GST Council meeting: Andhra Pradesh gains big, Telangana government demands on hold

GST on contracts to construct government buildings down, decision on tax cut for projects put off.

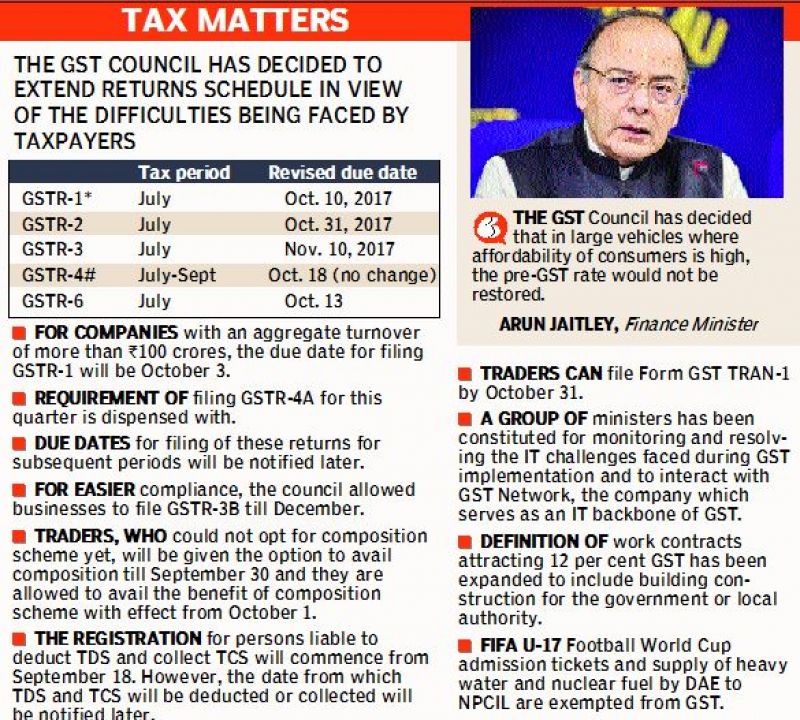

Hyderabad: In a partial success for the Telangana state government, the GST Council meeting, held in the city for the first time on Saturday, agreed to reduce the tax rate on work contracts to construct government buildings from 18 per cent to 12 per cent.

The AP government would be a big gainer as it embarks on constructing its new capital at Amaravati. The GST reduction will reduce the financial burden on the state, as contractors have demanded that the government bear GST on contracts.

Apart from this, there was little to gain for the TS government as none of its major demands found place on the GST Council agenda. All it got was assurances that the dema-nds would be looked into.

The TS government had raised three major de-mands among its 33 objections to the GST.

The first was exemption or reduction of GST on work contracts for projects of public importance such as irrigation projects, Mission Bhagiratha, Mission Kakatiya, power projects, 2BHK housing scheme for poor to five per cent from 12 per cent.

Chief Minister K. Chandrasekhar Rao threatened to move the Supreme Court on this issue if GST Council did not reduce the tax rate. He had threatened to write to Prime Minister Narendra Modi and Union finance minister Arun Jaitley on this.

Responding to this at the press meet, Mr Jaitley said if the GST rate was slashed to five per cent, the government would have to paid back more money to private contractors.

The GST Council only assured to refer the issue to the fitment committee, which will recommend the future course of action in the next GST Council meeting to be held in New Delhi next month.

The other two major demands were reducing GST on granite and beedi industries. The Cou-ncil has assured to look into these issues in its next meeting. Soon after the meeting ended, finance minister Etela Rajender briefed Mr Chandra-sek-har Rao on the outcome of the meeting.

Mr Rao, who is recovering from his eye surgery, is learnt to have told him that he would convene a meeting on the issue where a decision would be taken on whether or not to approach the apex court.

Mr Rajender is learnt to have informed Mr Rao that TS would still have to suffer a burden of Rs 9,000 crore due to higher GST on work contracts even after government buildings are exempted.

Telangana’s principal secretary, commercial taxes, Somesh Kumar said, “The tax reduction on government buildings is a big relief for us. The GST Council has not rejected our other demands. It has promised to look into our demands positively and referred them to the fitment committee to make suitable recommendations and place them on agenda for the next round. This is only a procedural hurdle. We are confident of the GST Council approving our demands very soon.”