Union Budget 2018: Share in Central taxes provides relief

Hyderabad: None of the three major representations made by the Telangana state government for funds, for Mission Bhagiratha, Mission Kakatiya and the Kaleshwaram irrigation project, figured in the Union Budget announced on Thursday by finance minister Arun Jaitley.

Telangana State Chief Minister K. Chandrasekhar Rao is also likely to hold a meeting with the TRS MPs on Sunday to decide on the party’s strategy in Parli-ament when the Session resumes on February 5.

MPs have been instructed to bring up the matter of TS being neglected and press for the expected fund allocations.

The Chief Minister has sought national status for the Kaleshwaram project, on which it has already spent Rs 22,000 crore, and has asked for Rs 10,000 crore in assistance from the Centre.

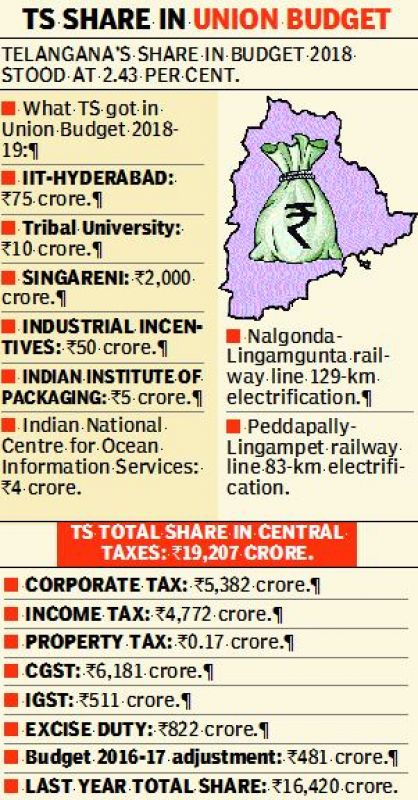

There were some positive takeaways from the Budget for the state, though. TS got a larger share in various Central taxes than it did last year — Rs 19,207 crore compared to last year’s Rs 16,420 crore, an increase of Rs 2,787 crore.

Breaking this down, TS got Rs 5,382 crore towards the state’s share in corporate tax, Rs 4,772 crore in income tax, Rs 0.17 crore in property tax, CGST, Rs 6,181 crore, IGST, Rs 511 crore, customs duty, Rs 946 crore, central excise duty, Rs 822 crore, and Budget 2016-17 adjustment, Rs 481 crore.