Kerala Finance minister defends funds in private bank

KIIFB Act doesn't prevent Board from investing in newgen banks'.

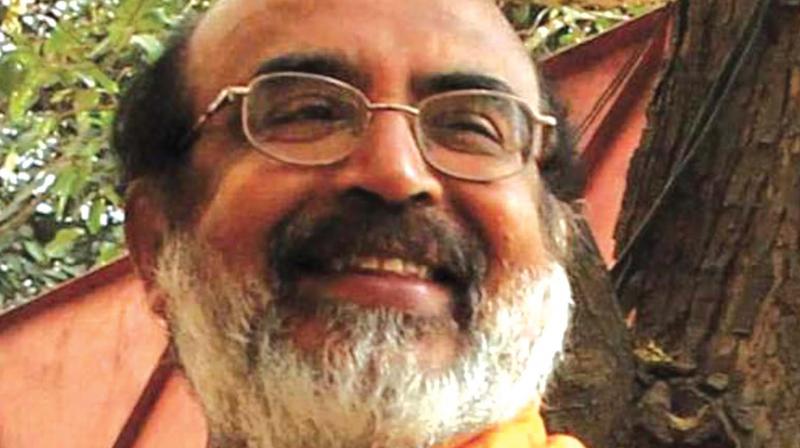

Thiruvananthapuram: Finance minister Dr T. M. Thomas Isaac has said that there was nothing improper or violative about investing around Rs 1,225 crore of KIIFB funds in private banks that the opposition UDF alternatively called ‘new-gen’ and ‘blade’ banks. “The KIIFB Act does not prevent the KIIFB executive board from investing in private banks,” the finance minister said in the Assembly on Wednesday.

KIIFB’s Rs 500 crore has been deposited in Kotak Mahindra, Rs 256 in YES Bank, Rs 373 crore in IndusInd Bank, and Rs 106 crore in HDFC. “The philosophy at work here is to reduce risk to KIIFB but at the same time to maximise gains. All the private banks that KIIFB has invested in have been rated ‘triple A’ by SEBI-approved credit rating agencies,” the minister said.

Opposition leader Ramesh Chennithala and Congress MLA V. D. Satheesan said it was ironic that the LDF, which was now investing over '1000 crore of public money in private banks, had raised a storm during the UDF tenure when just '50 lakh was deposited in Axis Bank. (Dr Isaac said that during the UDF tenure the transfer to Axis Bank was done without any transparency.)

The Congress leaders also questioned KIIFB’s preference for a “less creditworthy” bank like Kotak Mahindra over a nationalised bank like SBI. They said if the Act was followed, KIIFB should have deposited the money in nationalised banks or in sovereign bonds of state governments. (While '500 crore was invested in the savings bank account of Kotak Mahindra, only '216 crore was deposited in the SB account of SBI.)

Dr Isaac said that while the interest offered by SBI was 4 percent, that by Kotak was 5.7 percent. Moreover, he said that the Act spoke about “prudent investment”. He further stated that the KIIFB executive committee, which took the decision to park the funds in private banks, was peopled by top former SEBI officials. “And on top of that the move had the imprimatur of the FTAC (Fund Trustee and Advisory Commission), which is chaired by no less a person than Vinod Rai, former CAG, and has as its members the likes of former RBI deputy governors Usha Thorat,” the minister said.

The opposition also wanted to know why KIIFB funds were deposited in YES Bank for 7.16 percent and IndusInd Bank for 7.4 percent on the same day. “The entire amount could have been deposited in the bank that offered the higher interest. What was the need to divide the amount between two private banks,” Mr Chennithala asked. Dr Isaac said diversification of portfolio was necessary to reduce risk of investment. “The more we invest in diverse accounts, the lesser the risk,” the minister said.

Isaac denies report of treasury crisis

Finance minister Dr T. M. Thomas Isaac said that there was no fund crisis in the treasury. “It is just a cash management issue and nothing more,” Dr Isaac said in the Assembly on Tuesday. He said that all bills would be accepted but the payment would be done only after the middle of April. “This is because we intend to pay welfare pension during Vishu,” the minister said.

Further, there were certain constraints imposed by the KSRTC pension crisis. “For the consortium of banks to transfer money to the cooperatives for the pension payment, the state government will have to first deposit '3000-odd crore in the next few days,” the finance minister said. Moreover, the state can resort to open market borrowings only by the middle of April.

He said the deferred payment would not affect local bodies or government departments. He said there was nothing extraordinary about fixing March 28 as the last date for submitting bills and cheques. “This has been the practice for years,” the minister added.