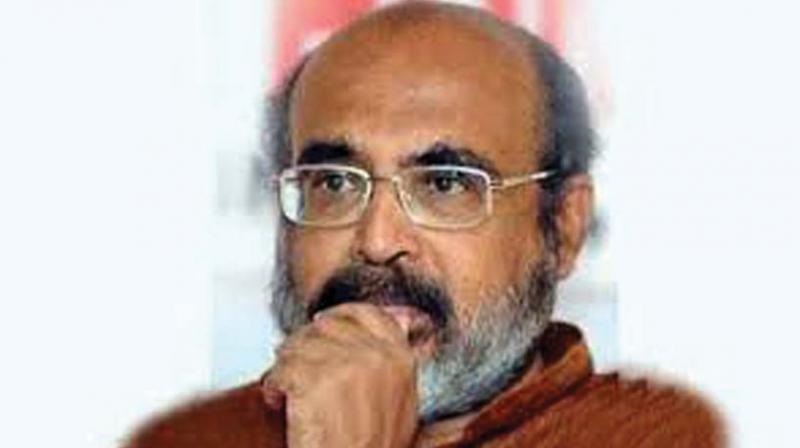

Finance minister Dr T M Thomas Isaac sets sights on VAT arrears

Dues stand at Rs 12,000 crore: CAG

THIRUVANANTHAPURAM: Now that the GST has come into force, finance minister Dr T. M. Thomas Isaac has doubled efforts to recoup VAT arrears. After deputing a few tax officials for the GST transition, the rest have been asked to focus on making VAT defaulters pay. Though the Kerala Value Added Tax had been subsumed in GST, the GST ordinance issued by the state has “saved” the VAT Act expressly for such purposes. Latest CAG figures show that the VAT arrears stood at nearly Rs 12,000 crore and Isaac would like to mop up at least Rs 2,000 crore of this.

The finance minister had announced an amnesty scheme in February. Though the last date for filing of option was initially fixed as June 30, it has now been extended to September 30. Here is what Isaac’s amnesty scheme says: “In the case of VAT dealers, if the tax arrears of the assessment years from 2005-06 to 2010-11 is completely remitted, the interest and 70 percent of the penalty amount and interest on penalty, shall stand waived.” The amount worked out under the scheme shall be paid in equal instalments on or before December 31, 2017. A top Commercial Sales Tax Department official said that all arrears pertaining to a year will be settled together. An assessee opting to settle arrears under this scheme should withdraw all cases, revision and appeals pending before any forums.

“Tax arrears and interest shall be calculated as on the date of submission of application,” the official said. The arrears of Rs 12,000 crore include taxes on sales, trade, vehicles and land revenue. Of this, the tax component would come to only Rs 2000- Rs 2500. “Most of it is penalty,” the official said. The department will not wait for defaulters to declare amnesty. Its officials will proactively dig out cases and approach defaulters. New avenues to get back lost VAT money have also been discovered. “For instance, there are many who had received refund of entry tax after the High Court had declared the tax unconstitutional. But the Supreme Court had had recently set aside the lower court order. Tax officials will now try and get back the refunded amount. We expect at least Rs 300 crore out of this,” the official said.