Kerala: Co-operative honchos wary of run on deposits

Sector is mainstay of banking facility for rural and urban poor.

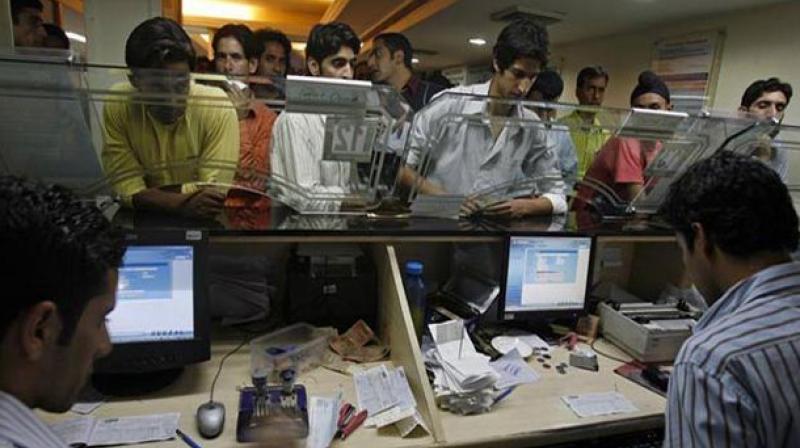

KOCHI: The co-operative sector in the state, the mainstay of banking facility for a cross section of rural and urban poor, petty traders and others, is increasingly worried about its long-term prospects in the wake of demonetisation. As the state is bracing up for a hartal on Monday on the issue, top honchos of the co-operative sector are apprehensive that a good number of high value depositors from the bank may withdraw their money giving a crippling blow to the sector.

"A number of persons, especially pensioners, have deposited amounts in the range of Rs 15-20 lakh to take advantage of the higher interest rate for fixed deposits in primary service co-operatives compared with scheduled banks. Most of them are anxious about the fate of their deposits and they may close the accounts to escape the prevailing uncertainty," said a source. Finance Minister Thomas Isaac has been blaming the centre mainly for creating a "crisis confidence" about the co-operative sector. The confidence of depositors is the mainstay of a bank and if that is lost the entire banking edifice will collapse, he pointed out. In the name of fighting black money, the BJP government is creating doubts about the existence of the co-operative sector, he pointed out in an article.

There are no signs of any largescale withdrawal of money by depositors from primary co-operative societies coming under the Ernakulam District Co-operative Bank, says its director M.E. Hassainar. "It is true that depositors are anxious in the wake of demonetisation but that has not created any panic withdrawal from the 175 primary co-operative societies," he said. "We have not shown any hesitation to people asking for the withdrawal of their money," he added.

Depositors are a worried lot

Those who have parked their money in the cooperative banks in the district are passing through a tough time. Father Michael Ouseparampil, the vicar of the Chettuthodu Fathima Matha Church, said it had deposited Rs 8 lakh in the Mylady cooperative bank, which was the income from the church's rubber estate. But he could not pay wages of its employees. “We are not able to withdraw money even for paying tappers. We don't have any other account,” he told DC.

"The rural economy has come to a standstill." E.P. Mathew, a former headmaster, had invested a few lakhs of rupees in the Anikad service cooperative bank. He is also in the same dilemma now. “The issue may be solved. But there is currently a difficulty,” he told DC. S. Sanil Kumar, a native of Olasha who has an account at the district cooperative bank here, says he is not able to withdraw money even to meet day to day expenses.

Collectors draw a blank

The political battle between the BJP and the CPM over the cooperative sector in the state has hit the livelihood of a cross-section of people. The daily collection agents of cooperative banks depend on the commission on the collections made by them. "After demonetisation, the cooperative banks are at a standstill. Since people have no money to deposit, we cannot collect anything," said A.K. Preman, a collection agent of Kuthuparamba Rural Co-operative Bank. The number of collection agents in Kannur district is estimated to be around 1,500. The average income of a collection agent varies from as low as Rs 4,000 to Rs 50,000 per month, Preman said. All such people are without work since November 10, he added.

P. Sreedharan, secretary, Kadirur Service Co-operative Bank, says many social welfare measures and schemes of the cooperative societies had come to a standstill. "We provide financial aid for medical treatment and scholarship to meritorious students. All such projects are facing uncertainty," he added. K. Prasad, chairman of Kerala Coir Products Manufacturers Society, Alappuzha, said the coir sector will grind to a halt if the restrictions on the cooperative sector continued. "It will result in loss of jobs to thousands of workers. The false campaign against cooperative banks should be stopped immediately," he said.