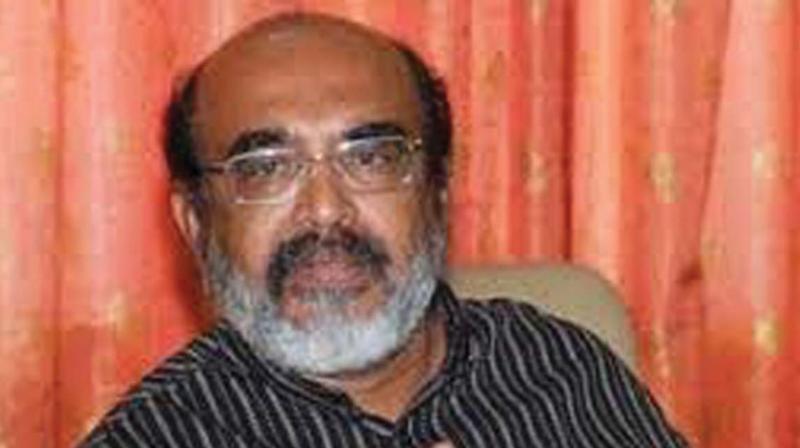

Traders' uncertainty caused price rise: Finance minister Dr T M Thomas Isaac

The GST regime allows a trader to claim input tax credit for all purchases, including from outside the state.

THIRUVANANTHAPURAM: Finance minister Dr T. M. Thomas Isaac said that it was the traders’ uncertainty about input tax credit that had not caused prices of goods to come down post GST. “If prices have not come down, it is because traders have not reduced the input tax credit that they would receive,” Isaac said while speaking at a seminar on Goods and Services Tax organised for legislators at the Legislative Complex here on Monday. Input tax credit refers to the set off a trader can claim for a tax paid earlier in the supply chain. In the earlier Sales Tax regime, there was no input tax credit. Under the VAT regime, there was input tax credit but only for transactions within the state. The GST regime allows a trader to claim input tax credit for all purchases, including from outside the state.

The minister said that at the moment traders were unsure about the input tax credit. “Now, it exists only as theory. The credit will reach their hands only after a month, in September when they file their first tax returns under the tax regime,” the minister said. “Perhaps after this, they will pass on the credit to the consumer,” he added. However, both the minister and most of the legislators were of the opinion that it would be naive to expect traders to pass on the gains. “We have now insisted in the GST council that when the new stock is packaged and brought out, the MRP has to be brought down to reflect the reduced taxes,” Dr Isaac said. According to him, the prices of virtually all goods would come down under the GST regime because cascading has been done away with.

“If the new stock does not have a lower MRP, then the anti-profiteering clause should kick in,” he added. Isaac had also argued at the Council that the punitive clause should become operational right away. This is contrary to the position taken by others who want action initiated on the basis of the anti-profiteering clause only after three months, when things are more settled. The finance minister further said that the biggest achievement for Kerala under GST was getting the ‘destination clause’ principle extended to the services sector. Now, for all kinds of services, be it banking or engineering consultancy, the revenue would flow to the state where the consumption happens.