Kollam: Cashew units on the warpath

KOLLAM: The cashew owners under the cashew industry joint protest council organised a march at Chinnakkada here on Wednesday protesting against the banks' coercive actions, including recovery proceedings against the units.

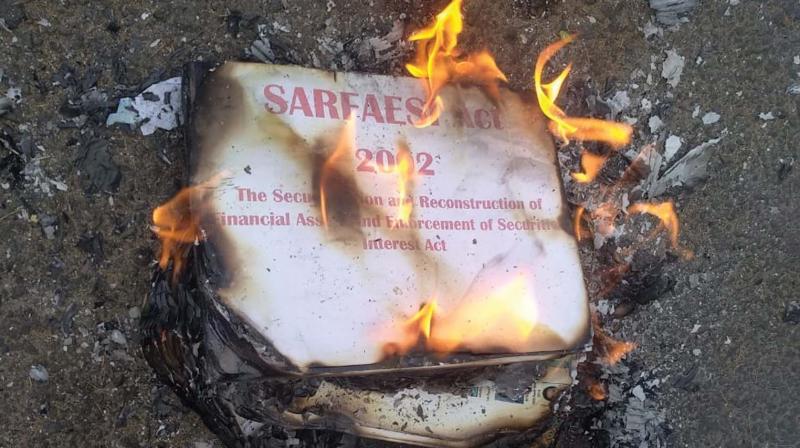

The protesters also burnt the book on Sarfaesi Act (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002) and paid tributes to the mother and daughter who committed suicide at Neyyatinkara allegedly fearing recovery proceedings by a bank.

"The banks sabotage the revival attempts by disregarding the agreement made for it. They are using the black law of Sarfaesi Act to wipe out the industry despite interventions by the government. This will lead to mass suicides of cashew owners in Kollam if the situation continue like this," said K. Rajesh, state convenor, joint protest council, at the meet.

In the latest instance, a private bank tried to seal a private cashew factory at Karikkode here a week back. The women employees and cashew industry joint protest council laid a siege on the officials following which they backed off from recovery. The move was in violation of the directive by the state government and State-Level Bankers Committee (SLBC) to avoid recovery procedures of banking institutions in cashew industry.

The government had already initiated a revival package for cashew industry distributing refinance to private cashew units. A total of 111 factories have been identified by an expert committee to provide financial aid. Of these, 30 units got Rs. 21 crore in the first phase.

The first phase of loan allotment is funded by Canara Bank and the Federal Bank while loans are given for the remaining cashew processors. The cashew processors under the protest council alleged that the package announced by Chief Minister Pinarayi Vijayan following a meeting with entrepreneurs, banks, and SLBC was not implemented by the bankers.

Currently, some 700 cashew factories in the private sector remain shut due to financial crunch while 173 have been declared non-performing assets (NPA) facing recovery procedures.