Slow growth challenges Modi 2.0

The famed fable of India Growth Story takes a beating with its core consumption theme losing plot.

Hold your bubbly folks before you celebrate the Modi 2.0 phenomenon. The ghost of Modi 1.0 may be coming to haunt the Modi 2.0 dispensation. Or that is what the latest reading of the macro data on the Indian economy tells us.

Most commentators as a norm after the landslide victory of Narendra Modi-led NDA in the bygone Parliamentary elections conveniently ignore the not so comfortable fact of a plausible double dip de-growth (recession to use an economist jargon) in an economy that many have forewarned.

It is now official that the famed fable of India Growth Story has taken a beating with its core consumption theme losing its plot. Or in other words, to borrow the words that are trending on the social media that India ceased to become one of the “fastest growing large economies” may be for now.

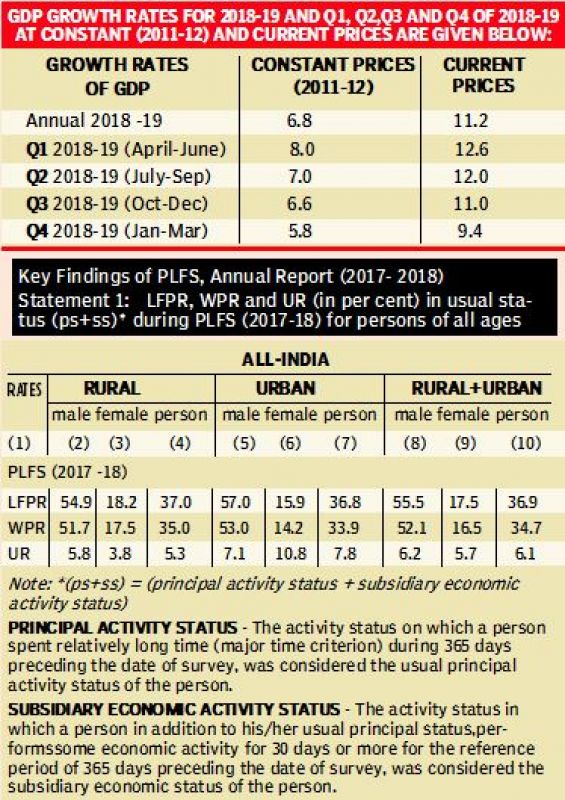

For one, economic activity (read GDP or Gross Domestic Product) growth at 5.8% during the last quarter of the past fiscal has pulled down the overall economic expansion to well below 6.8%, lowest ever in the past five years. Industrial activity, as mirrored by the growth in the eight core segments, including cement and steel, sends out more distress signals.

The known secret, which the Modi 1.0 tried to keep under tight wraps and is now out in open – the Labour Force Survey (PLFS) - shows that the unemployment rate has peaked to the highest level in the past 45 years during 2019 fiscal. Moreover, the farm distress needs no mentioning as the first cabinet decision by the Modi 2.0 dispensation lost no time in announcing a scour package for farmers dubbed as “landmark decision taken in the first Cabinet meeting of the NDA Government offers pension coverage to crores of farmers”, though the outcome of the policy merits the shades of doubts.

The growth in the services sector is in no man’s land, and the fault lines in the financial sector, including the banks and non-banks, run deep into the system need no mentioning. Further, it has now become clear that scoring brownie points in the World Bank’s Ease of Doing Business or competitiveness indices is not going to lure foreign investors to India since the latest numbers suggest that India’s FDI push has lost its steam.

This brings to fore the quintessential question: Who is to be blamed for the current mess that the Indian economy is in? Undoubtedly, the onus, or the credit, goes to the previous Narendra Modi Government or Modi 1.0.

This put the policy missteps of Modi 1.0 in the crosshairs. For the sake of perspective, the economic expansion which was trending at 7+ growth year on year has slumped to the sub 6% mark during the last quarter of the last fiscal. And the high-frequency numbers from official sources confirm the fear of a double-dip recession, in layman's words a fastest growing economy registers a slowdown for two quarters sequentially - may be well on our way with the economic growth shrinking for a straight second quarter during April-May of the current fiscal.

This calls for express action by the managers of the economy by righting the wrongs of the past, and the current Modi dispensation could do it with much ease since it enjoys the best ever majority that any political dispensation could possibly wish for. The major positive that weighs in favour of the Modi Government is the singular fact of ensuring the stability of the government.

But the managers of the economy have their hands full of tasks, including the express need to revive the consumption theme. For this calibrated actions is what required. For, giving the plot back to the consumption theme needs finding a durable solution for putting more money into the hands of common folks. For this, what is needed is more jobs.

Also giving remunerative or the so-called fair price for farm produces in itself will not change the things for the rural folks at the grassroots level. What is essential is a comprehensive policy that will pull the farm sector out of distress. These include stepping up capital investments in the agriculture sector to ensure necessary and sufficient irrigation facility, affordable price for farm nutrients and above timely availability of affordable credit.

The same can be said about the micro, small and medium enterprises which by any yardstick is the growth engines of the economy. And finally finding a lasting solution for the liquidity stress in the economy by fixing the faultiness that runs deep into the financial system also should be on the priority list of the government.

That past policy missteps, demonetisation and the ill-conceived way in which the GST was rolled out, need to be corrected without any delay. It is only in order here to recall that these two policy missteps shaved off close to 2% of India’s GDP.

To conclude, the saner advice for Modi 2.0 is to learn from the gross mistakes of Modi 1.0. After all, a fall in the pit is a gain in the wit or else history is replete with examples of sections of tribes who never learnt anything and forgot anything and being confined to the dustbins of history.

(P. Vinod Kumar is a Kochi-based financial analyst)