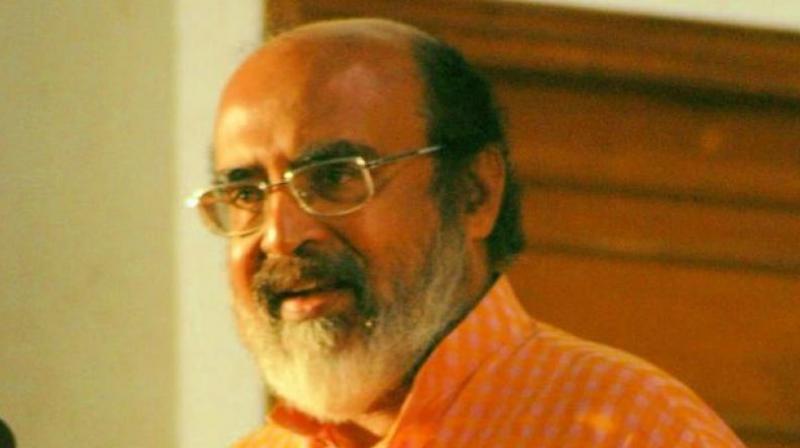

Finance minister Dr T M Thomas Isaac's fiscal nightmare turns real

The actual figures for 2015-16, the UDF's last fiscal, too is feared to be near 80 percent.

THIRUVANANTHAPURAM: Finance minister Dr T.M. Thomas Isaac’s hopes of reversing a fiscal free fall has been all but dashed. The share of revenue deficit within the fiscal deficit, which is a measure of the money available for the state’s development, has been sliding dangerously during the UDF tenure. What was 62.3 percent in 2012-13, fattened to 66.74 in the next fiscal, and then swelled to 74 percent in 2014-15. The actual figures for 2015-16, the UDF’s last fiscal, too is feared to be near 80 percent. But Isaac's attempt to stem the slide has failed big time.

After he took over, the minister said that revenue deficit for 2016-17 would be brought down to 56 percent. However, his strategy was pivoted around the assumption that the state’s tax revenue would grow by nearly 20 percent. However hard he tried, average tax growth this fiscal stayed below 10 percent. Demonetisation was not fully to blame as tax growth was virtually stagnant even before the Prime Minister announced the sudden withdrawal of notes. Nonetheless, Isaac had managed to improve tax collection by 18 percent in October. But this gain was completely washed away by demonetisation with November and December recording negative growth rates.

Isaac’s original plan was to bring down the RD/FD ratio to 48 percent in 2017-18. Isaac himself would be the first person to admit that this would be impossible in the changed circumstances. “Our informal sector has been thoroughly decimated after demonetisation, so tax growth will remain uninspiring. It would be a feat if the finance minister could hold the ratio at 70 percent,” a top Department official said. The ratio of revenue deficit to fiscal deficit indicates the extent to which borrowed funds were used for current consumption. Further, persistently high ratios of revenue deficit to fiscal deficit also indicate that the asset base of the State was continuously shrinking and a part of the borrowings (fiscal liabilities) did not have any asset backup.