Kerala Budget 2018: Time to elaborate on a chant

The Fund will depend on the petrol and motor vehicle cess for repayment of its obligations.

As if in a Gregorian chant, the Kerala Finance Minister repeated the name of KIIFB 63 times in his budget speech yesterday and that has drawn increased attention to how the much-vaunted Kerala Infrastructure Investment Fund will help the State crawl out of a dire financial situation to enable funding of growth and development projects. Among State Government initiatives, KIIFB is unique. Essentially, it seeks to borrow funds from the market outside of the budget and then based on budgetary allocations in the future, the repayment of loans contracted for various projects is expected to be made. For a State which has been living virtually hand to mouth and whose salary and pension payments amount to roughly 70% of total State’s own revenue there is perhaps no other way of finding resources for development expenditure.

The Finance Minister acknowledges the limitations of the KIIFB model of funding in the budget speech stating that it cannot be a perennial origin of resources. The Fund will depend on the petrol and motor vehicle cess for repayment of its obligations. To those looking for comfort regarding how the amounts required for repayment of the debt of KIIFB, the budget does not provide any ready answers. But there is no gainsaying the fact that, with the restrictions on fiscal deficits and market borrowings by the State directly, there was need to innovate an alternate mechanism for overcoming the budgetary constraints. The accompanying tables show the sharp increases in the level of outside liabilities, market borrowings and internal debt of the State along with the rising interest obligations and salary expenditures.

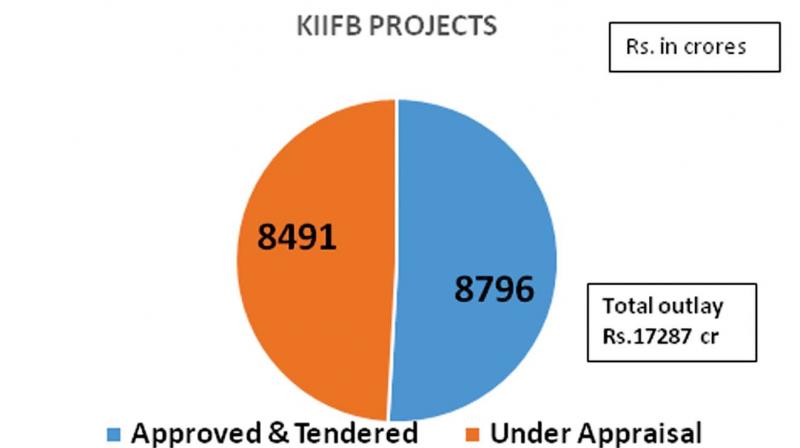

With outstanding liabilities projected at Rs 2,40,897 crores for 2018-19 and market borrowings at Rs 1,37,911 crores, KIIFB would be the only recourse for finding money for development expenditure. The track record of KIIFB has so far been restricted to extending approvals for projects being undertaken by different departments. There is a model tripartite agreement between the Government, the SPV/Department executing the projects and KIIFB. It has so far given approvals for projects worth Rs 8796 crores as per information available on its site and projects worth Rs 8491 crores are under appraisal.

In the medium run, KIIFB will emerge as a specialised agency which will approve, fund and monitor projects whereby implementation and monitoring of State Government projects will be under the scanner so that overall efficiencies will improve. But questions will remain regarding the ability to repay the debt to be raised by KIIFB. The Finance Minister himself has said that nearly Rs 1 lakh crore will have to be provided to the Fund over a period of 10 year. How KIIFB will fare in terms of raising debt is the next thing to watch out for. That it has received a rating of A+ from two rating agencies will definitely help when it goes to the market for raising debt.

Dr. Thomas Isaac has made it clear that this will be back-stopped by State Government guarantees and there is mention of hiking the limit or the headroom available for issuing such types of contingent liabilities. Sceptics will still question the model as clarity is lacking in certain crucial areas. When figures like Rs 54,000 crores (proposals put forward in previous budgets), Rs 20,000 crores (sanctions by the Fund so far) and Rs 10,000 crores (sanctions to be given, before long) are bandied about in the budget speech, it would be apposite to be transparent about KIIFB’s achievements/plans as part of the budget itself.

When you want to milk KIIFB for all its worth, disclosures about KIIFB’s approvals, plans for debt raising with exact figures and repayment obligations for the projects approved and so on would only add to the credibility of this experiment. After all, when we speak about figures of the kind that the Finance Minister has mentioned in relation to KIIFB, one should contextualise this in relation to a budget whose overall size is just about Rs 1,25,000 crores and where the revenue deficit is Rs 13,000 crores roughly. Even as the FM can take credit for reining in both the revenue and fiscal deficits -- - a commendable job, under very trying circumstances – KIIFB’s role needs to be elaborated further.

For instance, the figures obtained from the KIIFB site regarding projects approved and projects in appraisal stage do not exactly jell with parts of figures mentioned in the budget speech. The total of all projects (numbering 314) including both approved and under appraisal aggregate to Rs 17,000 crores approximately. May be, the Finance Minister can consider a report on KIIFB separately as part of the budget exercise as KIIFB is emerging as an alternate pole of the Government’s strategy for development. The sceptics will then be silenced.

(The author is banker. Views are personal)