Thiruvananthapuram: Govt gets serious on tax collection

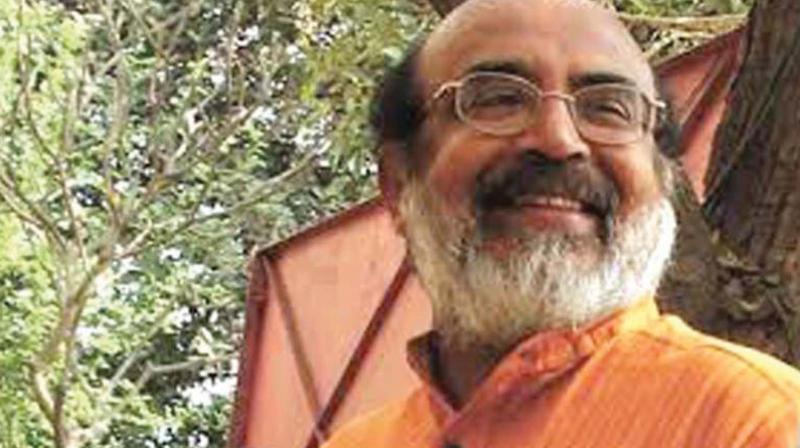

Thiruvananthapuram: Dr Thomas Isaac has said that the government would do whatever it takes to achieve the target of 30 per cent increase in tax collection.

Top officials of the taxes department have been given specific tasks to achieve the target. Apart from squads which have been pressed into service, special teams will also be deployed under the direct supervision of senor officials to shore up revenues.

A final shape was given to the strategy to achieve 30 per cent increase in tax collection at workshop held for senior officials of the taxes department on Monady. The entire exercise will be led by taxes commissioner Tinku Biswal and secretary Venugopal.

Firstly, the annual return due in August will effectively scrutinised and the attempt will be to recover a good portion of the leaked tax. Former collector of Ernakulam Safirullah, will lead the data analytics and other initiative.

The workshop decided to strengthen the activities of Enforcement Wing. As part of the move inspections will be carried out in institutions which are suspected to be resorting to tax evasion. Additional taxes commissioner Shainamol will lead the inspection.

More than 100 squads have been deployed in areas bordering the neighbouring states to check e-way bills. The automatic number reader system will be in place within three months. The assessments will be proc-essed and completed on a war footing. Stringent revenue recovery measures will be launched to collect the dues.

The finance minister said the amnesty project was the only way out of this headache. Penalties are completely waived. No interest or penal interest is required. One just needs to pay taxes under the scheme.

The amnesty scheme was announced to stren-gthen revenue recovery and arrears. Apart from the special teams the district collectors also have been asked to take immediate steps for tax collection. Earlier the government had pegged the arrears at Rs 13,000 crore. However, the officials say it would not be possible to collect such a huge amount. Therefore they are targeting to collect somewhere between Rs 4000- Rs 4500 crores.

But even achieving this target would require a gigantic effort.