Kerala: Education loans heavy burden on banks

About 13 percent of the total outstanding education loans is NPA.

Thiruvananthapuram: The banks give education loans liberally to the students in Kerala. That is indicated by the fact that as many as 3.7 lakh students owe a whopping Rs 10,131.6 crore to the banks in the state as on September 2016 on account of outstanding education loans. Moreover, the non-performing assets (NPA) component of education loans has risen by about 25 percent in the nine months to reach Rs 1,325.5 crore. The NPA is the portion of the total outstanding which is not being repaid over a period of time.

While the NPA on education loans was Rs 1005.56 lakh on December 2014, it increased to Rs 1062.33 crore by December 2015. Though the increase was only around five percent during that year, by September 2016 it increased by 25 percent to touch Rs 1325.55 crore, according to recent report of the State-Level Bankers' Committee (SLBC).

Banking sources said that the changes in the RBI policy with regard to restructuring of accounts as well as deteriorating repayment patterns were the reasons for the leap in NPA.

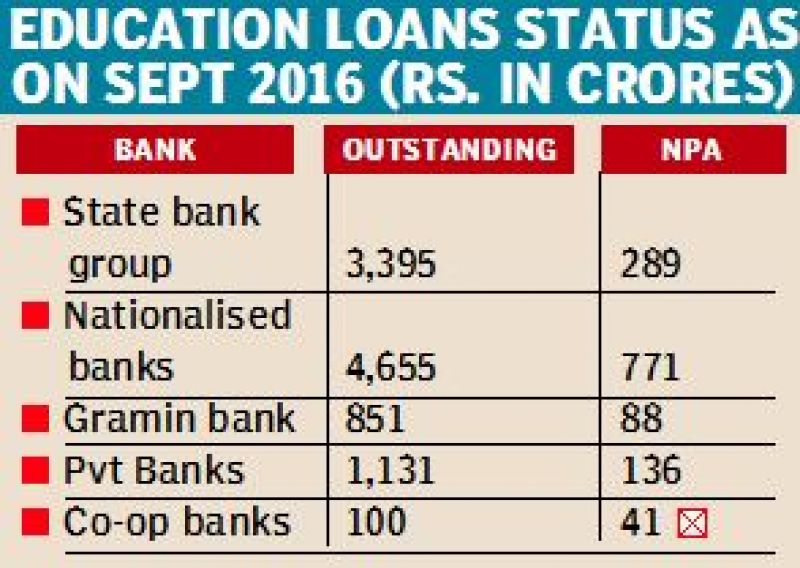

About 13 percent of the total outstanding education loans is NPA. The State Bank group has a comparatively higher amount of outstanding education loans of Rs 3,395 crore, nine percent of which is NPA -- Rs 290 crore. It may be recalled that the SBT had engaged Reliance Asset Reconstruction Company for the education loan recovery.

Proportionally, the cooperative banks are having the highest NPA. Of the total outstanding education loans of Rs 100 crore with the cooperative banks, 41 percent is in the NPA category.

With regard to nationalised banks, of the Rs 4,655 core outstanding education loans, 17 percent is NPA. The NPA portion of private sector banks is 12 percent of the total outstanding and that of gramin banks 10 percent.

Of the total NPA in education loans, 58 percent is with nationalised banks (Rs 771 crore), followed by 22 percent with the State Bank group (Rs 289.5 crore), ten percent with private sector banks (Rs 135.7 crore), seven percent with gramin banks (Rs 87.7 crore) and three percent with co-operative banks (Rs 41 crore).

Of the 3.7 lakh students who owe Rs 10,131.6 crore to the banks,27,823 owe more than Rs 7.5 lakh, 51,754 owe Rs 4 lakh to Rs 7.5 lakh and 2.9 lakh owe less than Rs 4 lakh.