Kerala budget 2017: One-time VAT amnesty scheme

All arrears pertaining to a year will be settled together.

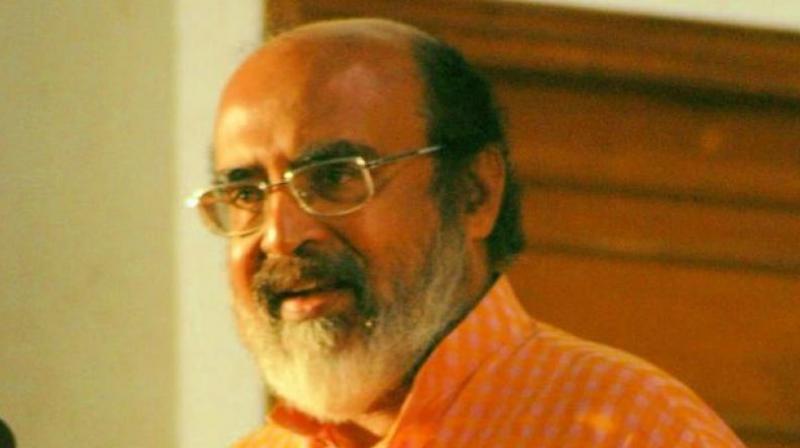

Thiruvananthapuram: With GST expected to roll out by July 1 this year, and as a last-ditch effort to crush revenue deficit further, finance minister Dr T. M. Thomas Isaac has announced an extensive amnesty for disputed VAT tax liabilities. Though he has not put a figure on the amount that he expects in the budget speech, Isaac himself had earlier said he was eyeing nearly Rs 2000 crore. “In the case of VAT dealers, if the tax arrears of the assessment years from 2005-06 to 2010-11 is completely remitted, the interest and 70 percent of the penalty amount and interest on penalty, shall stand waived,” the minister said in his budget speech on March 3.

The last date for filing option under this scheme is June 30 this year. Amount reckoned under the scheme shall be paid by equal instalments on or before December 31, 2017. All arrears pertaining to a year will be settled together. An assessee opting to settle arrears under this scheme, Isaac said, should withdraw all cases, revision and appeals pending before any forums. “Tax arrears and interest shall be calculated as on the date of submission of application,” he said.

According to CAG figures, the arrears of revenue stood at Rs 10,435 crore as on March 31, 2015. This includes taxes on sales, trade, vehicles and land revenue. Earlier, Isaac had said that the tax component would come to only Rs 2000- Rs 2500. “Most of it is penalty,” he had said. In the Commercial Sales Taxes Department, an amount of Rs 3673 crore is pending since 1974-75. Isaac also felt that securing Rs 2000 crore immediately would be of higher value than getting something like Rs 4000 crore some seven or eight years.