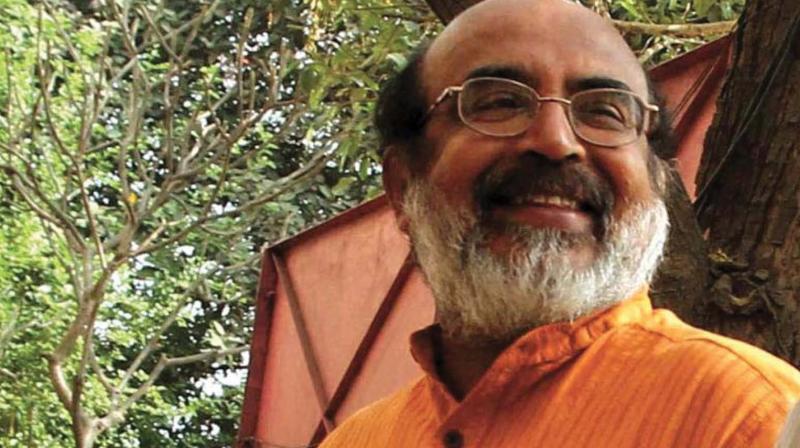

KIIFB can easily pay back Rs 1 lakh crore: Finance minister Thomas Isaac

Approval for projects after ensuring that amount received and repayment liabilities are balanced.

THIRUVANANTHAPURAM: Finance minister Dr Thomas Isaac attributes his sudden change in economic strategy, from liberalism to conservatism, to Kerala Infrastructure Investment Fund Board (KIIFB). "Fiscal discipline in the budget is necessary for the success of the leap in huge capital investments through KIIFB," Dr Isaac said. Proposals of around Rs 54,000 crore were put forward in the previous budgets, and Isaac had called for a moratorium on submitting proposals to KIIFB. Already, administrative sanction has been granted to projects worth nearly Rs 20,000 crore. The minister said that these were moving towards implementation stage.

"Before long, sanction will be given to another Rs 10000 crore. Remaining projects will be sanctioned in 2018-19. This unparalleled investment will be an antidote to the current fiscal recession," Isaac said. So far, the State government has given Rs 4270 crore as grant to KIIFB. “Procedures have been completed for issuing General Obligation Bonds worth Rs 3000 crore. This amount will be sufficient to encash the bills of construction activities submitted for the next 3-4 months,” he said and added: “It will not be difficult to mobilise the fund from market for the period after that.”

Assuming an interest of 9 percent, three years moratorium and 7 years repayment period, a total of '1 lakh crore will have to be repaid. Dr Isaac said that fears of KIIFB creating liabilities were unfounded. “KIIFB is only securitising future income (the assured returns from motor vehicle taxes and petrol cess). KIIFB shall approve projects only after ensuring that the amount received by KIIFB as grant during a particular period and repayment liabilities are balanced,” he said. “So, nobody need worry,” he said.

He said that besides various bonds like land bond and revenue bonds, KIIFB will launch ‘NRI Chitts’ in the coming March-April period. "The online facility for this has already been ready. It is intended to give pension, subject to certain conditions, and to provide accident insurance to those who enrol in this chit. The fact that dividend and commission, not interest, is the basic norm of the chit, will make it more attractive in Gulf region," he said.