Telangana, Andhra Pradesh among top 5 for bank frauds

Vijayawada: Undivided Andhra Pradesh was among the five states in the country that suffered the highest losses in public and private sector banks due to financial frauds between 2012-13 and 2016-17.

Data accessed from the Reserve Bank of India (RBI) shows that while the all-India loss incurred due to frauds by 78 commercial banks both public and private was '69,770 crore, Andhra Pradesh banks suffered losses of '2,721 crore from 594 fraud cases. The 78 commercial banks countrywide reported around 22,949 fraud cases during the same period.

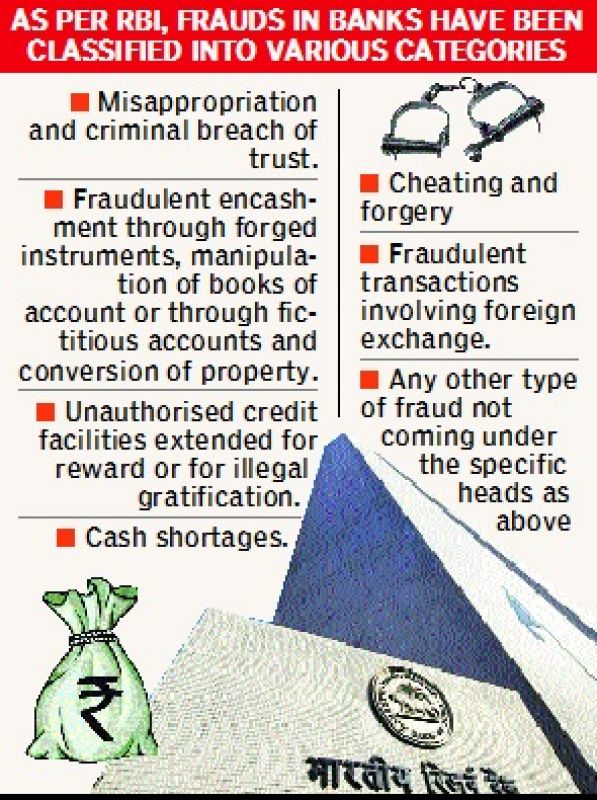

As per RBI, frauds in banks have been classified into various categories

As per RBI, frauds in banks have been classified into various categories

The other four states that reported high losses from bank frauds are Maharashtra, West Bengal, Delhi and Gujarat with '13,164 cr, '9,129 cr, '6,359 cr, and '3,716 cr respectively.

The number of cases wise Maharashtra, Uttar Pradesh and Delhi crossed the 1,000 mark with Maharashtra reporting 1,279 fraud cases followed by Uttar Pradesh with 1,069 cases and Delhi with 1,015 such cases.

Moreover, the extent of the loss increased by about 70 per cent between 2012-13 and 2016-17.

According to Factly, a public information portal that compiled data on bank fraud cases based on publicly available information, out of the 22,949 frauds reported by the 78 scheduled commercial banks during 2013-2017, the State Bank of India and ICICI Bank reported around 2,500 fraud cases each.

HDFC Bank with 1,146 cases was third on the list. Bank of Baroda and Axis Bank were the only other banks that reported more than 1,000 cases of fraud each. Punjab National Bank reported 942 fraud cases during this period. As far as the involvement of bank staff in the frauds is concerned, around 1,714 staff were involved in these cases between 2013-14 and 2016-17. Most of the staff involvement was seen in public sector banks with 1,146 staffers involved in such frauds.

Banks have to report frauds electronically in a specific format to the Central Fraud Registry (CFR), which is a web-based and searchable database available to banks.

Union minister of state for finance, Shiv Pratap Shukla, said, “RBI has taken many steps to monitor and prevent fraud, such as a new framework for dealing with loan frauds and Red Flagged Accounts, launch of Central Fraud Registry in January 2016, issuance of guidelines to prevent skimming of ATM/debit/credit cards, and legal audit of title documents in respect of large value loan accounts.”

AP reported loss of '4.33 cr due to 98 frauds

DC Correspondent

Vijayawada, Feb. 21

Andhra Pradesh also reported a loss of '4.33 crore due to 98 frauds reported by banks involving cheque/drafts, ATM/debit cards and credit cards in the last three years, between 2014-15 and 2016-17.

The most number of such frauds - 42 - occurred in 2015-16, involving an amount of '2 crore.

Across the country around 4,000 such fraud cases were reported in the last three years. The total amount involved in such frauds was close to '200 crore. The state of Maharashtra reported the highest number of such cases 1,134.