Finance minister Dr TM Thomas Isaac eyes One-Time Settlement in Budget

On the tax mobilisation front, the options before any state finance minister appear rather limited.

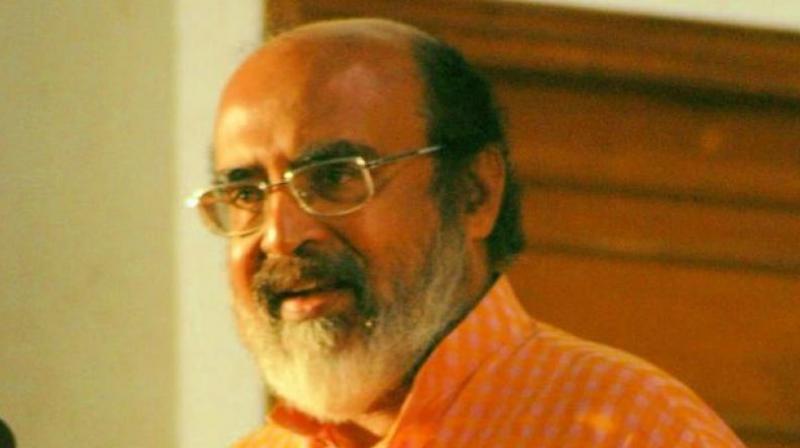

THIRUVANANTHAPURAM: With the Good and Services Tax set to replace all old taxes by July, the pragmatist in Finance Minister Dr Thomas Isaac could well be looking at a One Time Settlement (OTS) offer for disputed tax liabilities when he unveils his budget on Friday. According to a CAG report, the arrears of revenue for Kerala stood at Rs 10,435 crore, as on March 31, 2015 itself, which relate to taxes on sales, trade, vehicles and of course land revenue. Some of the disputed liabilities are over 40 years old! In the Commercial Taxes department itself, an amount of Rs 3,673 crores is pending dues which relate to the period from 1974-75 onwards. With the old state taxes set to become history, it would indeed be timely, if an attractive OTS for disputed taxes is drawn up. On the tax mobilisation front, the options before any state finance minister appear rather limited.

With the ability of states to differentially tax goods disappearing in one go, State Tax Revenue, a major component in Revenue Receipts, will be more of a “guesstimate” for 2017-18, than even an estimate. GST therefore affords a window of opportunity to clear up the cobwebs of the past and generate some immediate cash flows for the State. Hard pressed as it is with a fiscal deficit of about Rs 23,000 crores, of which the revenue deficit .itself is about Rs 13,000 crores, the State should indeed be looking at cash inflow on a priority basis. It is here that an income prospect in the form of an announcement of an OTS for tax arrears, most of which are disputed and under litigation, becomes evident.

As is widely known, governments are not an efficient litigant and therefore tax disputes drag on and on, like other civil cases before courts of law. This leads to an interminable postponement of the realisation of State's dues and what is often not reckoned is the discounted value of money. Simply put, say, Rs 1000 crores coming in today into the State's coffers is arithmetically equal to Rs 1500 crores being realised 5 years later at a discounted rate of approximately 8.5%. While some of the items falling under these arrears (like land tax) may still be taxable by the State even after the advent of GST, it would be prudent if the Government were to milk the time value of disputed taxes and clean up the slate, just before GST. An irresistible OTS with a partial upfront cash payment would be a win-win for both the State's business and Government alike. The only caveat is that the OTS should be transparent, non-discretionary and non-discriminatory.

(S. Adikesavan is a top bank executive. The views are strictly personal)