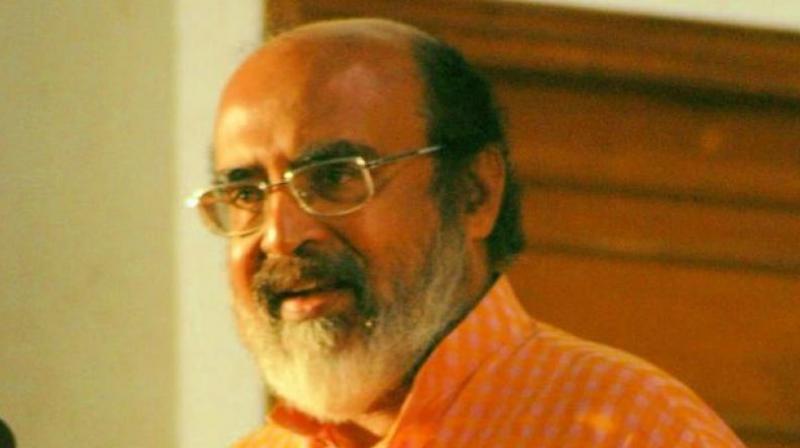

Finance minister Thomas Isaac happy prediction came true

He had predicted, in fact he was the first political leader to say so, that demonetisation would wreak havoc.

THIRUVANANTHAPURAM: Finance minister Dr T.M. Thomas Isaac has recently done something quite uncharacteristic: he has not just given up but has done so with great gusto. Dr Isaac has gone on record saying that Budget 2017-18 will showcase perhaps the most bloated revenue deficit figure in history. A harder look will reveal that Isaac was fighting hard to suppress his glee at how ugly the deficit will turn out to be. A higher revenue deficit, though economically unsound, is a political triumph for him. He had predicted, in fact he was the first political leader to say so, that demonetisation would wreak havoc. Now, he will have the sad plight of his own state to show as proof.

During December, as predicted, the growth in tax revenue was an alarming -0.49 percent. However, quite dramatically in January, growth in tax collection bounced back as if with a vengeance to an encouraging 18 percent. Isaac’s first reaction was one of disbelief. “It can’t be,” he had said. Later, after going into the details, he had his smile back. “VAT had indeed gone down to 4 from 9 percent,” he said. His office further argued that the increase was illusory as it was a book-keeping adjustment related to excise collection that has manifested as a spurt in revenue during January.

Now, Dr Isaac’s dystopian demonetisation narrative has been seconded by the ‘Planning Board’-appointed Committee to Study the Impact of Demonetisation on the State Economy of Kerala. “Given the post-demonetisation slump in economic activity and the revenue loss already seen in the real estate sector on account of stamp-duty collection and in motor vehicle tax collection, it is unlikely that own tax revenue of the state would grow at more than the assumed 19 per cent in 2016-17,” the report, submitted late last week, said. Further, it stated that decline in central transfers along with falling revenues would push up deficit or contract expenditure. (Isaac had already ruled out the latter.

The Plan outlay for next fiscal is pegged 10 percent higher, and Isaac has no plans to stinge on welfare measures either.) The Committee’s report, while observing that it was unlikely that the state could achieve its tax target, painted an alarming picture. “If the tax to GSDP ratio is assumed to be 6.5 instead of 6.85, shortfall in revenue caused by a one percentage point decline in GSDP would be more than Rs 2800 crore in 2016-17, and aggregate own tax revenue loss in turn would be around Rs 11,000 crore if the GSDP growth plummets to 10-11 per cent,” it said.