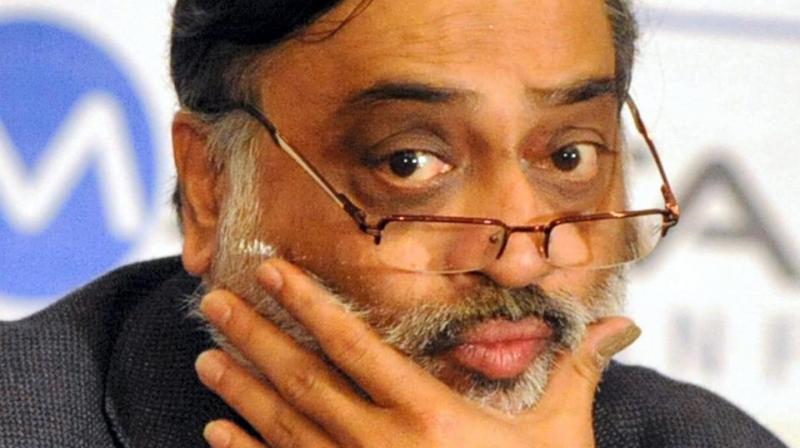

SIFO grills Ravi Parthasarthy of IL&FS group

New Delhi: Ravi Parthasarthy, till recently MD & CEO of the embattled IL&FS Group who was away in London reportedly for medical treatment has returned to Mumbai and is being questioned by Serious Fraud Investigation Office (SFIO) sleuths. Apparently, he has already undergone at least two rounds of questioning. SFIO was tasked with investigating the debt-stricken Infrastructure Leasing and Financial Services (IL&FS) and its subsidiaries after “serious complaints” were received about the beleaguered company.

The kernel of SFIO questioning revolves around the operational mismanagement and corporate governance loopholes in the Group which has a vast swathe of 344 entities with a huge number based overseas, as reported by FC on Tuesday.

It has been discovered that there has been exponential rise in the intangible assets of the company - which doubled from '9,808 crore as on 31 March, 2015, to Rs 20,004 crore as on 31 March, 2018.

The SFIO team has found many of the foreign subsidiaries and entities to be the zone for jiggery pokery by the erstwhile management.

Uncovering the entire swathe of this vast network is proving to be a problem. The consolidated financial statement of IL&FS holdco and its subsidiaries, associates and joint ventures projected a picture through highly exaggerated depiction of non current assets in the form of intangible assets amounting to over '20,000 crore. Parthasarthy is being quizzed on these foreign subsidiaries and entities.

With the Uday Kotak helmed board ready to present its plan to NCLT today, it is believed that all the foreign offices will be shut down while the foreign subs and entities will be wound up.

Govt is concerned over the spread of the pandemic to the financial system as the earnings season has shown more and more banks and NBFC impacted by the exposure to IL & FS. From IndusInd to DHFL, everyone appears to have been touched by the contagion. The shadow bank's borrowing from banks and financial institutions is '63,000 crore on a consolidated basis, while exposure to the banking sector alone is pegged at around '53,000 crore, about 16 per cent of all lending to NBFCs. The Uday Kotak board would like to sell IL & FS outright to a financially strong investor, but the SFIO probe shows that the rot is deep and wide. Alternatively break the business into verticals and hive them off to strategic investors, but the mountain of debt is a huge deterrent.

In fact SFIO is trying to understand the decision making process at the Ravi Parthasarthy led management which led to this alarming situation. The need to create so many foreign subs in disparate locations and the extent of losses recorded by them is another SFIO strand of investigation.

FC has reported in the past that the risk management committee of the company met only once in the last four years.