Lenders did not keep track of their money

Hyderabad: The CAG has slammed the Power Finance Corporation (PFC) and the Rural Electrification Corporation (REC) for violating internal guidelines and RBI rules while lending to independent power projects (IPPs) such as Lanco, Nagarjuna, Krishna-Godavari and GVK.

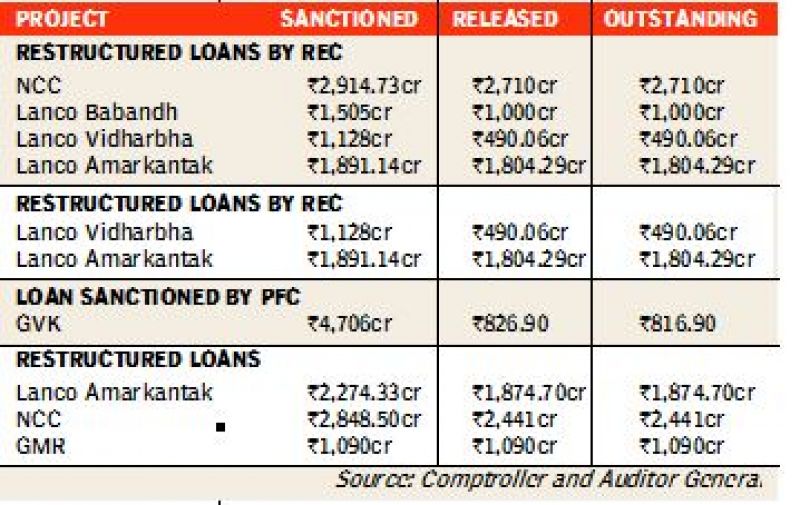

Nagarjuna Construction Company (NCC): The CAG said NCC which was sanctioned Rs 2,710 crore to set up a 1,320-MW power project had no experience in the field. It said that as per the project proposals, NCC Power Projects and NCC were required to contribute Rs 831.19 crore by October 2014, and Rs 646.94 crore in other ongoing projects by March 2015.

Thus NCC had a total equity commitment of Rs 1478.13 crore. The CAG said as against this the apprised note indicated adequate expected fund inflow for NCCL, the CAG noticed that the company had in 2001 failed to infuse envisaged equity in projects such as Himachal Sorang Power Project and KVK Nilachal Power Project. The CAG said that this indicated that the financial capability of the promoters to fund equity component of the instant project was not appropriately assessed.

Lanco: CAG said that a loan for a project is sanctioned based on the project financials including inter alia the proportion of interest during construction (IDC) in the project cost. The CAG noticed that during disbursement of loans amounting to Rs 3,294.35 crore to Lanco Babandh, Lanco Vidharbha and Lanco Amarkantak power projects, the REC had adjusted Rs 496.02 crore towards IDC beyond the IDC approved at the time of loan sanction. CAG said that with these adjustments the loan account remained “standard” through no repayment was made by the borrower as per the loan servicing schedule.

The CAG said that had the interest not been adjusted in this manner, these loan accounts would have become NPAs in 2013. The CAG said that such adjustment of IDC after a project was commissioned violated the REC’s guidelines.

The CAG said that the promoters of 1,320-MW Lanco Amarkantak, 1,320-MW Lanco Babandh and 1,320-MW Lanco Vidharbha had been operating eight power plants with a total capacity of 1,487 MW commissioned between October 2000 and April 2010 with capacities ranging from 3 MW to 369 MW. The CAG said the project proposals were awarded 75 per cent by REC in the experience criteria, tho-ugh the promoters had no experience in implementing projects with similar technology or capacity.

Krishna Godavari: The coal-based 60MW power project was to be implemented by Krishna Godavari Power Utilities ltd which was promoted by three entities — M. Venkataratnam and As-sociates (37.50 per cent) PTC India Ltd (52 per cent) and Krebs Bio Chemicals and Industries (10.50 per cent).

The CAG said the promoters had no experience in implementing such projects in the past. Venkataratnam and Associates had held positions and served as chairman of REC, Andhra Bank and Tobacco Board of India but no specific experience or their field of operation was indicated. PTC India was engaged in power trading while Krebs was engaged in developing commercially viable biotech process with applications in medicine, agriculture and industry. Despite this, the promoters were sanctioned a loan.

GVK: The proposal of the GVK Ratle Hydroelectric Project seeking a loan from the PFC did not consider a set of project costs like water usage charges (financial impact Rs 1.05 per unit) custom and excise duty (financial impact Rs 132.41 crore) and levy of entry tax, sales tax, VAT and other local taxes (financial impact Rs 225 crore). The CAG said that during appraisal of the project the PFC also did not consider these aspects and sanctioned the loan If the expenditure on these elements was considered, the project would have turned unviable. The CAG said PFC sanctioned Rs 4,706 crore on April 2, 2013, against the estimated project cost of Rs 6,274.77 crore, underwriting the debt portion to GVK Ratle Company.

Diversion of funds The CAG said that no specific measures were adopted by the REC and PFC to ensure end utilisation of funds by the borrowers. Several borrowers including GVK had diverted funds taken from REC and PFC for other activities, it said.

The CAG said PFC disbursed Rs 816.90 crore in September 2013 to GVK Ratle and the project was stopped in July 2014. It said Rs 380.61 crore of the loan was lying idle or was invested in fixed deposits and the promoter did not submit the non-encumbrance certificate for these fixed deposits.

The CAG said that the borrower neither took prior approval of the PFC for such diversion nor did the PFC monitor the use of funds.