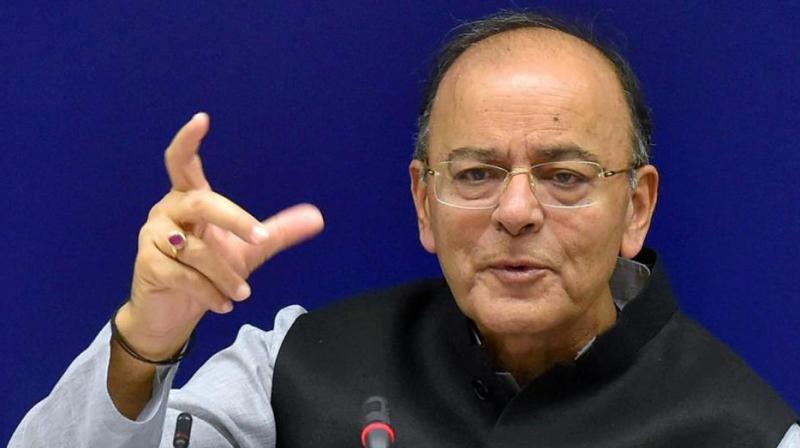

More public spending required: Finance Minister Arun Jaitley

New Delhi: In an attempt to give a push to economic activity across the country, the Union Cabinet on Tuesday approved a Rs 2.11-lakh crore recapitalisation programme of public sector banks to increase their lending capacity and gave its nod to a major road- building project, Bharatmala Pariyojana, involving an investment of Rs 5.35 lakh crore to build 34,800 km of roads and highways. "Today, at the Union Cabinet meeting, it was decided that the government should take a bold step to address this problem and Rs 2.11 lakh crores is the capital that is intended to be now indicted further in the banks. This will be accompanied by a series of banking reforms," the finance minister said, flanked by all five secretaries in the ministry and the chief economic adviser.

He said more public spending was required, and infrastructure expenditure would get an unprecedented push. "When you give such a big push to infrastructure, it helps in job creation. And job creation is the intention to push private sector investment and MSME funding," he said. In India, banks are the main source of funding for companies but bad loans have shrunk their profits and choked off new lending, specially to smaller firms, and this has hit job creation. Bharatmala Pariyojana is expected to generate 14.2 crore mandays of jobs to build 34,800 km road and highways in the next five years. The government said Bharatmala work had been proposed for completion in five years by 2021-22 through the NHAI, NHIDCL, MoRTH and state PWDs.

It said that for Bharatmala Rs 2.09 lakh crores would be raised as debt from the market, and Rs 1.06 lakh crores of private investments would be mobilised through PPP and Rs 2.19 lakh crores would be provided out of accruals to the Central Road Fund and NHAI’s toll collections. "The focus is rightly on infra spending given the need for pump priming by the government as private sector investments would still take some time to pick up. The investments are in sectors that are more labour intensive and hence a large number of jobs would be created, that would go towards stimulating demand. The significant bank recapitalisation announced would help in improving credit availability to some extent, possibly owing to a higher risk taking ability for the banks," said Ranen Banerjee, partner at PwC India.