Telangana government to skip GST on bar and liquor shops license

Plans to introduce registration fee to avoid paying 18 per cent GST on license fee.

Hyderabad: The state government is likely to follow the AP example to avoid GST being levied on the licence fee paid by bars and liquor shops.

In TS, the excise year is from September to August. To ensure that it continues to collect the lucrative excise revenue without defying the Supreme Court order that mandates that liquor cannot be sold 500 metres from a state or national highway, the state government petitioned the National Highway Authority to de-notify national highways within GHMC limits. The NHA has complied and issued a notification to this effect.

The government collects Rs 1.8 crore in licence fee from each wine shop and charges Rs 40 lakh for a bar licence in Hyderabad. In the districts, the licence fee for wine shops ranges from Rs 20 lakh to Rs 60 lakh depending on the size of the population. For bars, there is a common licence fee of Rs 40 lakh.

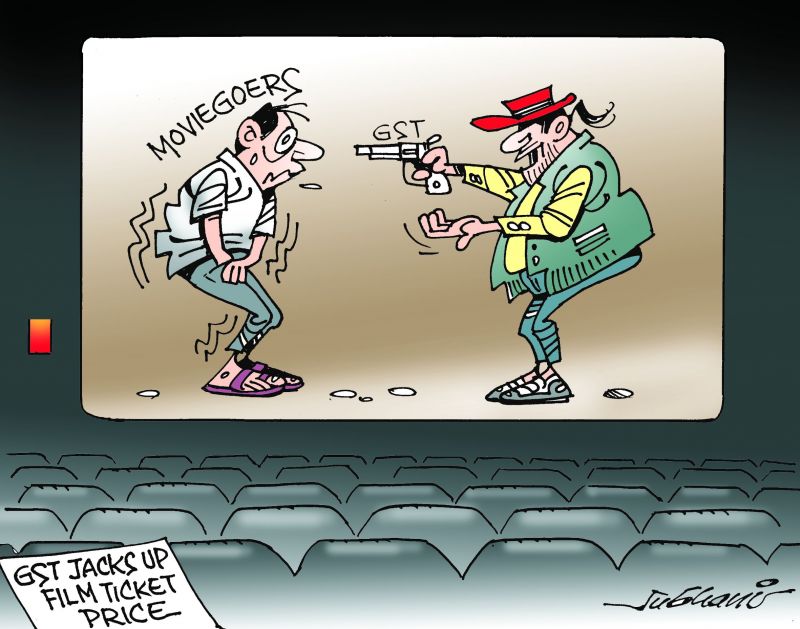

State governments have to pay 18 per cent GST on the licence fee collected by them. To avoid paying this, the AP government has introduced a registration fee and reduced the licence fee. The TS government is thinking of doing the same.

Liquor shop dealers have to pay 14 per cent tax if their annual turnover crosses seven times the licence fee. After bifurcation, the AP government removed this condition but TS continued with it.

In the new liquor policy, the TS government is also thinking of removing this condition. Wine dealers say this will help only big dealers and small dealers,whose sales are below Rs 50 lakh, will suffer. With the seven times turnover tax system, all dealers are selling liquor at maximum MRP. Once this condition is removed, big dealers will sell liquor at below MRP to increase their turnover, but small dealers cannot.

A representative of the Telangana Wine Dealers’ Association said that they are asking for the seven times turnover to be increased to 14 times instead of removing this condition. The state government is paying a 20 per cent margin to dealers currently and is thinking of reducing it to 10 per cent to get additional revenue.

A senior official of the revenue department said that they are concentrating on implementing GST. The new excise policy comes into operation from September 1.