Textile industry responds positively towards GST

However, industry players rue that there is a different treatment for cotton and synthetic fibre.

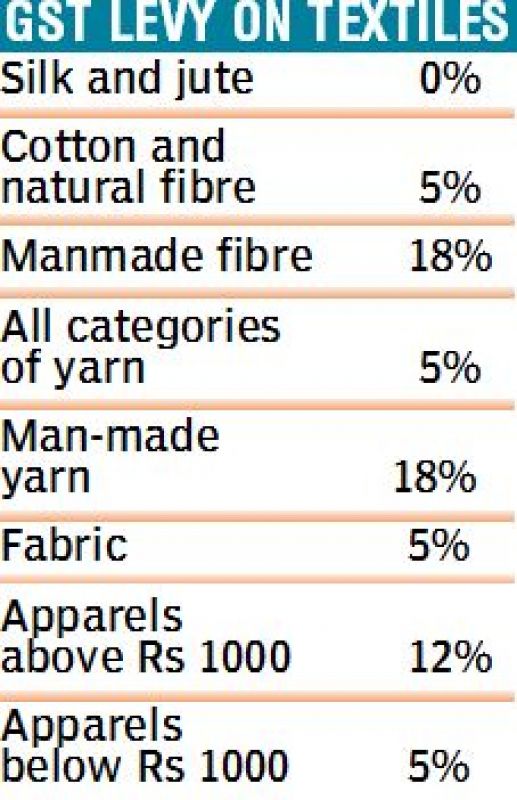

Chennai: The textile industry is one of the very few sectors that is positive about the Goods and Service Tax (GST). The five per cent GST rate for cotton textiles is seen as a progressive move for growth and development of the industry as India’s textile market is predominantly cotton based.

“The entire value chain is covered with GST, so input credit can be taken at every stage. This will make manufacturing very efficient and there is no way in which a person can evade taxes. Naturally, it will bring discipline and transparency to cotton textile industry,” said Prabhu Damodaran, Convenor, Indian Texpreneurs Federation. The move would also encourage farmers to grow more cotton, which might make India regain its competitiveness in the world market.

However, industry players rue that there is a different treatment for cotton and synthetic fibre. They lament the lack of uniformity. While GST on man-made fibre is 18%, yarn is 18% and fabric is 5%. Senthilkumar, Chairman, Southern India Mills Association said, “Though it’s a good initiative as a whole, there are some issues which need to be corrected. The mismatch will have adverse effects.

“At least, the government should have brought down the tax of yarn to 12%. To a certain extent, the input credit accumulation will come down. Also, the cut and sew would attract 18% tax and as there are many unregistered players, transparency cannot be maintained.”Industry players have requested the government to announce drawback rates and continue the Rebate of State Levies (ROSL) scheme for made-ups and the extension of the scheme to fabrics and yarn. The GST on textile industry might give a push to exports, making us one of the top players across the globe.