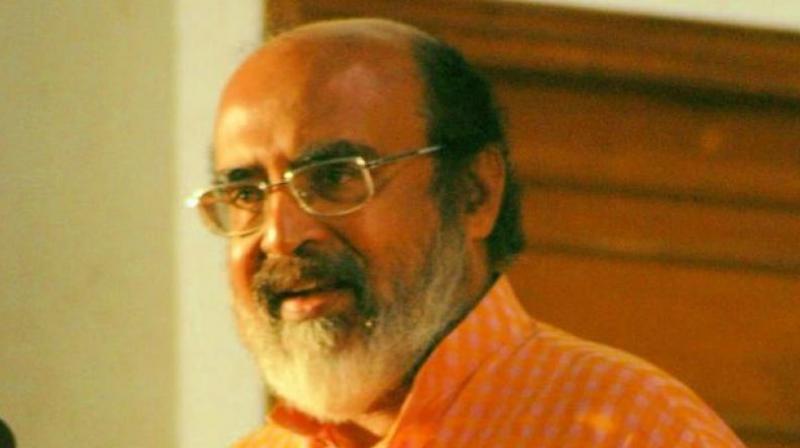

Tax in excess of MRP at traders' risk, warns Finance minister Thomas Isaac

Thiruvananthapuram: Finance minister Dr T. M. Thomas Isaac said that no trade or business had the right to sell products above the Maximum Retail Price (MRP). “Many instances of overcharging have come to our notice after the GST came into force. Such practices are illegal,” Dr Isaac told the media here on Monday. “They do it by heaping GST over the existing prices. The existing price is the sum total of existing levies like VAT, service tax, central sales tax and many other impositions. GST has to be applied only after taking out all these old levies,” he added. According to the minister, the prices of virtually all manufactured products should come down post GST.

He also brought out a list of 101 common daily-use items – food, stationery, textiles, consumer durables - for all of which the tax rate had come down. However, he conceded that the state had no enforceable powers. “If there are complaints, the public can submit the faulty bill to the nearest sales tax office, which will then hand over the complaint and the supporting documents to the State Screening Committee of the Anti-Profiteering Authority,” the finance minister said. Leave alone the Screening Committee at the state but even the Central Anti-Profiteering Authority has not been constituted. Isaac said it might take another five months. Nonetheless, the minister said that anyone found charging more than the MRP were liable to be punished under the anti-profiteering clause in the GST Act. “This includes even cancellation of registration,” he added.