Hyderabad: High cost of funds puts off road projects

According to highly placed sources, the SRDP has been temporarily put on hold as the corporation has failed to clear bills worth Rs 50 crore.

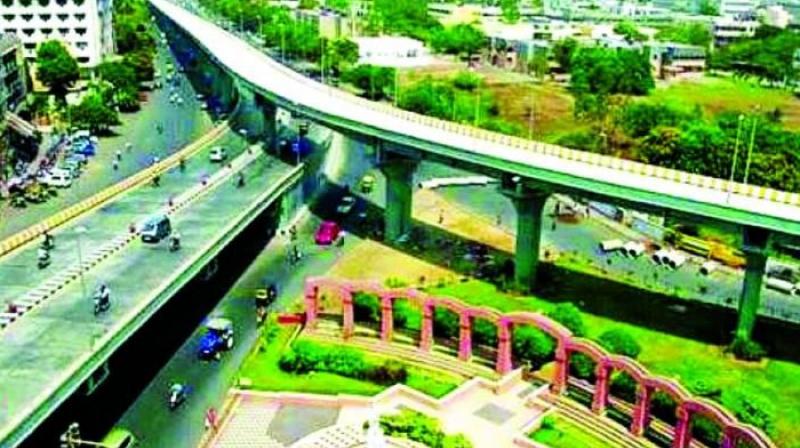

Hyderabad: Market fluctuations after the Union Budget was presented to Parlia-ment on July 5 and inc-essant rain in Mumbai have badly affected work on the Strategic Road Development Plan (SRDP).

The Greater Hyderabad Municipal Corporation which has raised Rs 395 crore from the market at 8.9 per cent and 9.38 per cent interest plans to borrow another Rs 300 crore. In the current prevailing scenario, the interest rate has been pegged at over 10 per cent which will cost the corporation at least Rs 60 crore.

With bills of Rs 50 crore piled up and another Rs 50 crore worth of works in the pipeline, corporation officials are undecided on whether to raise the funds through bonds or any other source. They said that a meeting will be convened soon to take a final decision.

According to highly placed sources, the SRDP has been temporarily put on hold as the corporation has failed to clear bills worth Rs 50 crore. The SRDP is a self-financed project being taken up by the GHMC relying on borrowings from external sources.

The GHMC had aimed to generate Rs 1,000 crore through bond issue, based on the corporation’s creditworthiness. The civic body has raised Rs 395 crore in two terms, Rs 200 crore in 2018 at 8.90 interest and Rs 195 crore during the current year at 9.38 per cent interest.

Sources said that corporation officials were concealing the fact that a higher rate of interest was being demanded. Instead, they have put off visiting Mumbai for the present and blamed it on the bad weather there.

These officials said that the corporation was exploring the option to raising the amount through rupee term loan (RTL) as the interest rate could be lower than municipal bonds.

As the officials plot and plan, the delay in the Rs 24,000-crore project is irking commuters. Any further delay in securing funds will result in the deadlines being pushed back.

A senior GHMC official said they have been negotiating with SBI Capital Markets Ltd, which has demanded 9.7 per cent interest to raise Rs 305 crore through municipal bonds. The official said the Rs 90,000-crore repayment default and Union Budget had unsetttled the market.

He said that the Centre’s assurance to provide an incentive of Rs 26 crore comes as a respite.