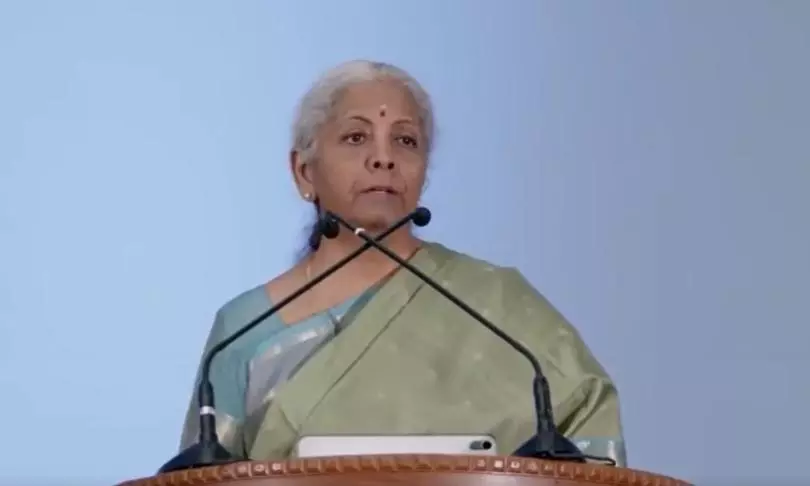

GST Overhaul a People’s Reform, Benefits All: Nirmala Sitharaman

Nearly 400 products — from soaps to cars, shampoos to tractors and air conditioners — will cost less when the rejig of the GST is effective from the first day of Navaratri on September 22.

New Delhi: Calling the landmark GST overhaul a “people’s reform”, Union finance minister Nirmala Sitharaman on Saturday said that rationalisation of rates for a wide swath of products will benefit every family, boost consumption and bolster the economy. In an interview with PTI, Sitharaman said she will personally monitor the passing on of goods and services tax (GST) rate cuts in the form of price reduction but hastened to add that industry has shown positivity towards such cuts.

Within days of the decision, from carmakers to public sector insurance companies and shoe and apparel brands, all have already announced significant price cuts and the rest are likely to follow suit by the time new GST rates are implemented, the finance minister said.

Nearly 400 products — from soaps to cars, shampoos to tractors and air conditioners — will cost less when the rejig of the GST is effective from the first day of Navaratri on September 22. Premiums paid on individual health and life insurance will be tax-free. A third rate of 40 per cent has been earmarked for a small list of sin goods and ultra-luxury items.

“This is a reform which touches the lives of all 140-crore people. There is no individual in this country who is untouched by the GST. The poorest of the poor also have something small that they buy touched by GST,” Ms Sitharaman said.

Starting September 22, the GST slab structure will change — 5 per cent for common use goods and 18 per cent for everything else. The existing slabs of 12 and 28 per cent rates have been done away with.

In the revamped GST structure, most daily food and grocery items will fall under the 5 per cent GST slab, with bread, milk and paneer attracting no tax at all.

Sitharaman said the reform, the single biggest since the 2017 rollout of the one-nation, one-tax regime, has been carried out with a focus on the common man. Every tax on daily use items has gone through a rigorous review and in most cases the rates have come down drastically.

While the significant relief in income-tax that the finance minister gave in her Budget in February this year left more money in the hands of common people, the GST rejig will allow for greater spending, making things more affordable.

"People do understand, for example, `100 with which they go to the shop to buy a thing. Today, with the same `100, they can buy one-and-a-half of the commodity. Earlier, they bought one," the finance minister said, adding that this rate reduction is going to bring down monthly household ration and medical bills, as well as help aspirational buying, like upgrading from a car or replacing white goods like refrigerators or washing machines.

"There is not going to be one family which is going to be without this positive impact of the GST touching them... 140 crore people are going to benefit from this in one way or the other. So this will boost consumption, and as a result, I think the virtuous cycle will start," the finance minister said.

Asked about the monitoring mechanism for ensuring the passing on of the GST rate cut benefit, Sitharaman said the ministry has been talking with industry and trade. "They've all come out openly to say we will pass this on. So, I can see the positivity from industry and trade... I'm very confident they will pass it on," she said.

"I have said from September 22 my main focus in my job would be to watch out and see if it is getting passed on and where it is not getting passed on, I will engage with industry and say that they have to," Ms Sitharaman said.

On inflation, the Union finance minister said it is already well under control and this cut in the GST will actually bring people out to consume more. "There is no doubt about it."

The finance minister highlighted that the reforms go far beyond rate cuts. They also focus on making it easier for businesses, especially small and medium enterprises, to operate.

"Simplified compliance norms, faster refunds, and easier registration are part of the reform package," the finance minister said, adding that under the new framework, 90 per cent of refunds will be processed within a stipulated time, and companies will be able to register within three days.

The GST overhaul, she said, addresses confusion over classification of products by bringing similar goods into the same tax bracket.

A classic example of the simplification is the popcorn. Popcorn mixed with salt and spice will attract five per cent tax, irrespective of whether it is sold loose or pre-packed. Earlier, salted popcorn, which was pre-packed, attracted a 12 per cent tax, while caramel popcorn was taxed at 18 per cent.

Similarly, the GST on cream buns has been revised to five per cent from the earlier 18 per cent.

Earlier, there was confusion on cream buns, as they were taxed 18 per cent, but buns and cream were separately taxed at 5 per cent. All these confusions have been sorted out in the overhaul.