Demonetisation: Cash or plastic should be citizen option

The move and advocacy for cashless society should be resisted at all cost because it costs us our freedom.

The Indian society right now is very much a cash society. USAID did a study which reveals that 77 percent of respondents received income in cash and 79 percent made savings in cash and 90 per cent who used debit cards, used them only to withdraw money from ATMs. RNCOS business consultancy services research paper, titled Indian prepaid card Market Outlook to 2017, says 97 percent of retail transactions are done with cash. World Bank Global Findex database says only 11 percent of consumers used debit card for purchases. RBI says the number of non-cash transactions per inhabitant per year is 6.7 in India. Only 6 percent of the merchants accept digital payments.

There were only 14.61 lakh point of sale (POS) machines in the country as on December 11 2016 as per RBI records.The number of POS machines per million is 693, the lowest in the world, according to Ernst & Young; 70 percent of these POS machines and 75 percent of the transaction happen in 15 cities. There are 1.5 crore retail outlets and 94 percent of them operate in less than 500 square feet of built up area. This shows we are so dependent on currency and that the infrastructure required for a shift to plastic money is simply missing.

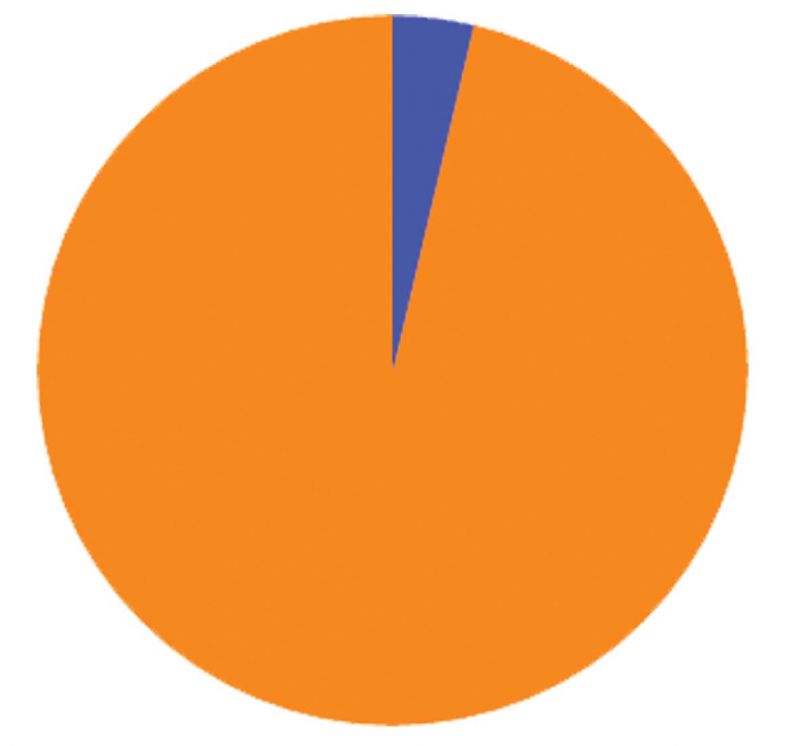

Credit vs debit cards: Total number of debit cards: 71.25 crore. Total number of credit cards: 2.64 crore

Credit vs debit cards: Total number of debit cards: 71.25 crore. Total number of credit cards: 2.64 crore

RBI came up with a concept paper in March 2016, which makes public and official the inadequate card acceptance network in the country. Says the RBI concept paper: "From the above, it can be noted that while there has been a significant growth in number of cards, the growth of infrastructure has been lower both numerically and in terms of geographic spread and this has impacted the card usage". Hence the government urging people to use cards after withdrawing currency is effectively driving people away from the 1.4 crore retail outlets to the less than 10 lakh stores, which have POS machines.

RBI has also listed seven possible reasons for the poor growth in card acceptance infrastructure. The high capital cost of POS machine, recurring maintenance / servicing cost, difficulty of servicing POS machines in rural areas, low footfall of cards in rural areas forcing acquiring bank to withdraw services, lack of telecommunication infrastructure, lack of incentives, merchant discount rates, awareness level of consumers and concerns about the security of using this facility are all cited as major constraints in our journey to a less-cash society.

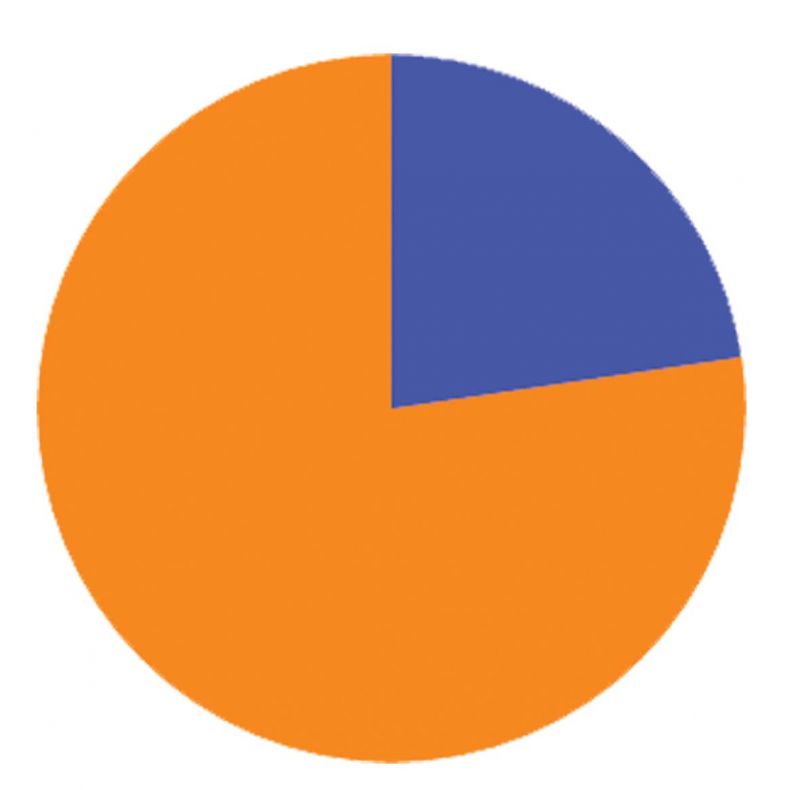

Transactions (Credit, Debit cards): Total Number of transactions: 97,18,68,686. ATM: 75,73,85,390. Point of Sale: 21,44,83,296

Transactions (Credit, Debit cards): Total Number of transactions: 97,18,68,686. ATM: 75,73,85,390. Point of Sale: 21,44,83,296

RBI had suggested two approaches to improve the card acceptance infrastructure- mandating banks to install terminals in some proportion to the number of cards they have issued and setting up of Acceptance Development Fund to subsidize the cost of acceptance infrastructure. As per World Bank, though 53 percent of adults in India have bank accounts a mere 15 per cent of adults reported using an account to make or receive payments. World Bank estimates that there are 33 crore internet users in India and that mobile subscriptions went up from 23 crore to 96 crore between 2007 and 2015. As per Airtel CEO Gopal Vittal, smart phone penetration is 39 percent with 60-70 percent having data connection. These connectivity details showing a fairly good growth pattern are insufficient to shift to a cashless economy.

Government record on managing infra

At the slightest provocation or anticipated provocation, the government blocks the existing infrastructure to the public. During the unrest following the killing of Hizibul Mujahideen militant Burhan Wani, mobile internet was suspended in Kashmir for straight 133 days. Internet access on prepaid mobile connections continues to be suspended. During the Jat quota agitation in February, Haryana Government suspended the internet for 10 days in several districts. In the last 3 years there were 39 forced internet blackouts across 12 states for almost 250 days.

When the government urges all of us to shift and depend on this infrastructure alone for all our transactions they are urging us to be in a state where those in power can switch on or off our lives at will. Whether a government will do it is a question but whether we should leave the government with such an option is another. The policy framework also needs to ensure interconnection and consumer protection. Today the payments regulator, the RBI, prevents a Paytm customer from paying a Mobikwik customer. If RBI does not trust these players then how would a customer trust them?

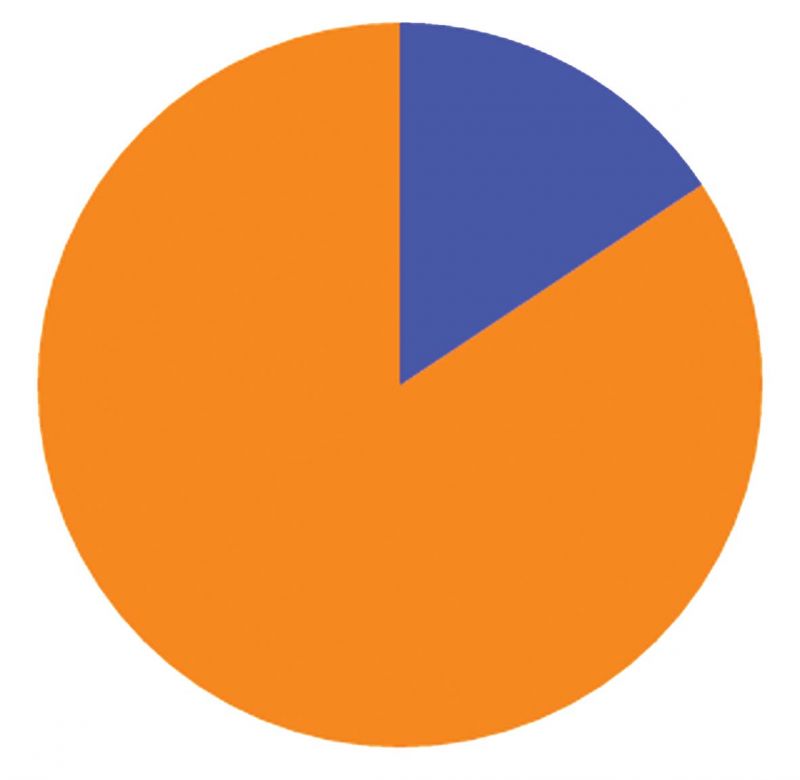

Transacted amount: Total amount transacted: Rs 2,64,080 crore. ATM: Rs 2,19,962 crore. Point of Sale: 44,118 crore

Transacted amount: Total amount transacted: Rs 2,64,080 crore. ATM: Rs 2,19,962 crore. Point of Sale: 44,118 crore

Will demonetization help move to a cashless economy?

Lack of currency notes might force people to shift to plastic money. Of course, there is a huge business opportunity out there and they are on an all-out campaign as if going digital is the end of black money. The gadgets, the POS machine manufacturers, the payment intermediaries - together is a business worth lakhs of crores. Demonetisation offers a great realisation too. If money which is current cash could be demonetized at one stroke, what about the money in accounts? Accounts are just a promise or a claim on money. The lack of currency notes might force people to opt for plastic money. But if this was the intention of demonetization, as is being stated now, then this government and the Prime Minister should be feared. They are not democratic, to say the least.

Restricting options and suffocating those who are already starving for fresh air to drive them to a cashless economy is authoritative and should be defeated because of that alone. If the state continues to push for a cashless society, then we should also look at technological ways of bypassing spying commercial banks acting as intermediaries. Crypto currencies such as Bitcoin could provide a counter-power to the hegemony of banks and intermediaries. Cash is in fact the only direct way we can hold government money. This is why people convert their commercial bank deposits into cash when they lose confidence in a bank, causing a bank run.

Does that mean only Cash?

This doesn't mean all transactions have to be in cash alone. We should leverage advantages that technology brings to us. But the choice of using cash or plastic money for a transaction should rest with the citizen. It can take away larger denominators and make doing transactions of larger amount in cash extremely difficult. Maybe, even mandate that transactions beyond a certain amount should be done through accounts. But the move and advocacy for cashless society should be resisted at all cost because it costs us our freedom.

((Joseph C. Mathew is former IT advisor to Kerala Chief Minister)