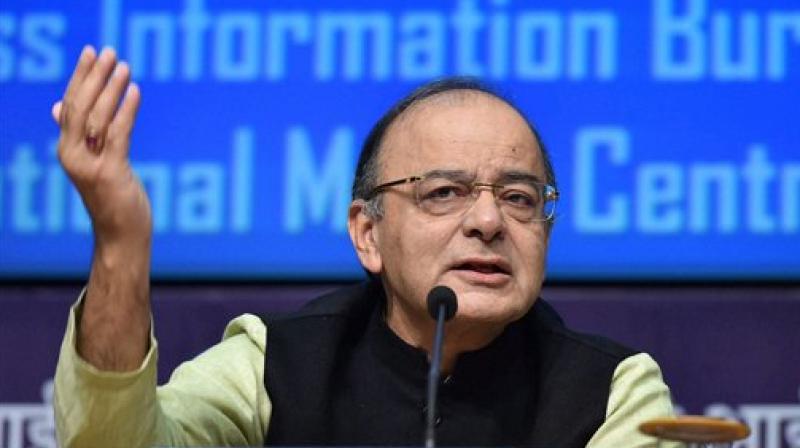

Regret inconvenience, recalibration of ATMs will be done in 2 weeks: Jaitley

The Finance Minister also warned those who were spreading false rumours over the demonetisation decision.

New Delhi: Union Finance Minister Arun Jaitley on Friday said that the government regretted the inconvenience caused to the common man due to demonetisation of Rs 500 and Rs 1,000 notes, but assured that ATMs across Indian will be recalibrated with the new notes within the next two weeks.

“It’s a big regret that people are being inconvenienced. The ATMs have not been re-calibrated for new Rs. 2000 currency note; the process is on and will be finished by two weeks,” Jaitley said in a press conference held in the national capital.

“According to an RBI report all the chests are filled with new currency, but sometimes proper amount of money is not available everywhere,” he added.

Jaitley hit back at political parties who criticised the Modi government for demonetising big notes and accused them of making ‘irresponsible’ statements.

“Different political reactions are coming, some of which are really irresponsible. When Government decided to demonetise, it had expected that people would go to banks in large numbers,” he said.

“It was expected that there will be some difficulty for the first few days as 86% currency is changed. Bank officials are working from morning to late night and people are also cooperating well despite all difficulties,” he added.

Read: Salt prices skyrocket to Rs 200/kg; Govt denies shortage rumours

Jaitley also clarified that there was no shortage of salt and warned those who were spreading false rumours post the demonetisation announcement by the government.

“It is very clear that some rumours stared on the first day like electronic chips in notes and salt rumours, but these are just rumours,” Jaitley said, trying to douse fears over false rumours.

“If anyone indulges in improper and unlawful activities, concerned departments are going to take it up.” Jaitley said.

Lack of small denomination currency had triggered rumours of black marketing of essential commodities like salt as shopkeepers refused to provide change when offered with higher denomination notes.

Listing out facts in which the banks are undertaking currency exchange, Jaitley said that Rs. 7,868 crore have been deposited in the SBI. The bank exchanged notes of 58 lakh people. 22 lakh people operated at ATMs, 33 lakh have withdrawn from SBI, which handles 20-25 per cent of total banking. Till 12.15 p.m. today the bank conducted 2.28 crore transactions. He said five modes of transactions are involved in banks, cash deposit, withdrawal from cash, cash to cash exchange, ATM cash withdrawal and cash deposit machines being used.

The finance minister also appealed to the business community to avoid using cash and start using digital payment gateways.

Jaitley rejected allegations that the information with regard to demonetisation was leaked two months prior to the announcement made by Prime Minister Narendra Modi.

"Some were alleging that the bank deposits increased from July to September, alluding to the fact information on currency exchange was leaked. However, as per RBI records, in last one year, there was spike in deposits in September only. It was due to disbursal of pay commission arrears," he said.

"Today our energy is concentrated on smooth and quick replacement of money. Enforcement Directorate and other departments concerned are keeping close watch on any illegal activities," Jaitley added.

There are approximately two lakh ATMs across the country.

Many ATMs, which was reopened after the Prime Minister Modi's demonetisation decision, were forced to shut down after it ran out of cash.