GST growth minimal

Finance minister hoped for 20 percent but has to do with 5 percent now.

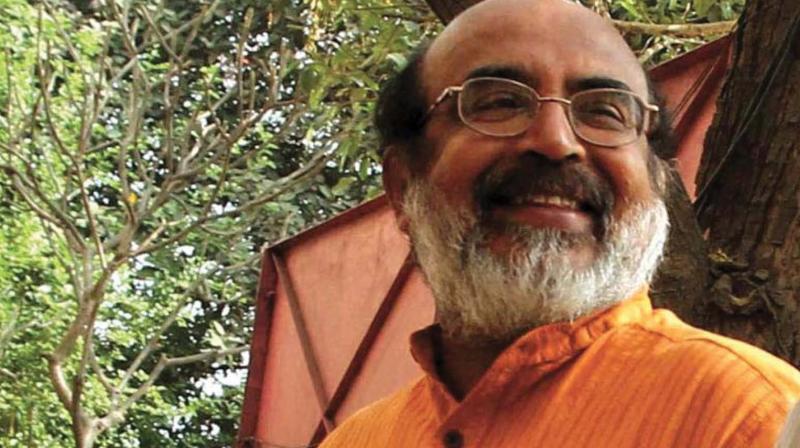

THIRUVANANTHAPURAM: The latest figures of the Accountant General show that the state’s GST growth rate till November 2017 was barely above 5 percent. Finance minister Dr T. M. Thomas Isaac was expecting at least a 20 percent growth post-GST regime. The only tax component that has shown a substantial rise is that of motor vehicles, which has grown by nearly 22 percent; the growth in motor vehicle tax is attributed to the state government’s crackdown on the tax evasion of luxury car owners.

Stamp and registration duties, despite the perceived slump in the real estate sector post-demonetisation, has also shown robust growth of 8.48 percent. Therefore, while the non-GST component of the state's tax revenue demonstrated a growth of 11.42 percent, that of GST was a feeble 5.26 percent. During the same period, however, the state has mobilised non-tax revenue of Rs 5817.60 crore, a growth of 17 percent. Nonetheless, the gains in the non-tax revenue have been negated by the fall in central transfers.

“This fiscal, there has been a fall of Rs 927 crore in central transfers,” the finance minister said. This period of sluggish revenue growth but coincided with relatively high development expenditure. It made a further dent in the state’s coffers. Plan fund utilisation shot up by 20.35 percent, and capital expenditure by 8.34 percent during this period. Non-plan expenditure, too, had grown by 22.16 percent. “The fiscal squeeze felt by the entire country in the wake of demonetisation, and the haphazard manner in which GST was rolled out, has affected the state also," the minister said.

He said the fall in revenues had indeed created a liquidity crisis. “But this does not mean that we are going to put a cap on development expenditure and social welfare spending. Both these components have been considerably raised in the 2018-19 Budget,” he said.