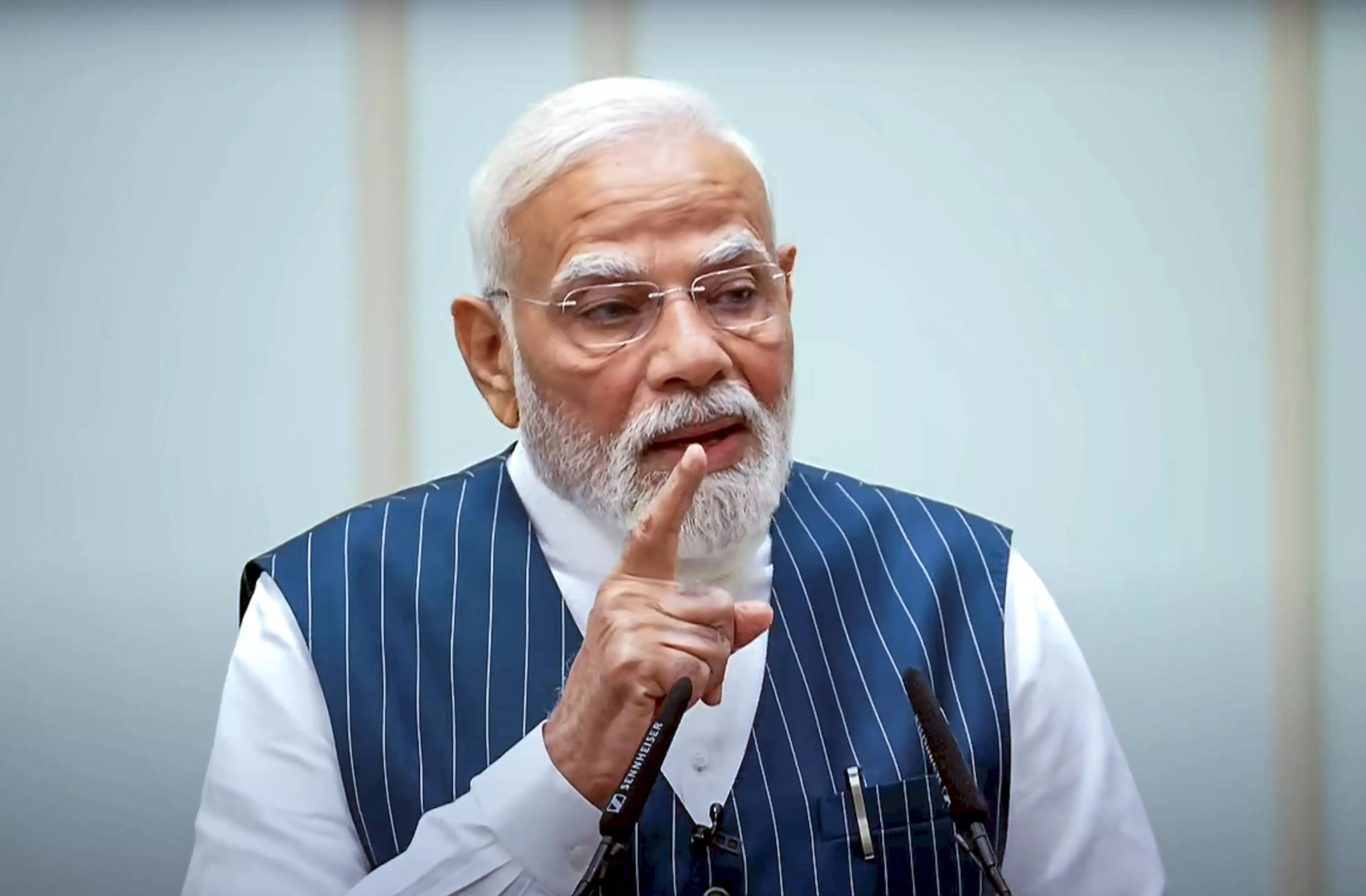

Modi: Buy Local Goods After GST Reforms

Savings festival has begun for people, says PM

PM Modi Speech Today Live Updates: Watch video

New Delhi: Prime Minister Narendra Modi on Sunday said that next-generation GST reforms will accelerate India’s growth story, simplify business operations and make investments more attractive while addressing the nation on the eve of the auspicious Navratri. In his address before reduced GST rates come into effect, he made a strong pitch for promoting "swadeshi" goods and urged people to buy products that are “Made in India”.

The Prime Minister underlined that the mantra of "nagarik devobhava" is clearly reflected in the next generation GST reforms. He said that a "GST bachat utsav" (savings festival) will begin on the first day of Navratri, and coupled with the income tax exemption, it will be a "double bonanza" for most of the people.

Modi stated this festival will enhance savings and make it easier for people to purchase their preferred items. The benefits of this savings festival will reach the poor, middle class, neo-middle class, youth, farmers, women, shopkeepers, traders, and entrepreneurs alike.

Modi said that in this festive season, every household will experience increased happiness and sweetness and underscored that these reforms will accelerate India’s growth story, simplify business operations, make investments more attractive, and ensure that every state becomes an equal partner in the race for development.

Recalling that India took its first steps towards the GST reform in 2017, marking the end of an old chapter and the beginning of a new one in the country’s economic history, Modi highlighted that for decades, citizens and traders were entangled in a complex web of taxes—octroi, entry tax, sales tax, excise, VAT and service tax—amounting to dozens of levies across the nation.

The Prime Minister highlighted that lakhs of companies and crores of citizens faced daily hardships because of the complex web of multiple taxes and emphasised that the increased cost of transporting goods from one city to another was ultimately borne by the poor and recovered from customers like the general public.

Emphasising that it was imperative to free the nation from the prevailing tax complexities, Modi recalled that upon receiving the mandate in 2014, the government prioritised GST in the interest of the people and the nation.

The Prime Minister stated that it was the result of joint efforts by the Centre and the states that the country was liberated from the maze of multiple taxes and a uniform system was established across the nation, and affirmed that the dream of “One Nation-One Tax” was realised.

The Prime Minister stated that reform is a continuous process, and as times change and national needs evolve, next-generation reforms become equally essential. He said that keeping in view the current requirements and future aspirations of the country, these new GST reforms are being implemented and highlighted that under the new structure, only 5 per cent and 18 per cent tax slabs will primarily remain.

“This means that most everyday-use items will become more affordable,” Modi said and listed food items, medicines, soap, toothbrushes, toothpaste, health and life insurance among the many goods and services that will either be tax-free or attract only a 5 per cent tax.

The Prime Minister further noted that of the items previously taxed at 12 per cent, 99 per cent—virtually all—have now been brought under the 5 per cent tax bracket.

Highlighting that in the past 11 years, 25-crore Indians have overcome poverty and emerged as a significant neo-middle-class segment playing a vital role in the country’s progress, Modi emphasised that this neo-middle class has its own aspirations and dreams.

Pointing out that this year, the government has given tax relief by making income up to Rs 12 lakhs tax-free, bringing substantial ease and convenience to middle-class lives, the Prime Minister said that now it is the turn of the poor and the neo-middle class to benefit. He stated that they are receiving a “double bonanza”—first through income tax relief and now through reduced GST.

The Prime Minister underscored that with lower GST rates, fulfilling personal dreams will become easier for citizens—whether it’s building a house, purchasing a TV or refrigerator, or buying a scooter, bike, or car—all will now cost less.

The Prime Minister further stated that travel will also become more affordable, as GST on most hotel rooms has been reduced.

Underlining that the mantra of nagarik devobhava is clearly reflected in the next-generation GST reforms, the Prime Minister said that when the income tax relief and GST reductions are combined, the decisions taken over the past year will result in savings exceeding Rs 2.5-lakh crores for the people of India. He affirmed that this is precisely why he calls it a "bachat Utsav".

Emphasising that achieving the goal of a developed India requires unwavering commitment to the path of self-reliance, Modi stated that a major responsibility in making India self-reliant rests with the micro, small, and cottage industries. He asserted that whatever meets the needs of the people and can be manufactured within the country must be produced domestically.

The Prime Minister said that just as the mantra of swadeshi empowered India’s freedom struggle, it will similarly energise the nation’s journey toward prosperity.

Modi emphasised the need to liberate ourselves from such dependence on foreign products and urged people to buy products that are “Made in India”, infused with the hard work and sweat of the country’s youth. He called for every household to become a symbol of swadeshi and every shop to be adorned with made-in-India products.

Live Updates

- 21 Sept 2025 5:24 PM IST

PM Modi says decisions of raising I-T exemption limit, GST reforms will save people Rs 2.5 lakh crore

- 21 Sept 2025 5:24 PM IST

PM Modi cites income tax exemption on earning upto Rs 12 lakh, GST reforms; says 'double bonanza' for poor, neo-middle class, middle class

- 21 Sept 2025 5:23 PM IST

“Every Indian should aim to become a job creator, not just a job seeker. When this happens, India will rapidly move towards development,” he said. The Prime Minister also urged all state governments to actively contribute to the mission of a self-reliant and developed India.

- 21 Sept 2025 5:20 PM IST

The Prime Minister emphasised that there are great expectations from micro, small, and medium industries. He reminded that when India was at the peak of prosperity in the past, MSMEs formed the backbone of the economy. “Every Indian should aim to become a job creator, not just a job seeker. When this happens, India will rapidly move towards development,” he said.

- 21 Sept 2025 5:18 PM IST

The Prime Minister said that the spirit of “Nagrik Devo Bhava” (citizen is like God) is clearly reflected in the new GST reforms. If the relief in income tax and the GST cuts are combined, people of the country will save more than Rs 2.5 lakh crore in a year. “This saving is a celebration,” he added.

He further said that to achieve the goal of a developed India, the nation must walk the path of self-reliance. A major responsibility lies on India’s MSMEs — the small, medium, and cottage industries — to produce domestically what can be made within the country, reducing dependence on imports and strengthening Atmanirbhar Bharat.

- 21 Sept 2025 5:15 PM IST

Next gen GST reforms being implemented from tomorrow, it is like 'GST saving festival': PM Modi in address to nation

- 21 Sept 2025 5:14 PM IST

With reduced GST rates, it will now be easier and more affordable for citizens to fulfil their dreams. From building a house to buying a TV, fridge, scooter, bike or car, expenses will come down. Travel and leisure will also become cheaper as GST on most hotel rooms has been reduced, said Modi. The Prime Minister expressed happiness that shopkeepers too are enthusiastic about the reforms and are committed to passing on the benefits of tax cuts to customers.