Demonetisation: One year later, traders still angry in Karnataka

Like the society in general, the opinion among shopkeepers too was deeply polarized.

Bengaluru: It’s exactly an year since Narendra Modi announced the controversial demonetization of Rs 500 and Rs 1,000 currency notes, which constituted nearly 86 per cent of cash in circulation. The government had argued that the move was to strike at the roots of black money and counterfeit currency, and to usher in a ‘less cash’ society.

While many welcomed the decision and hailed it as a ‘surgical strike’ on black money, the poor execution led to cash shortage, dry ATMs and endless queues in banks.

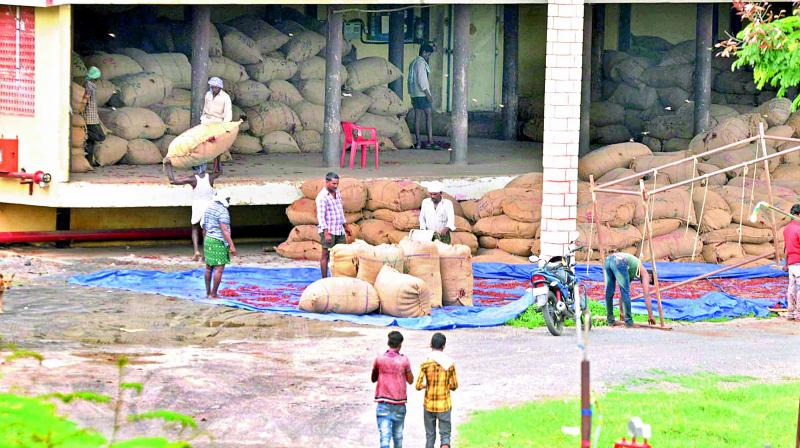

This plunged the economy to chaos and many shops and other small establishments, which constitute the informal economy and heavily dependent on cash, were badly hit and many had to wind up their businesses.

Now a year later, how is the situation? Has it improved or worsened? Deccan Chronicle takes stock by eliciting responses from shopkeepers in the city’s prominent markets - K.R. Market and Avenue Road. Like the society in general, the opinion among shopkeepers too was deeply polarized.

Ganesh (27), a wholesale dealer of soaps and shampoos, said “The sales have gone down by half and the business has shown no signs of any improvement in the past one year.”

Another shopkeeper Rishi, who owns a glass and crockery outlet at Avenue Road said that even though it was a good move, 60% of their business has been affected.

Though the government had tried to push for cashless transactions, it failed to retain the tempo after initial success.

Mohan (22), owner of S Shivaswamy & Sons in K.R. Market said, “Nothing has been affected and in fact we have adapted to the digital method of payment, which has made life much easier.”

However Abdul Karim (55), who owns an outlet selling bags, said that the push for a cashless economy was like shooting an arrow in the air without much thought.

“Not all of us are well equipped or maybe educated and cannot quickly get used to the whole systems of cards and swipe machines. For us cash serves the best purpose, especially because our sales are not in large quantities,” he added.

Finance Minister Arun Jaitley in his Facebook post claimed that this day signifies NDA Government’s resolve to cure the country from “dreaded disease of black money”.

After demonetisation, there were cases of seizure of black money, but was it worth the pain of withdrawing 86% cash in circulation and hitting a body blow to the country’s informal sector?

Moreover the Reserve Bank of India had recently announced that nearly 99% of the demonetised currency has returned to the banking system, thereby belying the hopes of demonetisation votaries that black money hoarders would not dare to deposit money in banks.

63 per cent rural retailers open to cashless payments: IIMB study

While the impact of demonetisation is still being discussed across industries and among the public, a study has found that 63% of retailers in the countryside have shown an inclination towards using the cashless system of payment.

The study titled ‘Going Cashless?’ aimed to check on various changes among perceptions, usage and behaviour towards digital payments in the country and comparing how it was before and after demonetisation.

The study has observed a significant increase in the number of retailers intending to use cashless system in locations with moderate consumption levels. Nearly 45% retailers intend to deploy a Point of Sales (POS) machine, out of which 5% are Kirana retailers, while 35% of consumers own cards.

According to the study, kirana retailers possessing smartphones and 80% of them using the internet has contributed to such a trend.

Considering retailers from rural areas, the report explains that 63 per cent of them plan to use a cashless system and the fact that 80 per cent and 84 per cent of the consumers own bank accounts and mobile phones respectively could be tapped to further cashless systems.

Taking age of consumers into consideration, it was found that consumers up to the age of 30 had played key roles to drive peers and others as well towards cashless payments. “Young consumers could not only be first adopters, but could help the older generation learn and adopt cashless payments,” cites the study.

Jointly conducted by Centre for Digital Financial Inclusion at the Institute for Financial Management & Research (IFMR) and Digital Innovation Lab at IIM Bangalore (IIMB), the report was released on Tuesday at the IIMB campus.