Kerala government may hike building tax

Finance department to act tough to squeeze revenue expenditure.

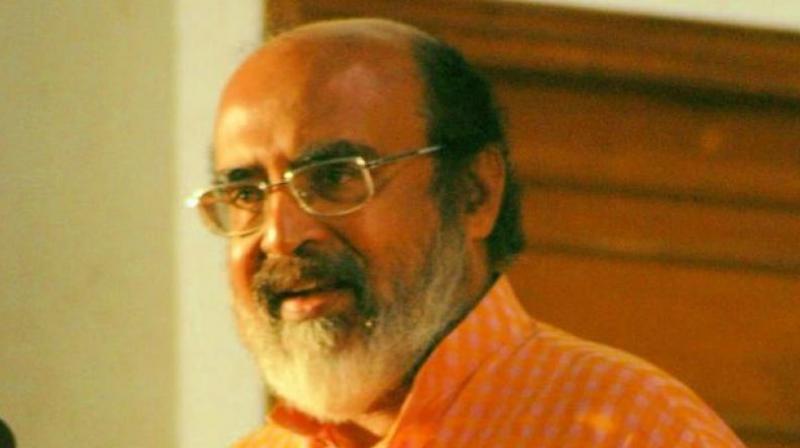

THIRUVANANTHAPURAM: Fiscal compulsions will force finance minister Dr T. M. Thomas to squeeze revenue expenditure, but he will also have to make some tough revenue-earning choices. Land and building tax, which had not been touched for quite long, could be two areas Isaac might be tempted to tap into. Experts, however, caution that this could be economically risky as it could dampen the real estate sector already in doldrums post demonetisation.

Dr Isaac's earlier decision to act tough had backfired. He had to virtually roll back his decision to impose three per cent stamp duty on all partition deeds, a move inspired by Thomas Piketty's philosophy that inheritance was the primary factor that engendered inequality. However, finding that the concept was not working, he promptly restored K. M. Mani's plan to have a stamp duty ceiling of Rs 1000 on all partition deeds up to five acres.

Nonetheless, Dr Isaac could put in place measures to strengthen the collection of taxes without going for any massive hike in rates. It is felt that luxury tax on buildings and 'cess' on building tax are not being collected. Under the Kerala Building Tax (Plinth Area) Rules, 1992, every village officer should submit before the assessing authority, within five days of the expiry of each month, a monthly list of buildings that have to be assessed.

"Fact is, the completion of hundreds of buildings is not reported to the 'tahsildars' for assessment," a top finance department official said. "The root cause for non-identification of the new buildings completed was non filing of return by the building owners," he added. Under the KBT Act, the owner of a completed building or of the building on which repair or improvement has been carried out should submit a return to the assessing authority.

Even when building tax was assessed, it was found that luxury tax was not insisted upon. What's more, interest was not levied when the luxury tax was paid after the prescribed dates. Under the KBT Act, an annual luxury tax of Rs 4000 is imposed on all residential buildings completed on or after April 1, 1999, and having a plinth area of 278.7 square metres or more. It has to be paid in advance on or before March 31 every year.

It has also been found that the 'cess' on buildings with plinth area of 4,000 square feet and above was not collected. As per the Kerala Finance Act 2011, a 'cess' at the rate of two percent on the building tax shall be levied for residential buildings completed after July 19, 2011, and having a plinth area of 4,000 square feet and above. The KBT Act mandates that the arrears of the 'cess' should attract an annual interest of six percent from the date of default.