ED Finds ₹415-Cr Scam at Al-Falah University

The ED said an analysis of Income Tax Returns from FY 2014–15 to FY 2024–25 showed substantial revenues listed as voluntary contributions and educational receipts.

New Delhi: The Enforcement Directorate (ED) has alleged that Al-Falah University and its controlling trust generated proceeds of crime worth at least ₹415.10 crore by fraudulently inducing students and parents to pay fees based on false accreditation and recognition claims.

The investigative agency made the allegations in its remand application filed before a court after the arrest of Al-Falah group chairman Jawad Ahmed Siddiqui late Tuesday evening.

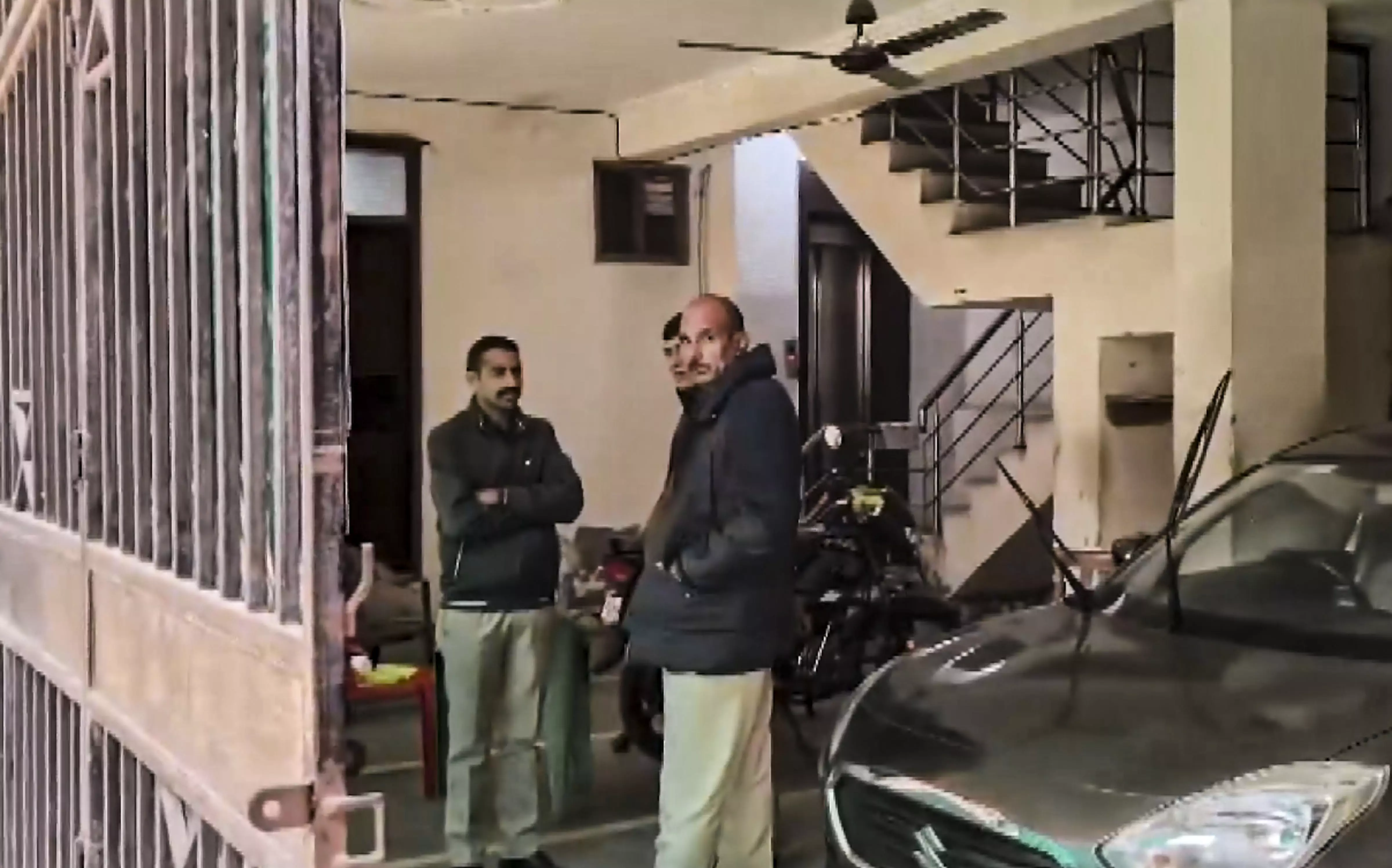

The ED arrested Siddiqui under Section 19 of the Prevention of Money Laundering Act (PMLA), 2002, following a detailed investigation and analysis of evidence gathered during search operations conducted earlier on Tuesday at premises linked to the Al-Falah group. The searches were part of an ongoing probe based on an Enforcement Case Information Report (ECIR) registered on November 14.

The ED said an analysis of Income Tax Returns from FY 2014–15 to FY 2024–25 — the period after the university’s establishment — showed substantial revenues listed as voluntary contributions and educational receipts.

It noted that the trust declared ₹30.89 crore in FY 2014–15 and ₹29.48 crore in FY 2015–16 as “voluntary contributions”. From FY 2016–17 onwards, large incomes were reported as “receipts from main object” or “educational revenue”, including ₹24.21 crore (FY 2018–19), ₹41.97 crore (FY 2019–20), ₹55.49 crore (FY 2020–21), ₹55.15 crore (FY 2021–22), ₹89.28 crore (FY 2022–23), ₹68.87 crore (FY 2023–24) and ₹80.10 crore (FY 2024–25).

The agency said the aggregate income from years when the institution lacked valid accreditation amounted to ₹415.10 crore. It told the court that Siddiqui exercised complete control over Al-Falah’s educational ecosystem, and only a part of the proceeds of crime had been traced so far.

Seeking his custodial interrogation, the ED said Siddiqui’s custody was essential to uncover fee structures, donations, fund flows between entities, and any benami or off-book assets created using illicit funds.

The agency also warned of a “serious risk of dissipation” of tainted assets, stating that Siddiqui continued to wield de facto influence over the trust and could potentially divert funds, alter ownership structures or encumber properties, including the Dhauj campus, to obstruct the investigation.

The ED added that custody was needed to establish the roles of family members and associates who appeared as trustees and directors across the university network, though evidence suggested Siddiqui was the “controlling mind”.

Citing two FIRs registered by the Delhi Police Crime Branch, the ED said there were reasonable grounds to believe Siddiqui committed money laundering under Section 3 of the PMLA by engaging in activities linked to proceeds of crime generated through cheating, forgery and misrepresentation of NAAC and UGC recognition.

The FIRs, filed on November 13, alleged that Faridabad-based Al-Falah University falsely claimed National Assessment and Accreditation Council (NAAC) accreditation to deceive students, parents and stakeholders for wrongful gain.

They also stated that the university falsely claimed University Grants Commission (UGC) recognition under Section 12(B) of the UGC Act, 1956, with the intent to cheat aspirants and the general public.

The ED said Al-Falah Charitable Trust was constituted on September 8, 1995, with Jawad Ahmad Siddiqui named as one of the first trustees and designated as Managing Trustee.

The agency conducted search operations at 19 locations in Delhi on Tuesday, including Al-Falah University premises and residences of key persons linked to the group.

The ED said its investigation revealed that “large amounts of proceeds of crime have been generated”, with evidence showing crores of rupees diverted to family-owned entities. During the searches, the agency seized over ₹48 lakh in cash, multiple digital devices and documentary evidence.